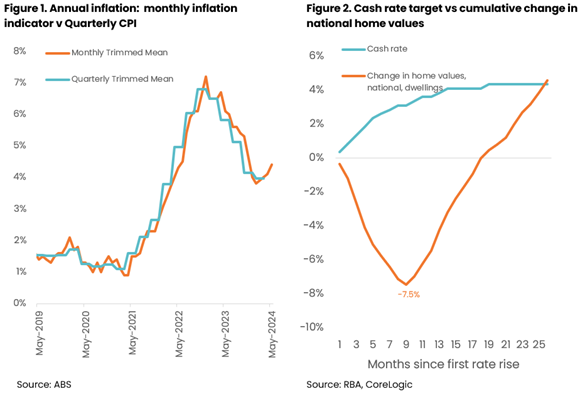

Alarm bells were ringing across Australia when May’s monthly CPI indicator showed inflation beat economists’ expectations lifting to 4.4% year-on-year, up from 4.1% in April.

While the monthly CPI indicator isn’t as complete a measure as the quarterly inflation result, Eliza Owen, head of research at CoreLogic Australia, said there is concern that inflation is back on the rise.

“This could necessitate another increase in the RBA cash rate target,” said Owen (pictured above).

The Australian housing market has been fairly resilient despite higher interest rates.

Figure 2 above shows the cumulative change in national home values from May 2022, showing an initial peak-to-trough fall of -7.5% from the start of the rate-hiking cycle through to January 2023, which marked the low point of the downturn in housing values.

From the start of 2023, the cash rate would increase a further five times, but home values consistently rose, staging a recovery by November 2023, and rising further to be 4.6% higher than in May 2022.

There are a few explanations for why housing values have continued to rise even as the cost of debt has risen, and borrowing capacity has eroded. Part of the explanation, said Owen, comes from low supply relative to demand.

“Tight labour market conditions and an accumulation of savings through the pandemic have broadly underpinned mortgage serviceability, mitigating a need to sell as rates have increased, the construction sector remains squeezed, and unable to deliver a large backlog of dwellings, and strong population growth has increased demand for housing, both for purchase and rent,” Owen said.

In the June quarter, there were around 127,000 homes purchased, but only about 125,000 new listings added to the market for sale.

“As long as there are more people willing to purchase a home than sell, prices should theoretically continue to rise,” Owen said.

“The composition of buyers may also be propping up purchases, with higher deposit sizes indicating the current buyer profile may be less debt-dependent than when interest rates were at record lows.”

Other demand-side factors influencing housing purchases could be the predominance of variable rate mortgages in Australia.

“Buyers may be pricing in a future reduction in the cash rate to their purchasing decisions, with the expectation that they are buying in around the peak of the rate cycle, and their mortgage rates will trend lower over time,” Owen said.

From this perspective, a further rate increase could certainly slow demand and signal to the market that interest rates are not yet at peak or at the very least, are likely to take longer to reduce.

Despite resilience in the headline numbers, there are some suggestions that demand is already weakening.

National home values were up 1.8% in the June quarter, but this has slowed from a 3.3% rise this time last year, when the market was rising off a lower base.

Buyer demand seems generally skewed to cheaper markets, with Perth now being one of the primary markets driving growth in the capital cities.

In the month of June, it is estimated that Perth accounted for 32.4% of the 0.7% uplift in CoreLogic’s capital city home value index. Adelaide has also contributed more to the headline growth figure through June (14.2%), up from 4.1% a year ago.

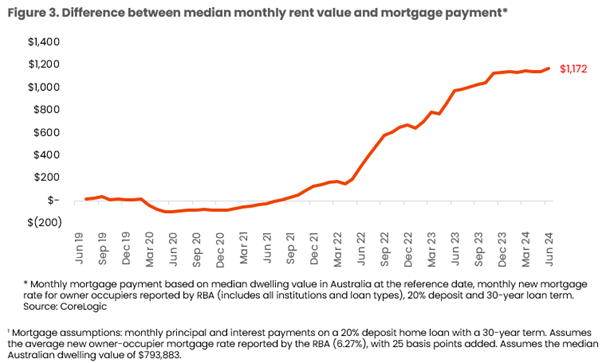

Owen said that another 25-basis-point rise in the cash rate in August, all else being equal, would take monthly repayments on the current median dwelling value to over $4,000 per month.

“Not only is this further out of reach for prospective buyers, it would likely also represent a further blowout in the premium of holding a mortgage relative to renting,” she said.

“The bigger that premium becomes, the weaker demand for purchases may become relative to renting, despite rent growth still sitting well above average.”

The RBA has expressed an extremely low tolerance for any further uplift in inflation, with the RBA board minutes of the May policy meeting released yesterday suggesting the central bank is increasingly adopting a hawkish stance.

The board said the case to raise the cash rate could be further strengthened if members judged that aggregate supply was likely to be more constrained than had been assumed.

Members noted that productivity growth remained very weak.

And while inflation expectations were judged to be consistent with the inflation target, the increase in the market-implied risk premium suggested a “higher risk of an increase in inflation expectations more widely”.

Notably, this was before the May monthly CPI figures exceeded expectations.

However, Owen said there’s no guarantee of an August rate rise yet.

The Reserve Bank’s own deputy governor noted last week that it would be a ”bad mistake” to base the August rate decision on one result, highlighting that quarterly inflation figures, the labour market report and retail sales data could also feed into the rate decision.

For what it’s worth, Australian retail turnover rose 0.6% in May 2024, according to seasonally adjusted figures released July 3 by the Australian Bureau of Statistics (ABS).

This followed a 0.1% rise in April 2024 and a 0.4% fall in March 2024.

However, the modest growth was attributed to end-of-year promotions and sales events, with underlying spending remaining stagnant.

Other economists have pointed to the limitations of the monthly CPI measure, which does not always indicate the direction of the quarterly result.

Westpac’s economics team had predicted the increase in the headline result to 4.0%, in part due to base effects. Despite ANZ and NAB now revising the timing of the first rate cut to 2025, none of the four major banks are anticipating another rate rise just yet.

However, six financial market economists - from Citi, Deutsche, Judo Bank, Morgan Stanley, Rabobank and UBS – now expect a rate hike in August, as reported by The Australian.

While another rate hike would be a killer blow to many homebuyers’ aspirations, Owen suggests demand may weaken even with a pause.

“Even if rates do not increase further, housing purchases are expected to slow as economic conditions become weaker and affordability constraints play out,” she said.

“Labour force conditions are clearly starting to unwind, as job vacancies drop, employment growth slows and the unemployment rate rises lifts, which will limit new demand, and possibly weaken mortgage serviceability if mortgage holders become unemployed or work less hours.”

“The household saving ratio has already weakened to just 0.9% of income in the March quarter, which will slow the accumulation of deposits for prospective home buyers, and impact savings buffers for households that own their home.”