Merging the Aussie and Lendi home loan brands is a mammoth task, but Lendi Group CEO David Hyman is up for the challenge. He discusses how the merger is progressing and the exciting benefits it will bring for brokers and their clients.

It’s been just a little over six months since the merger of Aussie Home Loans and Lendi Group was signed, and the new entity has been a hive of activity.

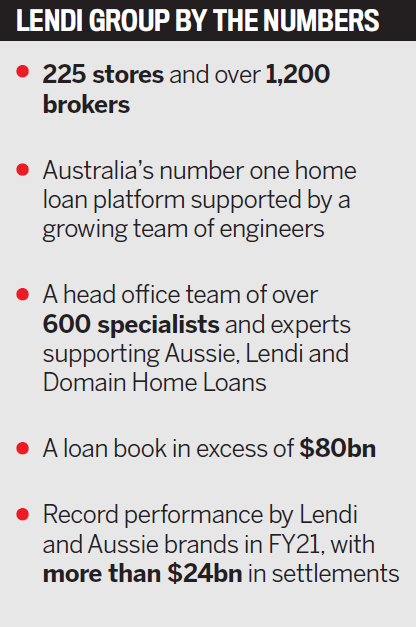

Lendi Group CEO David Hyman (pictured) now leads Australia’s biggest retail broker network, combining Aussie’s much-loved franchise group of more than 1,000 brokers with the cutting-edge technology behind Lendi and Domain Home Loans’ 200 brokers.

“It’s been a busy and incredibly productive six months since we completed the merger transaction,” Hyman says.

“We’ve not only brought our teams together, kicked off an ambitious and complex integration strategy, set out the five-year business plan, deployed platform and technology upgrades benefiting both Aussie and Lendi brokers, but we’ve also won awards, smashed records and grown the Lendi and Aussie brands.

“It’s been a huge accomplishment by the whole team, particularly when you add a pandemic and multiple state lockdowns into the mix.”

Hyman says FY21 ended with record performance across both Lendi and Aussie and more than $24bn in loan settlements.

“This is an outstanding result and testament to the momentum in the group, which isn’t slowing down. Our results for the September quarter have us on track to come in well ahead of our FY22 target.”

Aussie brokers will eventually operate on an Aussie-branded version of the Lendi technology platform.

“The number one objective for the business is to get the platform Aussie-ready so we can migrate all the Aussie brokers and customers across,” Hyman says.

“We’ll be doing that progressively over the next 12 to 15 months.”

“The underlying platform and technology is the exising Lendi platform which today powers the Lendi brand and the Domain Home Loans brands. Once the platform experience has been built to also service the Aussie broker network and their unique businesses, then customers will engage with Aussie, with Lendi or with Domain separately, but there will be a single technology platform powering all of those experiences.

“For Aussie brokers, they’ll continue to operate under the Aussie brand and with the unique service-led proposition – they’ll just get the benefit of the platform technology and all that enables both for them and their customers.”

Hyman says the merger business case was clear from the outset.

“By combining Aussie’s iconic brand, strong distribution model and trusted relationships with proprietary Lendi technology and processes, the opportunity to supercharge the growth of our brands and drive greater investment in their market-leading capabilities is huge.”

Hyman says securing a property can be one of the most stressful and disjointed experiences Australians go through.

“We know the system is large, fragmented and strewn with barriers. Lendi Group exists to change this.

“All of our activities are designed to close the gaps between the standards and benchmarks we have today and what is possible when the right technology is applied to solve problems for brokers and their customers.”

This means simple things like freeing up time for brokers and customers by removing routine tasks and admin from their lives, Hyman says.

“It means empowering customers with more choice and more control in how and when they engage in the home loan process. It means richer relationships and exchanges between brokers and their clients.

“Looking ahead, it means a future of property finance powered by seamless connections between customers, brokers, lenders, products and data.”

Hyman says Lendi Group has already invested millions in proprietary processes and technology but is putting “even more resources and investment into solving problems for brokers and customers”.

“Our head office team is made up of more than 600 specialists, experts, developers and engineers dedicated to powering growth and innovation across our network.

“Our aim is to power our brokers with best-in-breed technology, data and systems that make them indispensable to customers and lenders.”

