Brokers are experts on financial matters, but what happens when their clients face domestic violence? To help train brokers on how to handle situations like these, the MFAA is partnering with Accidental Counsellor, whose CEO, Cutty Felton, talks to Australian Broker about what the program will offer.

Domestic violence is a scourge on society, and the MFAA wants to help the finance broking community raise awareness, reduce stigma, and increase the safety of customers when it comes to family and domestic violence.

In 2019, the Banking Code of Practice was updated to include appropriate processes to identify and respond to customers in vulnerable circumstances. Sadly, 2020 saw an increase in people living in vulnerable circumstances, including domestic and family violence, which spiked during the year.

Starting on 4 May, as part of the MFAA’s social responsibility initiatives, the association will be running 2.5-hour sessions with a focus on this vulnerability.

Developed and delivered by Accidental Counsellor CEO Cutty Felton, the training sessions will focus on educating brokers so they can assist customers who are experiencing domestic and family violence.

Cutty Felton spoke to Australian Broker about what the sessions will offer, the need for greater sensitivity and compassion, and what inspires her to raise awareness of these vitally important issues.

Q: Can you tell us what brokers can expect from Accidental Counsellor’s upcoming training sessions on Customers in Vulnerable Circumstances?

Q: Can you tell us what brokers can expect from Accidental Counsellor’s upcoming training sessions on Customers in Vulnerable Circumstances?

A: What we will be looking at is increasing awareness around the different factors of vulnerability, particularly the ones that are highlighted in the Banking Code of Practice. There are, of course, a number of different vulnerabilities – mental illness, physical disability, age-related impairment – but the one aspect of vulnerability that we will be concentrating on the most in this upcoming series is domestic and family violence, financial abuse and elder abuse.

We will also have a look at the meaning of ‘coercive control’, which is terminology that a lot of people may be hearing at the moment but not be too clear on identifying. So, it will be very much around that aspect of vulnerability and how it relates to brokers in terms of the provisions of the Banking Code of Practice.

Q: What was the thinking behind changing the scope of the program and focusing in on domestic and family violence and that area of vulnerability?

A: We felt that, having provided the skills and frameworks to respond to people experiencing challenges in the Accidental Counsellor sessions over the past two years, we would now extend brokers’ knowledge and ability to better identify potential domestic and family violence situations, particularly because there is a requirement within the Banking Code of Practice to have that awareness of domestic vulnerability.

We are not for one moment asking brokers to become counsellors or therapists, we are not asking brokers to become experts or investigators into any of the fields of vulnerability, but there is a requirement that we all respond with sensitivity, with compassion, and that we take extra care when our customers are in vulnerable circumstances. Of course, we need to recognise what that in fact means before we can really comply with our obligations in terms of the code, and quite honestly with our obligations to one another as human beings.

Q: What impact has COVID had on people living in vulnerable circumstances?

A: Firstly, we know that approximately 41% of people have experienced some kind of negative employment impact through this pandemic. Just as a factor all on its own, that creates vulnerability for certain people who were never before in vulnerable circumstances. And it will exacerbate vulnerability for those who were already in that space. We also know, for instance, that pre COVID-19, every year in Australia about one in five people were experiencing mental illness. During this time of COVID-19, it looks as if that could end up being something like one in three. So, quite clearly, there’s been a dramatic increase in the number of people who might not only be diagnosed with mental illness but certainly who might be living with or struggling with mental illness. And of course I have to mention domestic and family violence as well. Pre COVID-19, we already recognised domestic and family violence as being at national emergency levels. Disturbingly, all evidence shows that during times of isolation and lockdowns and the restrictions the pandemic has imposed, the rates of domestic and family violence increase quite dramatically. So, not only for people who were already in vulnerable circumstances but for many others, COVID-19 has resulted, and will continue to result, in really difficult situations.

Of course, what we need to remember is that it is not necessarily only our customers who might be experiencing difficulty and vulnerability. Brokers and their colleagues may also be facing their own circumstances of vulnerability, stress and challenge.

Q: How common is it for people to find themselves in an abusive relationship or environment, and why is it particularly important for brokers to be aware of the signs?

