On May 15, Treasurer Jim Chalmers delivers the 2024 Federal Budget. Australians across the country are watching closely, hoping for measures to address the rising cost of living.

While Australia's vast size and diverse population mean there will be a variety of priorities, a common concern is the increasing pressure on household budgets.

Housing costs have soared, and grocery and energy prices continue to climb. This budget will be scrutinised for its ability to offer relief to those most affected.

The housing market is a key concern.

Some 41% of Australians said their rent/mortgage was one of their most stressful expenses in April, according to Finder’s CST. Victorians felt this the most (44%).

The Finance Brokers Association of Australia (FBAA) worries about potential interest rate hikes impacting homeowners already struggling with rising rates.

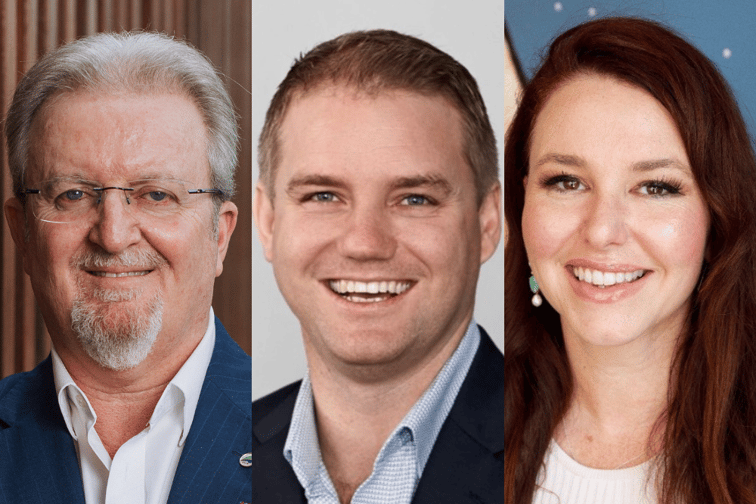

“I am concerned about commentary from economists who believe the budget may keep inflation and interest rates higher for longer,” said FBAA managing director Peter White (pictured above left).

The comments come after April’s inflation data came in higher than expected. While the RBA decided to hold interest rates on the first Tuesday of May, governor Michele Bullock issued the central bank’s most hawkish warning yet.

“I hope this is not the case and that the treasurer is correct with his prediction that the budget will help bring down inflation,” said White.

“Recent talk of yet another interest rate hike is creating greater stress for homeowners with a mortgage who have ridden the interest rate wave and now need a break. Lower rates are particularly important for middle Australia where interest rate hikes have hit hard.”

The FBAA also welcomed the government’s package aimed at boosting the supply of social and affordable homes.

“This should over the long term help ease the pressure on home availability and rents,” White said. “However as always the devil is in the detail and the plan has to be properly implemented.”

“We also welcome the continuation of the instant asset write-off for small and medium business.”

To pre-empt the sentiment of business owners and decision makers ahead of the announcement, business lender Prospa has commissioned new research from YouGov, which revealed that one in five (22%) say their SMEs don’t have any cash reserves.

As SMEs struggle to keep their head above water, 57% are hopeful for tax cuts, while 46% would like to see more rebates or subsidies on business expenses, including energy, according to the research.

“With SME owners and decision makers feeling the pinch, the cost-of-living pressures are further exacerbated by the tightening purse strings of their customers,” said Beau Bertoli (pictured above centre), co-founder and chief revenue officer at Prospa.

Nearly three in four (73%) Australian SME owners and decision makers had also noticed behavioural changes in their clients or customers over the past year as a result, with 41% now spending less frequently.

This has led to 38 % of SME owners and decision makers indicating higher prices are already top-of-mind to manage the impact of rising costs over the next year.

“As Australian SMEs emerge from the highest month on record for business insolvencies, support measures from the upcoming budget will be critical to their survival,” Bertoli said.

Finder has further data on how many Australians are struggling, the bills causing them the most stress, and how the federal budget will impact them.

According to the survey, 40% of Australians listed their groceries as a top bill stresser, with Queenslanders feeling stress at the till the most acutely (49%).

More than one in four (27%) Australians said their energy bill was one of their most stressful expenses in April, followed by petrol (22%), and health insurance (17%).

Perhaps most concerning of all, one in two (48%) Aussie workers could only survive off their savings for a month or less if they lost their job tomorrow.

While the federal budget won’t be a magic bullet to alleviate cost of living concerns, any relief to household budgets will be welcome news, according to Sarah Megginson (pictured above right), money expert at Finder.

“Energy bill relief looks to be a firm favourite feature in this year’s budget and depending on where you live, your state or territory could have more energy bill relief on offer,” Megginson said.

“We’ve already been told the government will reduce last year's huge 7.1% HECS-HELP indexation. The changes could save the average person with student debt around $1,200.”

“We also know that thanks to tax cuts, the average Australian earner will be paying around $1,700 less in tax from July 1. At the same time, superannuation is increasing from 11% to 11.5% in July, so workers will benefit from those extra retirement savings too.”

What do you want from the budget? Comment below.