Housing affordability in Western Australia took a hit during the June quarter, according to the latest REIA Housing Affordability Report.

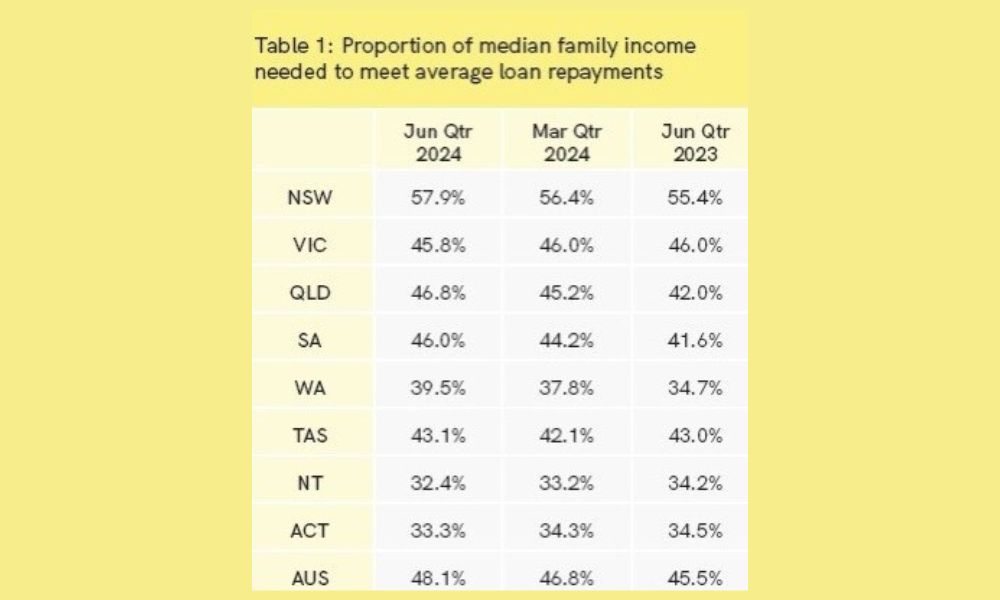

The report revealed that the portion of family income required for loan repayments jumped 1.7 percentage points, bringing the total to 39.5% – a 4.8% increase compared to the same period last year.

The average weekly family income sits at $2,630, while typical monthly loan repayments have climbed to $4,504.

See LinkedIn post here.

REIWA CEO Cath Hart (pictured above) attributed the decline in affordability to robust property price growth over the past year.

“A year ago, price growth was relatively low, but 12 interest rate rises saw mortgage repayments increase by nearly 50%, which has affected housing affordability,” Hart said.

While interest rates have remained stable since late 2023, the ongoing surge in property prices – Perth’s median house price increased by 20.5% over the year – has led to mortgage repayments rising by 16.1%.

Hart also noted that strong population growth combined with limited housing supply, due to low building completions, has further fueled price increases.

Despite the challenges, Western Australia remains the most affordable state for homeowners, with only the ACT (33.3%) and Northern Territory (32.4%) requiring a lower percentage of family income for loan repayments.

However, states like South Australia saw sharper declines in affordability, while New South Wales continues to be the least affordable state, with residents needing 57.9% of family income for mortgages.

Despite the drop in affordability, WA’s home loan market has remained resilient.

The total number of loans to owner-occupiers rose by 13% over the June quarter, with first-home buyers making up a substantial 38.1% of the market. The average loan size for first-time buyers increased to $475,393, reflecting a 17% rise over the past year.

Hart pointed out that WA remains one of the more affordable places for first-home buyers, with only Tasmania and the Northern Territory offering lower average loan amounts.

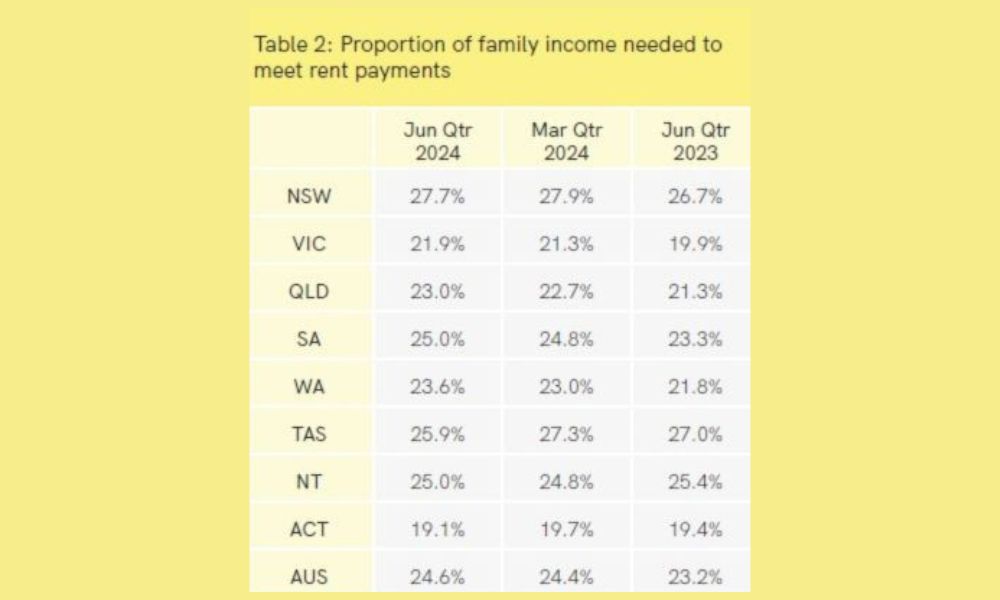

Rental affordability in Western Australia also worsened slightly during the June quarter, with the portion of family income needed for rent payments rising by 0.6 percentage points to 23.6%.

Hart noted that despite the marginal decline, “Changing market conditions indicate rental affordability will continue to stabilise over the remainder of the year.”

As of August, rental prices have remained stable, with house rents at $650 per week and units at $600 per week, largely due to increased supply from new investor-owned properties and completed tenant homes.

On a national level, Western Australia sits mid-range in terms of rental affordability, with Queensland, Victoria, and the ACT proving more affordable.

New South Wales remains the least affordable state for renters, requiring 27.7% of family income for rent payments, although some areas, including Tasmania and the ACT, experienced slight improvements in rental affordability over the quarter.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.