Commonwealth Bank has announced the launch of an Australian-first police referral pilot in NSW that will set new standards for how banks report technology-facilitated abuse to law enforcement.

CBA has leveraged its capability in artificial intelligence and other technologies to detect and block abuse in transaction descriptions to develop, in collaboration with the NSW Police, a new streamlined process that will allow the bank to report abuse with the consent of the victim-survivor.

The latest initiative delivered by CommBank Next Chapter will start by mid-September, providing a tailored escalation path to enable impacted customers in NSW to report their abuser easily and quickly.

Since implementing abusive transaction monitoring in June 2020, CBA has blocked nearly 400,000 transactions annually by the automatic filter that prevents offensive language being used in transaction descriptions on the CommBank app and NetBank.

CBA said the technology is augmented by an AI model that reviews transactions and annually detects around 1,500 perpetrators that send potentially abusive messages, which the bank then manually reviews to determine severity and the appropriate action required.

In the pilot, once a customer is detected to be receiving repeated abuse in transaction descriptions, that customer will be contacted by the Next Chapter team to ask if they would like CBA to report the abuse on their behalf to NSW Police. If the customer has consented, CBA will initiate a report to the NSW Police. Victims of this kind of abuse can also contact CBA and ask the bank to report these instances of abuse on their behalf.

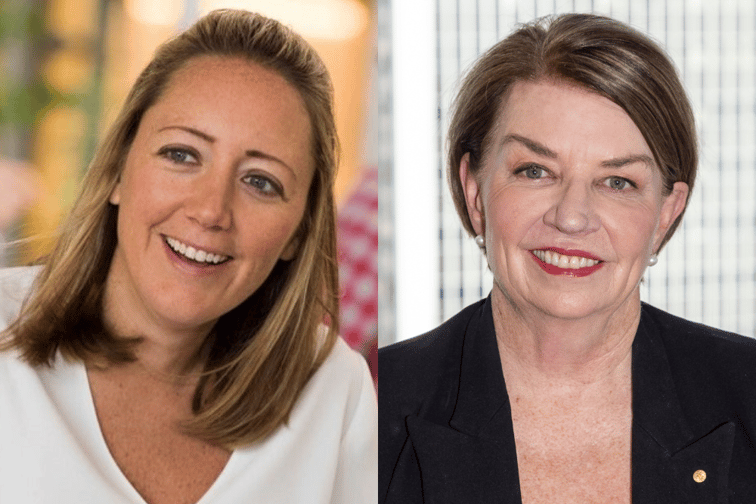

Angela Macmillan (pictured above left), CBA group customer advocate, said the latest CBA initiative will help provide better support for customers experiencing abuse.

“Technology-facilitated abuse continues to be a serious problem, and this collaboration with NSW Police enables us to act – not only in supporting victims, but in the prevention of abuse,” MacMillan said. “This is a first of its kind initiative between the banking industry and law enforcement, and we hope this paves the way for more effective collaboration in the fight against domestic and financial abuse.”

Anna Bligh (pictured above right), CEO of the Australian Banking Association, said the collaboration between CBA and the NSW Police meant “critical information can now be shared when financial transactions are being used to threaten, harass, or intimidate victims of domestic violence.”

“This trial will provide valuable insights for police services and other banks about how to better combat the scourge of domestic violence,” Bligh said.

Use the comment section below to tell us how you felt about this.