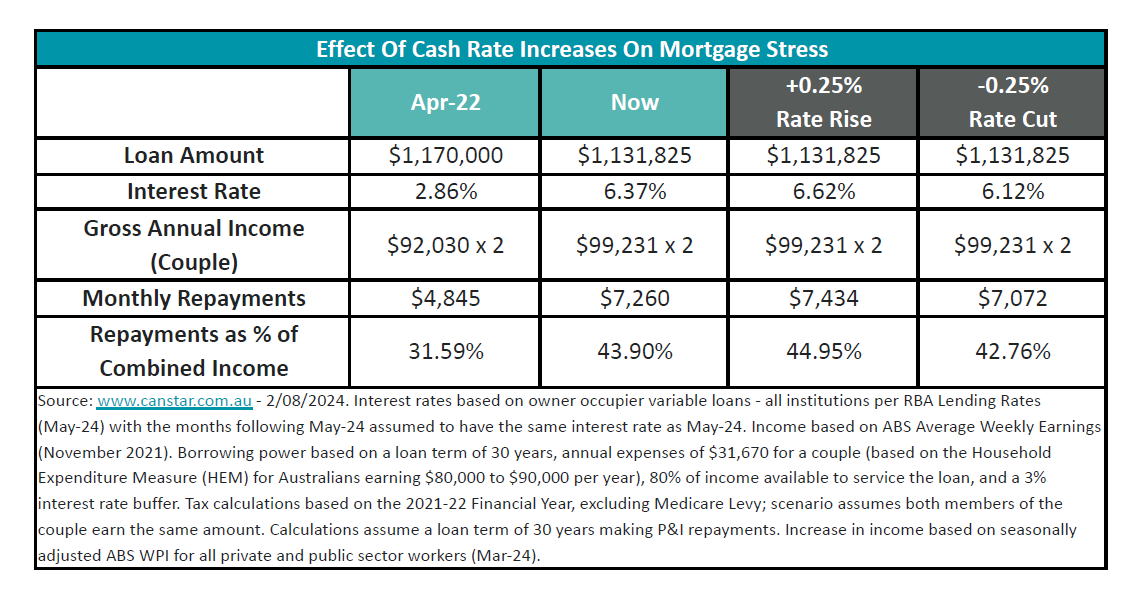

An unexpected rate rise could push recent homebuyers to spend 45% of their before-tax income on loan repayments, leaving little for other essential expenses, according to Canstar.

New research from Canstar showed that borrowers who purchased homes at the peak of their budget just before rate hikes in 2022 are dangerously close to the breaking point.

A dual-income couple earning a combined average income of $184,060, who maximised their borrowing capacity in early 2022, could now be spending approximately 43.9% of their before-tax income on repayments.

This increase in financial pressure is due to ongoing inflation and the potential for further rate hikes, which could push repayment commitments close to 45% of their income.

While recent inflation figures met expectations, the high inflation rate continues to pose a threat.

Any setbacks in controlling inflation could lead to additional rate hikes, further straining borrowers.

Canstar’s finance expert, Steve Mickenbecker (pictured above), stressed that even a potential rate cut, predicted by some major banks to occur as soon as November, may not provide sufficient relief.

“Borrowers who maxed out their borrowing to the highest affordable level just before the Reserve Bank started lifting the cash rate will now be in a seriously stressed position,” Mickenbecker said.

“When rates rise by 4.25% in 18 months, way more than the lift in incomes, stressed borrowers are in uncharted treacherous waters.”

Mickenbecker said that the situation is particularly dire for those who borrowed at the peak.

“With today’s loan repayments tipping 44% of their pre-tax income, they are in clear-cut stress,” he said. “Borrowers who borrowed just before rates went up in a rising house price environment are doing it toughest.”

The rising costs of insurances, petrol, groceries, and other expenses further compound the financial strain on these borrowers. Predictions indicate no significant rate cuts before May 2025, prolonging the stress for many.

Despite potential savings from refinancing, many stressed borrowers are unable to access these benefits due to stringent credit guidelines.

“Borrowers in April 2022 who took out a loan at the lowest rates on record and at high property prices are the ones who most need repayment relief, but they are excluded because their already stressed finances won’t pass lenders’ credit guidelines,” Mickenbecker said.

For those feeling the pressure, Mickenbecker advised, “The best tip for anyone feeling they are headed towards breaking point is to speak to their lender about relief support and also consider reaching out to the National Debt Helpline. Managing financial stress in the times we are in now, can mean a happier future.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.