By

Mortgage brokerage Smartmove is consistently recognised for its industry-leading customer service. CEO Darren Little explains how this was achieved and why the current environment makes this focus on the customer more crucial than ever

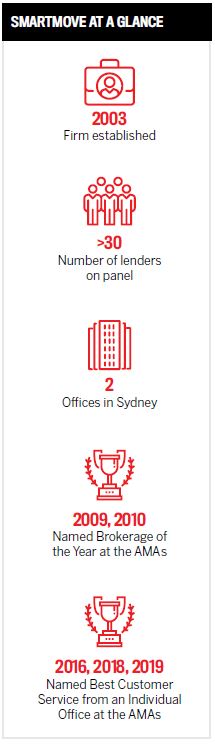

Since 2003, Smartmove has been on a client-centric journey. Winning the Best Customer Service award for an individual office at the Australian Mortgage Awards in three out of the past four years has been a humbling experience for the award-winning brokerage firm.

“Our vision to be unparalleled leaders through trusted lifelong relationships with clients and business partners has enabled us to continue to thrive and adapt in an ever-changing marketplace,” explains Smartmove CEO Darren Little.

“A clear focus on the client, all the way from recruitment of new team members through the application process and beyond to post-settlement, has seen our business meet and exceed clients’ expectations.”

He says Smartmove runs its business with a very clear strategy for how it goes to market.

“We are very systematic and deliberate to ensure our clients get the same Smartmove experience in all their dealings, regardless of whether they are working with a new broker or a broker who has been with us for 15 years,” Little says.

This allows its brokers’ individual personalities to shine through, while a meticulous approach to the application process, compliance and Smartmove’s post-settlement systems ensures strong advocacy of the brand.

Ensuring strong recruitment processes

Smartmove runs a pay-as-you-go salaried model – with regular payments (instalments) throughout the year – because it believes this is the way to go from a team and client perspective.

“This model allows team members to better focus on our clients’ needs, rather than having a perceived self-interest around remuneration, as the pressure of not having a regular income has been removed.”

It also enables Smartmove to recruit very client-focused team members. The brokerage looks for team members who are hungry to do the best for their clients, as it has the coaching and technical side covered.

Most of Smartmove’s brokers are in their 20s and new to the industry when they join, says Little.

“We also recruit from various sources, with a focus on those with experience in client service roles, and we have found these team members join with a better client service philosophy,” he explains.

“We are methodical when we hire, and during the recruitment process the candidate spends time within our business with a variety of team members to get a good feel for how we do things. This gives us a great opportunity to see them interacting with the team, not just in an interview situation.”

All new Smartmove brokers work with a team leader to learn the Smartmove way. It can take about six to 18 months for them to reach the level they need to be at before they can approach clients.

“At Smartmove we have built a strong and defined career path for them to transition from brokers to leaders of teams,” says Little. “Having stability in our team, with minimal turnover, has become an advantage and has really helped bring that consistent approach to our clients.

“Our clients’ feedback has been positive with respect to the Smartmove approach, regardless of the tenure of the team member, which is a testament to our process.”

Supporting brokers

Smartmove has an operations business that focuses solely on the processing side of the client experience to support its brokers. This enables the brokerage to provide a seamless and coherent experience that is smooth and orderly, and ultimately puts both its clients and business partners first in all their interactions with Smartmove.

Little says this defined separation of duties allows Smartmove to focus on helping its people become experts in their chosen niche.

The brokerage also does a full Kaizen review annually – a methodology that reassesses, rethinks and constructively challenges each of its business activities, with the intention of continuously improving all functions, involving all team members – with an external facilitator to ensure its clients receive the best experience possible.

“I always find it interesting how much a process can creep in a year. What often looks good in isolation can end up looking completely di erent when combined, so if done poorly the end-to-end process can make the client experience less than it could be,” says Little.

“A great example of how we are tackling this is our strong focus on the broker getting everything upfront from clients at the application stage, which allows the operations team to prepare the necessary documentation. This is more e cient for everyone and creates an exceptional experience for the client.”

Clients’ needs continue to grow, as does the number of lenders the brokerage deals with consistently each month. Therefore, upskilling its brokers and operations team with regular training from its partners has been critical to helping Smartmove meet these needs.

“The support we get from our business partners has been fantastic, from the face-to-face broker training to the webinars with our operations team,” explains Little.

“No longer can we rely on fitting a square peg into a round hole at our main banks, and this is because clients today are more diverse and their needs are more complex than ever before, as are banks’ credit appetites,” he adds.

“We need to make sure we keep pace with clients’ needs, and as a result, we are now more proactive than ever in finding a bank that will take them outside of the box transaction, with appropriate mitigants.

”Smartmove is a big supporter of technology and will always be curious about how it can help the business and in turn enrich the client experience, Little says.

“We see technology as an enabler, but the true disrupter is the trusted relationship we have with our clients. The key is being open-minded about the possibilities technology can bring to us,” he adds.

“We made the decision three years ago to buy off -the-shelf technology and customise it to suit the needs of Smartmove, rather than build technology – we are a broker business after all and didn’t want to become a tech company.”

But times have changed and peer reviews now hold immense clout.

“Take TripAdvisor as an example. Many people check its reviews before they book a holiday, and we use Google Reviews very much like this as well,” Little explains.

“To have a client complete a Google review is our best form of advertising, and while we can’t control the review, we can control our part in the client experience.

“This is the essence of who we are and is our passage to a long-term client relationship.”

Little says Smartmove is confident in the model it has built over the years and that it will see the brokerage continue to grow and meet client needs in a sustainable way.