As traditional lenders become stringent with their lending conditions, the second choice of going with a private lender has become more popular, according to a commercial broker and a private lender.

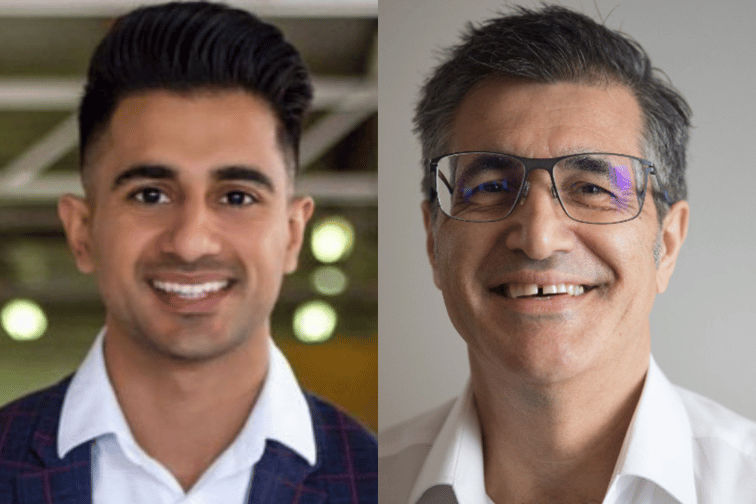

Gee Taggar (pictured above left), a private lender at Archer Wealth, said he understood that banks would continue to be primary choice among brokers for most clients throughout the year but urged them to consider private lenders for non-standard customers.

“The big banks have the reputation your clients trust, and they have the finance your clients want first. Private lenders like me? We come second and we know that,” Taggar said.

“But just remember, if the money is urgent, the bank has rejected, or your client needs money fast but doesn’t want to move banks, speak to your private lender.”

When it comes to banking in Australia, there are a plethora of options with 96 banks amassing over $5 trillion, according to the RBA’s December 2021 numbers.

However, tighter financial conditions and weaker economic activity pose some risk to banks’ credit quality, according to the latest RBA’s six-monthly Financial Stability Review.

Considering banks are also bound by APRA and its 3% serviceability buffer, lending could tighten in the coming months.

Rob Kirk, a broker and mortgage manager (pictured above right) at Equity Partners, said in many cases, banks often turned away self-employed customers.

“This is especially true if their financials are insufficient and do not go back for a period of three years,” said Kirk.

Non-banks operate under ASIC’s more relaxed regulations with lending criteria typically being more lenient. However, they face pressure for funding or asset quality as arrears rise in the space.

Krik said he had experienced some recent wins with private lenders who were not strict since their finance was not treated as consumer loans, which are subject to the National Credit Code.

“While private lenders will require some evidence that the borrower can service their loan, this evidence can be a simple letter from their accountant that they have capacity to make monthly interest payments,” Kirk said.

Of course, private lenders are not without their faults.

Private lenders often charge higher interest compared to traditional and often non-bank lenders, significantly increasing borrowing costs.

However, Taggar argued that – if they are good – private lenders “should be open” to negotiate with their borrower and give them the opportunity to obtain more favourable terms, including interest rates, loan duration, or prepayment options.

“It's crucial for borrowers to compare offers from multiple private lenders to find the most competitive rates,” Taggar said. “This is where a mortgage brokers can provide a tremendous amount of value.”

Additionally, taking a high-interest private loan without a clear repayment plan could lead to a debt spiral.

Taggar admitted that some private lenders may also have unethical practices, intentionally lending to borrowers who can't repay to seize property for profit.

However, Taggar said that any private lender that doesn’t help borrowers work out a well thought-out repayment strategy before settlement “isn’t worth their time”.

“Due diligence is therefore essential when selecting a private lender. Borrowers should research the lender's reputation, check for reviews or complaints, and work with experienced mortgage brokers who can provide recommendations,” Taggar said.

“Look for lenders with a track record of transparency and ethical lending practices.”

While private lenders came with some concerns, Taggar and Kirk said private lenders were fast becoming non-traditional solution for many brokers.

Taggar said it was all about making brokers’ lives easier.

“I want to help them grow their businesses, maximise their deal flow and provide the absolute best customer service to their borrowers so they keep coming back to them for more,” Taggar said.

“We know private lenders are not your first choice, but we should definitely be your second.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.