By

The ABA is leading a campaign to tackle financial abuse of the elderly. Australian Broker examines the implications for those on the industry’s frontline

Stories of elderly people being tricked, forced or emotionally blackmailed to hand over their money make headlines with alarming frequency.

In June, the Australian Banking Association (ABA) kicked off its latest campaign to raise awareness of the issue, in collaboration with National Seniors, the Council on the Ageing (COTA), the Older Persons Action Network and the Finance Sector Union.

Together, this coalition wants finance professionals to be empowered to “properly detect and safely report elder financial abuse”. Calling on the general public to write to their federal, state and territory governments, the campaign is pushing for key policy changes to be enacted by Christmas, including standardised power of attorney orders across states and territories; an online register of power of attorney orders; and a “safe place” to report suspected financial abuse to.

“There are far too many heartbreaking stories of elderly, vulnerable Australians who have been financially exploited by family members or close friends. This is a really difficult, complex problem, but there are things that can be done about it,” says ABA CEO Anna Bligh.

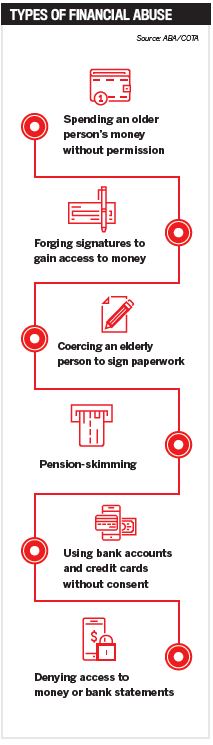

In Australia, there are eight million consumers aged 50 years or older. Referred to by COTA as the “silver economy”, it is estimated that as many as 10% have experienced financial, legal, emotional or physical abuse. Financial abuse can include a friend or family member pension skimming, spending an older person’s money without permission, forging their signature, coercing them to sign paperwork, using their bank accounts and credit cards without consent, and denying them access to money or bank statements.

COTA chief executive Ian Yates has referred to such behaviour as “inheritance impatience”, and there is the added challenge of close familial ties masking untoward intentions.

He says, “Older Australians are among those most susceptible to financial abuse, and more often than not incidences go unnoticed. The situation as it stands is completely unacceptable, and we need to do much more.”

It isn’t the first time this year the ABA has called for reform, and momentum is starting to build. The latest federal budget allocated funds to a national online register and a dedicated national financial abuse body that suspected cases can be reported to.

Elsewhere, ASIC has issued its own guidance online and provides contact details for major national hotlines and charities that can offer advice to those worried about a client, customer or family member.

Major lenders are also taking action. At CBA the Safe and Savvy program, launched in early June, covers financial abuse, scams and fraud against the elderly. The bank has also issued a guide to help staff and customers identify suspicious transactions.

“The program will improve the skills of our employees to identify elder financial abuse and provide practical advice on tips and traps to older customers and their families,” says the bank’s customer advocate, Brendan French.

“Training will soon be rolled out to our teams in nearly 1,000 branches nationwide so they can recognise and report the signs.”

The role of a broker

Like branch staff, brokers also have a role to play. According to Heartland Seniors Finance CEO Andrew Ford, brokers are well positioned to spot financial abuse, particularly when it comes to dealing with reverse mortgages, or elderly customers trying to take out loans after falling for a scam.

He advises, “Look out for those potential red flags. If a broker becomes aware of something, we recommend that they talk to an elder financial abuse hotline in each state.”

“The broker has always been the first line of defence when it comes to detecting unusual behaviour, such as fraud and laundering, so it would be no different to ensure brokers are trained up to keep our elderly safe from abuse,” says William Ngo, finance specialist at Finance Garage.

“Brokers are expected to speak out and report suspicions, but why are we not given the same reporting lines, procedures and training to help real people that need it the most? Taking advantage of an elderly family member or friend is as bad as robbing them. It should be taken very seriously, and prevention is key.”

Mojo Mortgages principal Betty Preshaw recently spoke to a number of major and non-major banks on behalf of a client who wanted to purchase a property with his grandmother. It would have been the first purchase for both borrowers and was intended to be partly funded with inheritance money that belonged to the grandmother.

According to Preshaw, no bank was interested in lending money secured on an owner-occupied house that would be purchased with an elderly relative. While she says the client was coming from a “genuine place”, she praises the default protection the bank provided as a matter of due diligence.

“Bank policy when it comes to senior owner-occupied properties is very tight, as no bank ever wants to have to foreclose on an elderly person’s home in a worst-case scenario.

“However, when it comes to investment properties, policies are less conservative. Provided there is a strong exit strategy, such as the sale of the investment property, banks can lend to applicants or guarantors over a 30-year term that takes the loan past the retirement age of 75,” Preshaw says.

Although unofficial, brokers do have a role to play in tackling the issue of financial abuse. However, knowing how to approach difficult conversations requires knowledge as well as confidence.

“Under our responsible lending obligations, it is incredibly important brokers meet the elderly applicant and have a detailed discussion to explain all of the implications,” Preshaw says.

“As brokers, we can explain the options available to all applicant parties and workshop other solutions that are not as imposing financially on the elderly party. Also, speak to other brokers and ask for advice, particularly if you feel uncomfortable about a particular scenario.”

Ngo adds, “I do not believe at this stage enough is being done to address this issue, but the ball is rolling and I believe changes are coming. I believe brokers can play a major role in helping with the monitoring and reporting of elderly financial abuse and, if given the tools to do so – appropriate training, awareness, reporting procedures – we can slowly chip away at this problem.”