The recent announcement by the NSW government to ban “no grounds” evictions has sparked a debate about its potential impact on the rental market.

While some fear this reform could lead to a decline in investor activity, broader economic and demographic factors play a more significant role in shaping the rental market.

Eliza Owen (pictured above), head of research at CoreLogic Australia, argued that investor activity is primarily driven by broader economic conditions rather than changes to tenancy laws.

“The supply of rental property is largely influenced by access to finance and capital growth return,” Owen said.

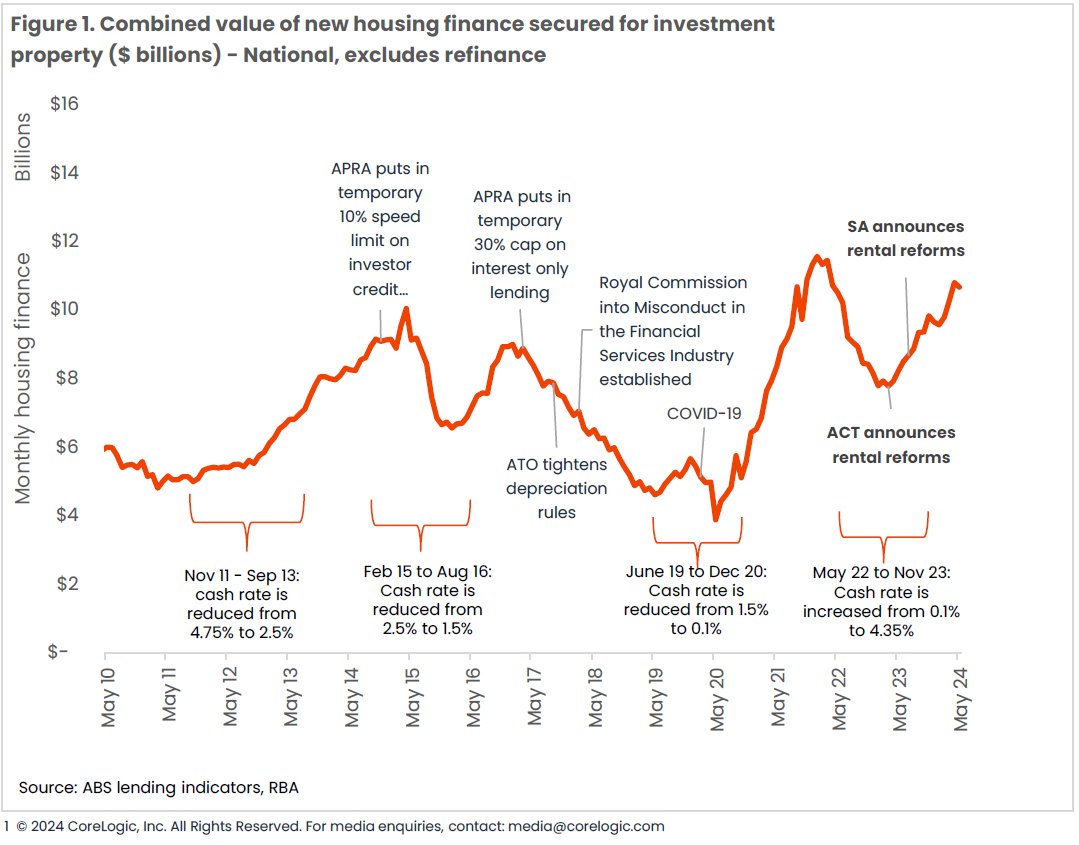

She said that changes in lending rules, interest rates, and the global pandemic had more pronounced effects on investor finance than tenancy reforms.

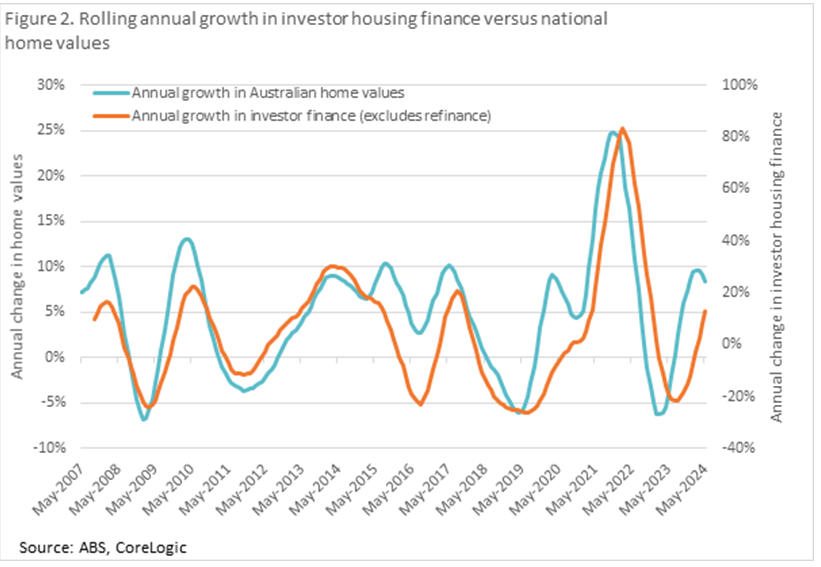

Data from the ABS showed that investor lending has been more responsive to changes in home values and economic conditions.

“Annual growth in investment activity was strongest in the year to February 2022,” Owen said, correlating with peak home value growth.

Despite tenancy reforms in various states, investor demand has remained resilient in markets with strong capital growth prospects.

Owen pointed to different outcomes in various states following tenancy reforms.

In South Australia, investor activity increased by 37% despite rent reforms.

In contrast, the ACT saw a decline in investor activity following a ban on “no grounds” evictions, which Owen attributed more to weak capital gains and market oversupply.

Western Australia, with no such eviction bans, experienced the highest rise in rents and investor loans.

Owen concluded that tenancy reforms like ending “no grounds” evictions will enhance security for tenants without significantly deterring investors.

“Prices in the rental market will continue to be dominated by demand factors such as population growth, household size, and income,” she said.

The supply of investment property will depend more on capital growth prospects, credit availability, and interest rates.

The tenancy reform aims to balance the power between tenants and landlords.

While it may limit some rental income gains for landlords, it is unlikely to cause a substantial drop in investor activity or significantly alter rent values.

The rental market will continue to be shaped by broader economic trends and demographic shifts, CoreLogic reported.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.