Australia’s GDP rose by a modest 0.2% in Q2 2024, bringing annual growth to just 1%, slightly below expectations and underscoring persistent economic challenges, particularly in the private sector, according to NAB chief economist Alan Oster (pictured above).

“Economic growth remains very weak,” Oster said.

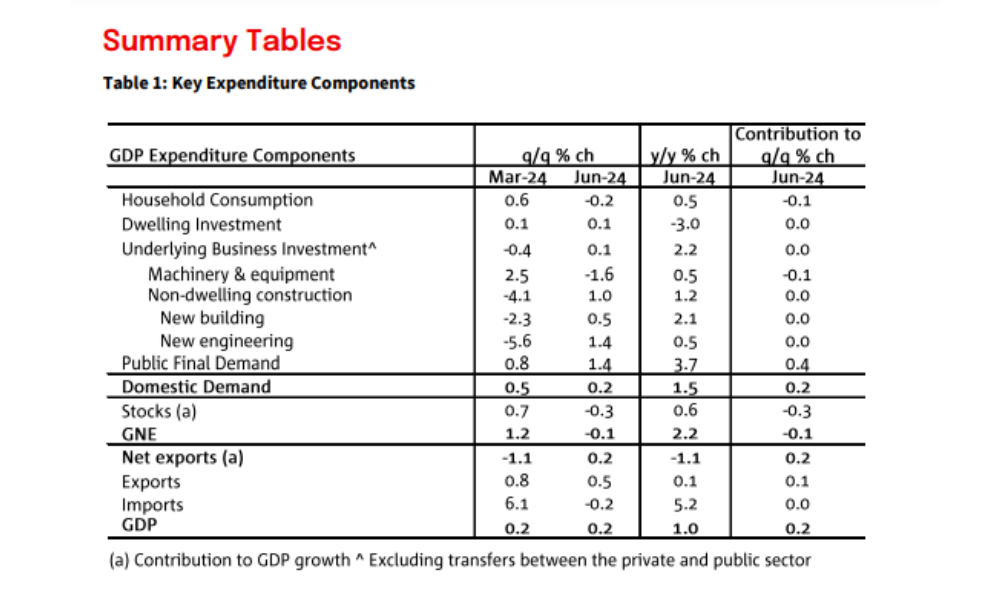

While net exports and public demand provided some much-needed support, other key areas – particularly business and dwelling investment – made no contribution to the economy's growth.

See LinkedIn post here.

The Australian economy has now seen six consecutive quarters of declining per capita GDP, a fact obscured by strong population growth.

“The public sector has been an important support with private sector components very weak,” Oster said.

The weakness in private sector performance continues to put pressure on economic recovery, even as population growth pushes up headline figures.

Household consumption, which accounts for a significant portion of economic activity, fell by 0.2% in Q2, the first quarterly decline since Q3 2023.

Notably, discretionary spending dropped by 1.1%, with steep declines in categories such as transport services (-4.4%), clothing and footwear (-1.6%), and dining (-1.5%).

“Households are feeling the pinch, especially in discretionary spending,” Oster said, attributing the declines to the ongoing effects of inflation and high interest rates, which have eroded purchasing power.

However, spending on essential items like electricity and household fuels rose by 2.4%, highlighting the shift in household consumption patterns as inflation and interest rates continue to bite into budgets.

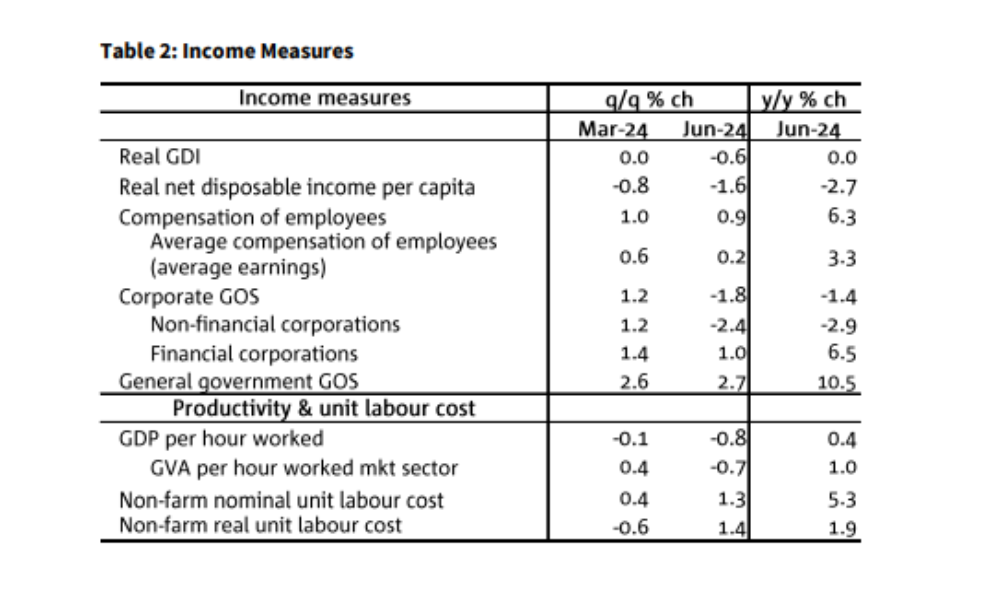

Despite a slight 0.9% increase in household disposable incomes, real buying power remains under pressure, especially with income taxes ticking up and inflation still persistent, though easing gradually.

The public sector continued to be a crucial driver of economic activity, with public final demand rising by 1.4% in Q2.

Government consumption, particularly in health services, was a significant contributor to growth.

However, Oster pointed out the imbalance between the public and private sectors.

“Productivity has been weighed by weak mining output and strong public sector employment growth,” he said.

Business investment remained flat, edging up only 0.1% in Q2.

Dwelling investment saw similarly weak results, growing by a mere 0.1%, leaving it 3.0% below levels from a year ago, NAB reported.

Looking ahead, Oster believes the Australian economy may see slight improvement in the second half of 2024 but warns that growth is likely to remain below trend.

“We expect growth to improve but remain below trend in H2,” he said.

While inflation is gradually easing, it remains elevated, and weak productivity continues to push up unit labor costs. NAB forecasts GDP growth of around 1% for the year, lower than the Reserve Bank of Australia's projection of 1.7%.

As for interest rates, Oster is cautious about the possibility of a rate cut. “We continue to expect the conditions for a cut will not be in place this year,” he said, noting that NAB expects the first rate cut to occur in May 2025, although he acknowledged that the timing could change depending on inflation trends and the broader economic environment.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.