One tech platform feature Lendi Group is incredibly proud of is Approval Confidence.

“This gives brokers and customers a real-time indication of whether their loan will be approved. We’ve got five lenders on the Approval Confidence panel, including ANZ, Bankwest and Adelaide Bank, and more in the pipeline.

“As more lenders come on board, this is going to be a real game changer for the industry because it’s the precursor to on-demand home finance.”

Approval Confidence is market-leading technology, Hyman says.

Brokers can spend weeks learning their clients’ objectives and financial situations, looking at lenders’ serviceability spreadsheets or calling lender BDMs to come up with suitable loan options. But Lendi’s platform has all this information in structured data points as well as direct integrations with banks. Approval Confidence sends the data to the banks and gets information back from their decisioning engines, which is converted into a score showing how likely the client is to be approved for a loan.

“It’s one of the reasons why Lendi, from an experience perspective, is rated well above other brokers and why Lendi is able to deliver faster approvals, and more of them,” says Hyman.

“When Aussie brokers are rolled onto the platform, they’ll get access to Approval Confidence as well, under the Aussie brand.”

Lendi Group has already introduced highly effective tech upgrades into Aussie’s systems and is piloting process innovation that will deliver big benefits to Aussie brokers in the next few months. The Lendi platform will automate many routine, manual tasks for Aussie brokers.

“That frees up the broker to spend more time nurturing customer relationships. They can help more customers, more quickly.”

But he says tech tools won’t replace the broker-customer relationship.

“They are designed to enhance it. The broker-partnership mentality that sets Aussie apart from its competitors is not changing, and we continue to work closely with our broker representative groups, Voice of the Broker and Aussie Franchise Council, along with our top-tier Signature Platinum brokers, to develop best practices and improve efficiency.”

The two brands are already sharing best practices and leveraging complementary strengths across the group, Hyman says.

“An example of this is the work we’re doing on creating a single, combined and comprehensive lender panel that will be available to all brokers on platform, encompassing a ‘best of breed’ approach for the current Aussie and Lendi panels.

“We’re looking at all the various customer segments that both the Aussie brand and Lendi brand serve today, and we’re determining a group lender panel, which will apply to both Aussie and Lendi.

“Aussie’s lender panel will slightly expand – there’ll be some new lenders added into the mix – and Lendi’s lender panel will slightly contract.”

Lendi Group has also set up a client solutions pilot that’s already enhancing the lodgement process, in terms of broker efficiency and quality assurance.

Slow loan discharge and processing times are a big issue, but not a new issue for brokers, customers and the industry, says Hyman.

“We’ve been both lobbying lenders and working with industry bodies,” he says. “When it comes to discharge times, there’s a clear opportunity for regulators to step in and hold lenders to account. Last December, the ACCC’s home loan price inquiry report recommended all lenders be subject to a maximum time limit of 10 business days to complete the discharge process.”

Hyman says this hasn’t happened, and there were times this year when it was taking up to 40 days for a lender to process a discharge. While this has now dropped to 15 to 20 days, “it is still an unjustified delay and cost for customers”.

“With the right technology in place, we believe discharge processes could be standardised and completed in as little as two days.”

Lendi Group aims to remove some of the processing barriers by using tools such as Approval Confidence.

Hyman says the Lendi and Aussie merger has brought together two complementary but very different models.

“The merger strategy is very much a growth strategy, which enables two things – one, using the technology to make our team more efficient so we can unlock growth faster, and two, having a killer proposition for brokers, meaning it’s attractive to join us, whether that’s through Aussie, Lendi or Domain.”

The Lendi Group is “100% committed to helping our brokers grow their businesses”, Hyman says. It also offers brokers more entry pathways and options once they are in, including the opportunity to work as a salaried employee (Lendi and Domain), a mobile broker (Lendi and Aussie) or a franchise broker (Aussie).

Hyman says as Australia emerges from the pandemic, consumer confidence is high, and there’s still a lot of momentum in the housing market.

“There’s also a phenomenal amount of untapped opportunity in the refi market, and the building sense of anticipation that the RBA will raise rates, together with the recent movements we’ve seen on fixed rate offers, may well shake borrowers out of complacency.

“Competition between brokers will heat up, and this is where innovation and agility will be key to sustaining performance.”