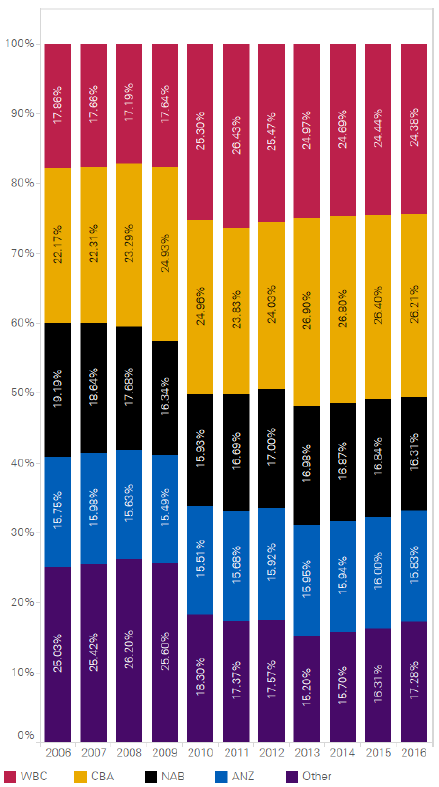

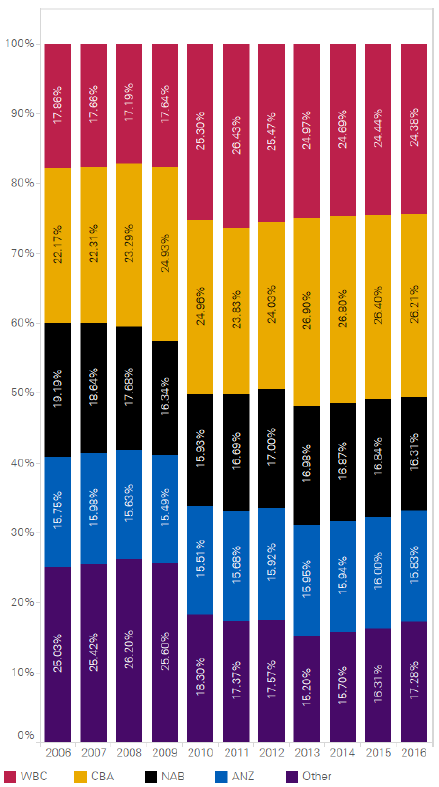

Competition between the major and second tier banks has resulted in a continually declining market share for the big four.

In KPMG’s latest full year analysis of the major banks, it found that the combined market share for National Australia Bank, Commonwealth Bank,

ANZ Banking Group and

Westpac decreased by 97 basis points to 82.7% during FY16.

This is the third consecutive year in which non-major banks and other lenders have taken market share away from the big four.

Despite this downward trend, loan volumes at the major banks have actually increased by 4.2%, equating to $1.5 billion during FY16.

While additional scrutiny of housing loan portfolios within these banking giants has gone some way to address the risks involved, KPMG’s report suggests that the big four banks need to go even further.

“Continued discipline will be important for the majors to ensure that asset quality and resilience is maintained, especially if the housing market in geographically concentrated segments experiences an abrupt correction, interest rates rise and/or unemployment increases dramatically.”

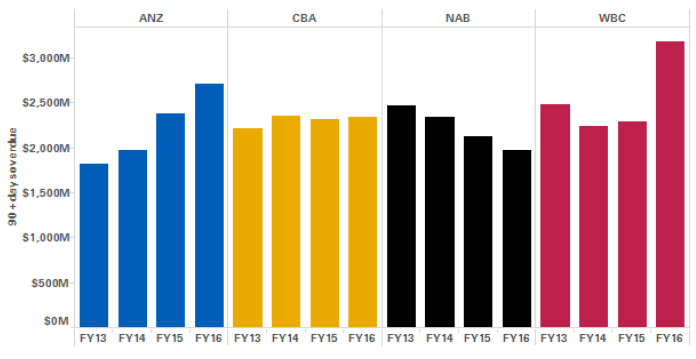

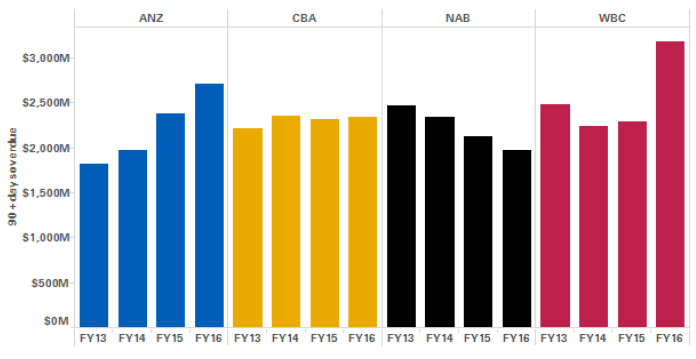

Across the big four, 90+ day mortgage delinquencies have remained relatively stable during the past financial year, increasing by a mere 2.5 basis points. This has taken the total number delinquencies to 37.3 basis points of total loans and advances.

KPMG also found that mortgages were more likely to have deteriorated in regions exposed to the mining and resource sectors, especially in states such as Western Australia and Queensland.

Related stories:

Major bank reports rise in loan delinquencies

NAB continues to snap up brokers

Broker originated loans trending up at ANZ