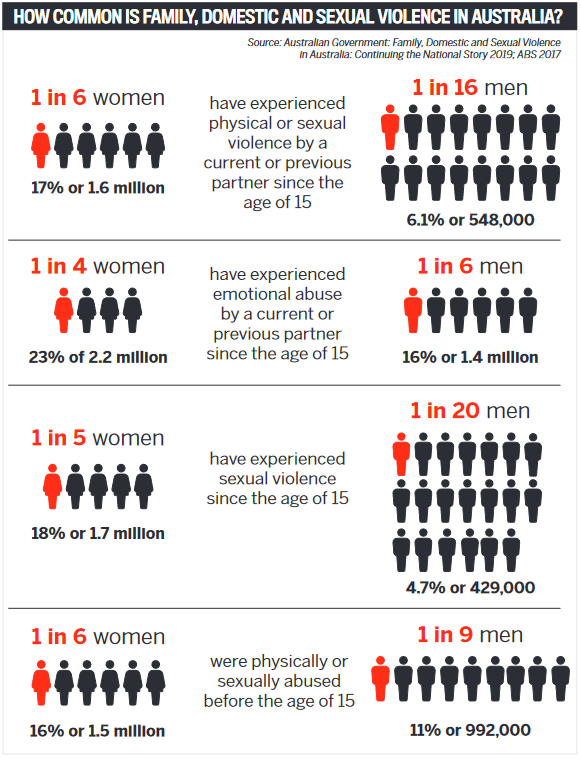

A: Pre COVID-19, we knew that, for example, one in four women over the age of 15 had experienced at least one incident of physical violence within a domestic relationship. That’s just one statistic. We do need to be careful, though, to make sure that we don’t make any assumption around who might, and who might not, be living in abusive circumstances within our communities.

Yes, it is agonisingly common for women and children to be in that situation, but of course that does not mean that men, or in fact any person no matter how they identify, might not be experiencing domestic and family violence. We need to be very aware as well that these are circumstances that are occurring in all types of domestic or family relationships. It’s quite dangerous to have tunnel vision to think that we’re only looking at a traditional husband and wife. We need to broaden our thinking and understand, for example, that people living with disability are at a hugely increased risk of abuse as well.

So, in terms of how common it is, this is something that each and every one of us really does need to be aware of, particularly brokers who are in a unique position in the type of relationship that they create and build with their clients. Relationships, I understand, are really at the core of a successful broker business, which means that they get a unique insight into people’s lives and experiences.

For those people who are at risk, a bad experience or response from a third party such as their broker can really create a huge barrier to them coming forward to get the support that they might need. So it really is important that brokers understand the necessity to be absolutely aware and to understand how to ensure that, every time they are responding, safety is the priority – not to become the therapist or the counsellor or the investigator, but to understand that safety is an absolute priority.

Q: What are brokers’ obligations under the Banking Code of Practice when it comes to the mental and physical health and wellbeing of their clients?

A: Generally speaking, what the Code of Practice asks is that, whenever a customer finds themselves in any type of vulnerable circumstances, we respond with sensitivity, we respond with compassion – and the words “extra care” are used. And I guess that really is the question: what does “extra care” really mean?

Again, making sure everything we do prioritises safety is incredibly important, but my understanding is that, at the end of the day, what extra care probably means for a broker – in addition to being aware, noticing what’s going on – is that every single time it comes to their attention that a client is experiencing any type of vulnerability, it is imperative that they refer it to the lender in accordance with each lender’s processes. The lenders have specialist teams that are in place to support those circumstances. So, it’s very important that the broker is familiar with each lender’s requirements or process and makes that referral through to the lender.

Q: What inspired you to become a counsellor and do this important work?

A: I particularly love this question, and the reason I love it is because I am not in fact a counsellor, and that’s exactly what inspired me to do this. I have experience through my time with Lifeline’s 13 11 14 crisis support and suicide prevention service of just what an extraordinary impact every single one of us can actually make in those moments when we are with people who are facing enormous challenges.

Q: In what other ways do you hope your upcoming sessions will help brokers?

A: There is so much talk around the various factors of vulnerability at the moment, but as people, each broker really does approach their client on a very human basis. That’s what makes brokers such a strong force within our communities; that’s why people trust their broker. So, as human beings, I’m hoping that these sessions will raise awareness around these issues of vulnerability. When we raise awareness and have open conversations, we start to reduce stigma. Safety and stigma are the two main reasons why people who are in desperate circumstances very often find it almost impossible to disclose it and seek help. So if we can reduce that stigma, then essentially what happens is that we will start to increase safety for everyone in our community, not just as professionals but as human beings too.

To register for the MFAA Accidental Counsellor sessions from 4 to 13 May, visit mfaa.com.au/education-events/events.