New research has revealed that Australians generally don’t trust generative AI to help select their mortgage plans, showing that most borrowers still value the human touch of mortgage brokers throughout the home loan process.

The study by FIS, a global financial services technology company, showed that over half (54%) of Aussies were uncomfortable with having gen AI assist with choosing a mortgage, with a further 15% saying they are not at all comfortable.

Only 15% of survey respondents said they didn’t mind.

“Brokers will, can and should remain at the centre of a customer’s experience,” said Aussie mortgage broker Phillip Stewart (pictured above left). “There is no one size fits all solution when it comes to home ownership.

“At the end of the day, home loan customers are making one of the most important financial decisions of their lives, and most still want to talk to a person about this decision.”

Generative AI sites like Open AI’s ChatGPT or Google’s Bard have come a long way in a short time.

From legal and financial services to healthcare and advertising, generative AI’s scope continues to expand into new and exciting areas, creating new information based on users’ prompts.

However, it’s still so new that not everyone has had a chance to use it yet.

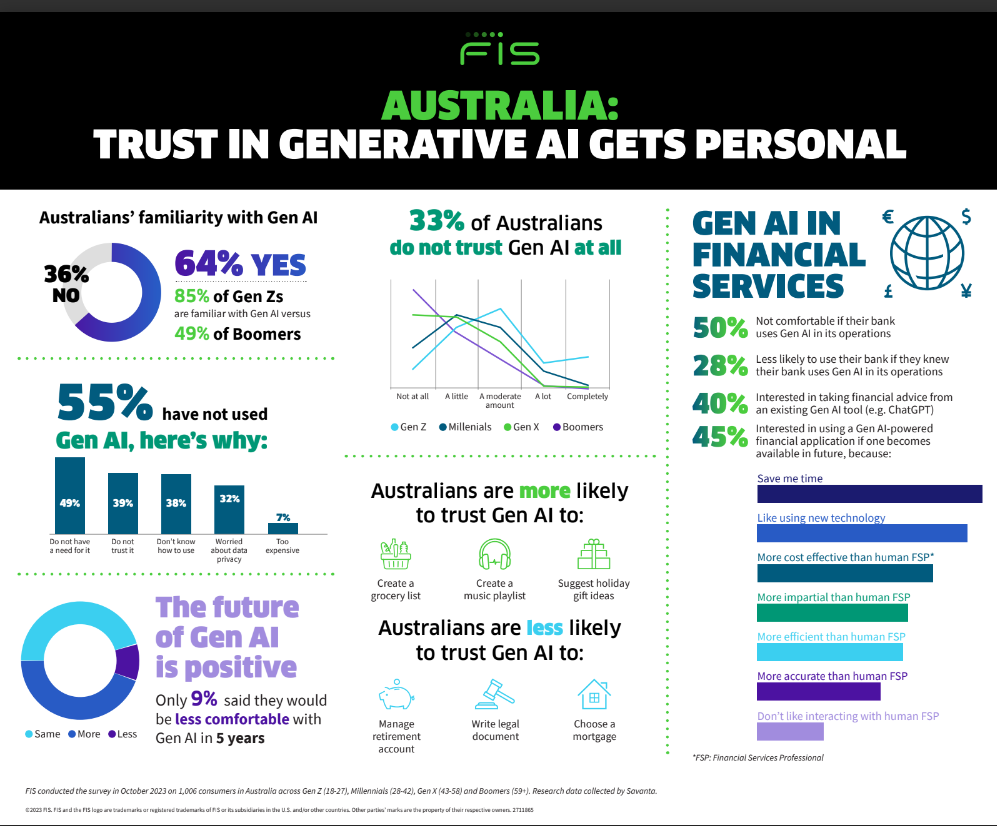

The FIS research found the majority (64%) of Australian consumers are familiar with generative AI but less than half (45%) have experience using it.

Generative AI adoption is primarily driven by Gen Zs, with 75% of Gen Z survey respondents saying they have experience with Gen AI, versus only 22% of Boomers.

This predictably meant that Millennials (38%) and Gen Z (34%) were more comfortable with having generative AI assistance when choosing a mortgage compared to other generations.

Bernard Desmond (pictured above right), director of mortgage brokerage Blank Financial, said the current mistrust is not a unique problem.

“It is not just Australia, but rather a global phenomenon where users are not fully confident and educated about the benefits and use cases for AI in this industry,” Desmond said.

While borrowers may mistrust generative AI when selecting mortgages themselves, the other point is how they feel when brokers and banks use it to assist their processes.

For those who are not interested in an AI-powered financial service, the FIS research showed they have little trust in AI and prefer dealing with a person for financial services.

Nearly 75% of Aussies don’t know if their bank uses AI and around one-third would change if a bank did, primarily due to data security and fraud concerns.

Stewart said that he can see how AI can be a “helpful co-pilot” for brokers allowing for more time with customers and less on admin.

“I think that where AI can get really exciting is where it works hand in hand with the broker to provide a hybrid experience, allowing customers to make their own decisions on how they interact with technology,” Stewart said.

“I think there are some incredible innovations in this space that will hit the industry in the coming years, which I’m excited to see land.”

Desmond agreed, saying he already can see how AI can automate routine tasks like data entry and document processing. However, he said there is massive potential for lenders too.

“GenAI can analyse large amounts of data to identify patterns and trends that would be difficult for humans to spot,” Desmond said. “This can help lenders to make more accurate underwriting decisions and to provide borrowers with more transparent information about their mortgage options.”

Overall, Desmond said this would provide a more personalised experience for borrowers by providing them with personalised information and recommendations based on their individual needs and circumstances.

“Imagine a broker spending less than 10% of their time doing routine administrative work – how effective would it be for them to drive some exceptional growth for themselves?” Desmond said.

“I can confidently tell you this – I meet many brokers, and most are drowning in completing their admin work. All this can go away.”

The issue, according to Desmond, is that generative AI needs to “act as a facilitator rather than a decision-maker” in its current format.

“We are entering a whole new digital world, and being anxious is normal. What would help is as an industry, we lay the guidelines and rails for AI to operate with confidence,” Desmond said.

“Australia has a unique opportunity to blend AI into decision-making and be the first in the world to do it successfully across the industry.”

One way or another, the future of mortgage broking is shimmering with the promise of generative AI.

Stewart said when done well, generative AI and other technology will assist brokers and banks with their processes, allowing for a better experience for borrowers.

However, at this point, Desmond said co-existence is the key.

“We work with humans, and we will need humans to service them,” Desmond said.

“I don't foresee – at least for the next five years, AI replacing a human – while the possibilities are endless, AI will continue to be a facilitator – rather than a broker's best friend.”

Do you use generative AI as part of your day-to-day? Comment below.