Resimac CEO Scott McWilliam regards the lender’s prestigious Non-Bank of the Year win as an endorsement of its performance over the last few years.

He says Resimac’s delivery has resonated well with its business partners and customers.

“We have made a considerable investment into our products, our people and our processes and will continue to do so to ensure we remain the lender of choice for the Australian mortgage market.”

The non-bank has been around for 35 years. It has offices in Sydney and Perth, with 250 staff operating across Australia, New Zealand and the Philippines, serving more than 50,000 customers.

Resimac pioneered residential mortgage-backed securities in Australia, was one of the first non-bank lenders to offer specialist lending products, and is the only non-bank lender in Australia with an end-to-end digital loan origination process.

It bought stakes in Adelaide-based asset finance provider Positive Group in 2019, and earlier this year it bought a controlling stake in financial services company IA Group.

During calendar year 2020, Resimac issued $1.8bn in mortgage-backed bonds, and a further sizeable issue is underway. The lender also renewed and extended almost $2bn in funding facilities with support from onshore and offshore partners.

During calendar year 2020, Resimac issued $1.8bn in mortgage-backed bonds, and a further sizeable issue is underway. The lender also renewed and extended almost $2bn in funding facilities with support from onshore and offshore partners.

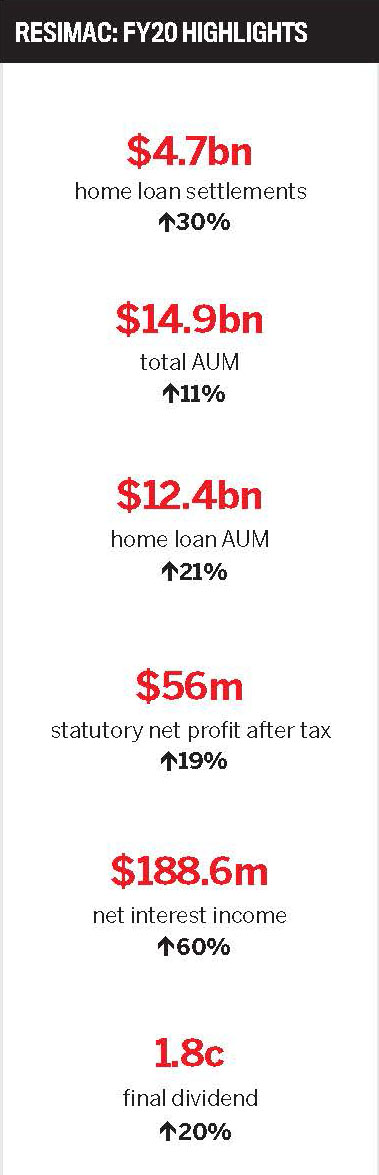

Despite the difficulties posed by the coronavirus pandemic, including economic uncertainty, McWilliam says Resimac has achieved record origination volumes and strong portfolio growth well above system; in fact, this has been the firm’s most successful year yet.

“It’s a testament to our focus on consistent and timely credit decisioning and a service offering that resonates with brokers and consumers alike.”

“The speed at which our business transitioned to a working-from-home model and our swift implementation of support structures for brokers and borrowers showed remarkable resilience and agility.”

“Using automation, digitisation and AI, the simple and easy-to-use technology-based solutions will provide a richer experience for customers and brokers”

McWilliam says the lender’s various measures to support borrowers have taken the pressure off brokers, who are typically the first point of contact when a borrower experiences financial hardship.

“We also recognised that brokers would experience significant financial hardship themselves if they were to miss out on trail commissions, so we reassured our brokers and made the early commitment to continue paying trail on loans that are on a payment moratorium.”

Digital transformation meant Resimac was well placed to adapt when COVID-19 hit.

McWilliam says several innovations were introduced this year to make it quicker and easier to apply for and settle a home loan.

These included a complete end-to-end digital loan origination process allowing brokers to work from any location, lodge their applications efficiently and monitor their progress with real-time status updates – all without having to meet clients face-to-face.

Resimac borrowers can now receive and execute mortgage documents via email, avoiding the need to print and sign a bulky paper-based documentation pack.

“While these enhanced digital capabilities were already largely in place when COVID-19 hit, they quickly became crucial for ensuring our broker partners could continue their normal business activities despite the COVID-19 social distancing restrictions,” says McWilliam.

Scott McWilliam, CEO, Resimac

Scott McWilliam, CEO, Resimac

Resimac’s digital transformation project produced workflow improvements to maintain industry-leading service-level agreements of one to two days across its product range, even when the pandemic led to turnaround times blowing out across the country.

“We have partnered with some of the most respected and proven technology and service providers to create a platform for sustainable and scalable growth.”

Recent digital initiatives include application workflow improvements, a digital telephony integrated customer contact system and a partnership with artificial intelligence platforms.

“We reassured our brokers and made the early commitment to continue paying trail on loans that are on a payment moratorium”

“Using automation, digitisation and AI, the simple and easy-to-use technology-based solutions will provide a richer experience for customers and brokers.”

The digital transformation project is set for completion in FY22.

Looking ahead, McWilliam says the trend of consumers moving away from the big four banks will continue, and with so many options to choose from, brokers are well placed to help borrowers navigate the market and find the best lenders and most suitable products.

“With a history steeped in product innovation, non-banks are well poised to support brokers as they deliver these solutions to their clients.”

Despite all of Resimac’s successes, there remains a sizeable opportunity for business growth.

“Our goal is to continue to expand our market share through our third party channel in a way that is scalable and sustainable, as well as build out a digital platform that provides a market-leading experience for both brokers and borrowers,” McWilliam says.

“Our business partners can be reassured that we will not be resting on our laurels as we maintain our focus on continual improvement in both our loan origination and customer service experience.”