Two of Australia’s largest banks announced they were launching a no interest credit card within 24 hours of each other, a move which has been interpreted as their going head to head with the buy now, pay later (BNPL) services which have been attracting customers in droves.

“These new cards signal it’s game on between the big banks and buy now, pay later,” said RateCity.com.au research director Sally Tindall.

The largest players in the BNPL space, such as Afterpay and Zip Pay, boast more than 5 million customers between them.

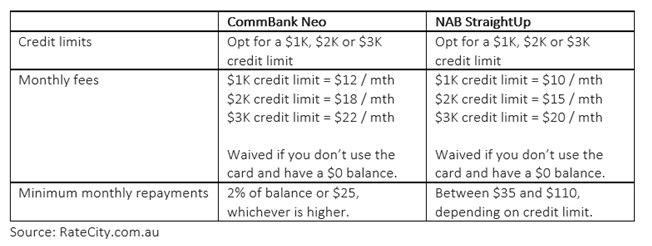

While CBA and NAB’s new offerings are similar, with 0% interest charges or foreign exchange fees and no late payment fees, there are two key discrepancies to note.

“The main difference between the two cards is NAB is asking customers to pay back more of their debt each month, which will see them clear it faster,” said Tindall.

“The second difference is CBA offers shopping perks, but only if customers spend at certain stores.

“Customers should be wary: if they start buying things in a bid to claw back their monthly fee, then they’ve probably been had,” she added.

Despite this warning, Tindall expressed cautious optimism good could come from the launch of the new credit card offerings.

“Hopefully this competition will bring more low cost, consumer-focused credit options to the table,” she said.

“Bank minds clearly think alike when it comes to tackling buy now, pay later.