New data has revealed Australia’s major banks recorded “significant leaps” in their Net Trust Scores through the COVID-19 pandemic.

While Westpac charted the most progress, nearly tripling its score from 3 to 8 since last quarter, it remains the least trusted of the big four.

The Australian Banking Brand and Trust Index, developed by research tech firm Glow, surveyed 1,230 Australians around their sentiment towards 31 bank brands before awarding each a Net Trust Score between -100 and +100.

“It’s pretty remarkable - the influence of the big four banking brands is so strong that Australians' perception of banks in general has jumped significantly in only three months,” said Glow head of insights, Eddie Kowalski.

“COVID-19 and the resulting mortgage freeze, recently extended to January 2021, presented the big banks with an opportunity to redeem themselves in the eyes of the Australian public following the Royal Commission last year. And so far, their efforts seem to be working.”

However, while Kowalski undoubtedly identifies COVID as a turning point for consumer sentiment around the big four, he sees another strong sentiment marker on the horizon.

“It is only when the proverbial – but inevitable – financial cliff emerges and Australians are required to pay up once again, whether in the form of increased mortgage repayments or through losses to their superannuation, that this built-up trust in banks will be tested,” he said.

Notably, even with their sizeable gains, the big four remain in the bottom half of the index’s rankings.

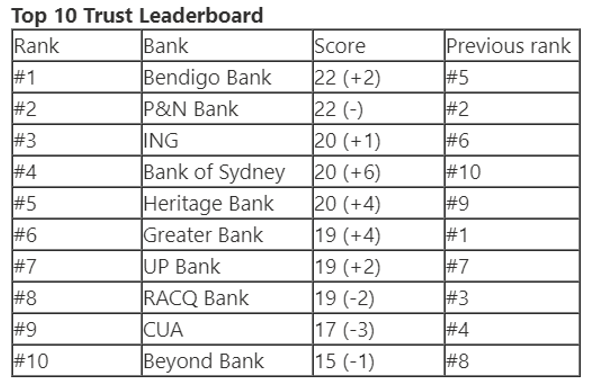

Smaller, “less tarnished”, brands were among the top five most trusted institutions including Bendigo Bank, Police & Nurse Bank and Bank of Sydney.

Second tier banks such as ING, Greater Bank and Suncorp also featured in the top ten.

Neobanks continued to climb the rankings, led by 84 000 and Xinja, which both boasted the biggest jumps of six points each.

It was internationally-owned brands which took the most significant hit.

Bank of China remains in last place, with its Trust Score falling from -21 to -27, while trust in HSBC and Citibank also declined slightly, sending the former down eight places in the rankings and the latter four.

“Our research appears to reflect society’s continued retreat to an increasingly nationalist mindsets and more community-based values during the coronavirus pandemic, with the suggestion that this is influencing where Australian consumers choose to bank,” said Kowalski.

“It will be interesting to see how this trend plays out next quarter.”