As traditional banks face increased funding costs and changing market conditions, the space is open for non-banks and private lenders to provide solutions to customers who may no longer fit the banks' criteria.

Banks are facing a credit crunch, according to Darren Liu (pictured above), chief strategy officer at FINSTREET Group, and he believes there’s a window for non-banks and private lenders to take market share over the next 12 to 18 months.

“Equally, it’s an opportunity for brokers to navigate the challenges of the credit crunch and provide valuable assistance to customers,” Liu said

Banks fund themselves through a range of sources, including deposits, wholesale debt and equity. The cost of this funding is key to determining the rates they offer on loans to households and businesses.

Part of the bank’s current funding comes from the Term Funding Facility (TFF) announced by the Reserve Bank Board in March 2020 as part of a comprehensive policy package to support the Australian economy in response to the COVID-19 pandemic.

Through the TFF, the banking sector borrowed $188 billion (around 8% of the banks’ total credit) on a three-year fixed rate of 0.25%.

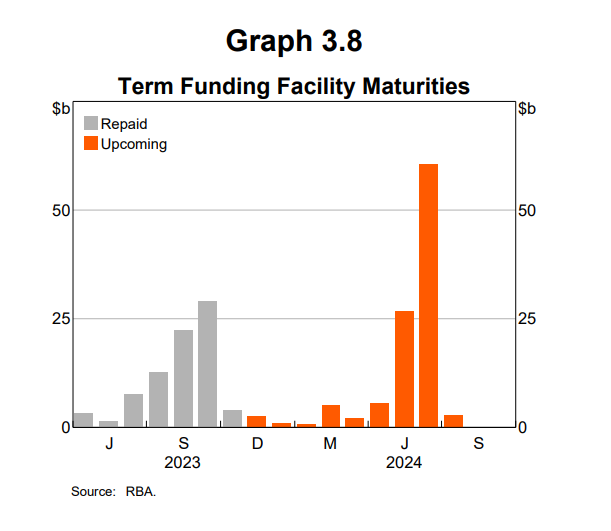

The TFF closed to new drawdowns at the end of June 2021, so the last of this funding will not mature until mid-2024. Already though, banks have repaid about $80 billion since June 2023.

Since the end of the financial year, the size of the bank’s balance sheet has fallen from around $600 billion to $530 billion, according to the RBA in its November quarterly Monetary Policy Statement.

The RBA said this was expected to decline gradually over the coming months, followed by “a sizeable decline in 2024 as a further $104 billion in TFF loans and $38 billion in the Reserve Bank’s domestic bond holdings mature”.

While the TFF repayments may cause a headache, banks may also not be able to rely on the money people have deposited into the Australian banks, said Liu. These deposits represent around two-thirds of banks’ funding, according to the RBA.

“Since the effects of interest rates often lag, borrowers will continue to face increased repayments, adding stress to households,” Liu said. “Customers with savings, despite an increase, will see their funds deplete rapidly due to higher repayments and will transact less with banks.”

Additionally, Liu said the international capital market is currently inflationary and unstable due to ongoing conflicts, making it challenging to obtain cheaper money. As a result, the low-cost funding banks previously enjoyed may no longer be available.

“This liquidity issue affects the banks, as the transactional money used for credits is drying up. Banks will face higher funding costs, impacting their profit margins.”

As the credit crunch digs in, Liu predicted that banks may struggle with funding higher risk loans, leading to a cycle of higher costs and lower net growth.

This can already be seen in the Commonwealth Bank’s recent mortgage market slide that has seen its mortgage portfolio contract by over $4 billion between June and September.

“Banks are left with the option of either passing the higher funding cost to customers or finding alternative ways to secure cheaper funding. However, the latter is becoming increasingly difficult,” Liu said.

“Customers who no longer fit the bank's criteria may face more stringent conditions leading them to have to look elsewhere.”

Liu predicts that the banks currently have a three-pronged strategy:

“The overall trend seems to be a shift from aggressive growth strategies like cashbacks to a more conservative approach to maintain profitability in the face of changing market dynamics and potential increases in funding costs.”

Liu said the credit crunch would likely extend beyond the mortgage market, with commercial assets “especially vulnerable” in tightening financial conditions.

“Unlike residential properties, which still have demand for living, commercial assets are more investment driven,” Liu said. “If the return on commercial properties decreases due to factors like rising interest rates, it can lead to a decline in asset value and profitability.”

With non-banks in the same sector and looking to take the market share from the banks, it’s easy to assume that they too will be facing a credit crunch. However, Liu said this would likely not be the case because their funding sources were different.

“Banks rely heavily on deposits and term facilities, which can pose challenges during a credit crunch,” Liu said. “Non-banks and private lenders often source funds from wholesale markets, institutional banks, or even traditional banks, and they have a more flexible approach.”

“While they face similar risks in terms of asset value decline, their funding structure and risk appetite differ, allowing them to navigate challenges differently.”

Liu said non-banks could fill the gap and provide solutions where banks might face limitations.

“For instance, if a customer has a unique situation, like a significant change in repayments, a non-bank might have the flexibility to find a tailored solution using various lenders and products.”

To help brokers meet this opportunity, FINSTREET developed FINSERV – an AI-powered platform that helps brokers find non-bank loan products through technology that assesses non-standard risk.

“The FINSERV platform will have product and policy engines to quickly provide solutions to brokers, ensuring they can offer tailored options to their clients efficiently,” Liu said.

“It's about empowering brokers with the resources they need to maintain good relationships with clients by assuring them that solutions are available for their unique situations.”

Like any major financial sector, banking goes through cycles. Liu emphasised that his comments were not intended to criticise banks, but rather to acknowledge the evolving risk landscape within the sector.

As this evolution happens, Liu said it was essential for the industry to evolve their thinking about non-banks.

“In the past, when people heard ‘non-bank’, they associated it with customers facing credit history problems or other issue. Now, it's more about understanding that the customer might be prime but facing a temporary servicing issue or seeking a bridging solution,” Liu said.

“The challenge is that brokers may lack knowledge or familiarity with non-bank solutions, making them reluctant to present these options. We aim to build a community of brokers who are well-versed in non-bank solutions and can efficiently handle diverse customer needs.”

What do you think of the banks’ credit crunch and the opportunity for non-banks? Comment below.