Australian retail spending showed modest growth in September, rising by 0.1%, according to the latest data from ABS.

The slight increase followed a stronger 0.7% gain in August and a flat result in July, reflecting a stabilising trend in consumer spending as household budgets remain tight.

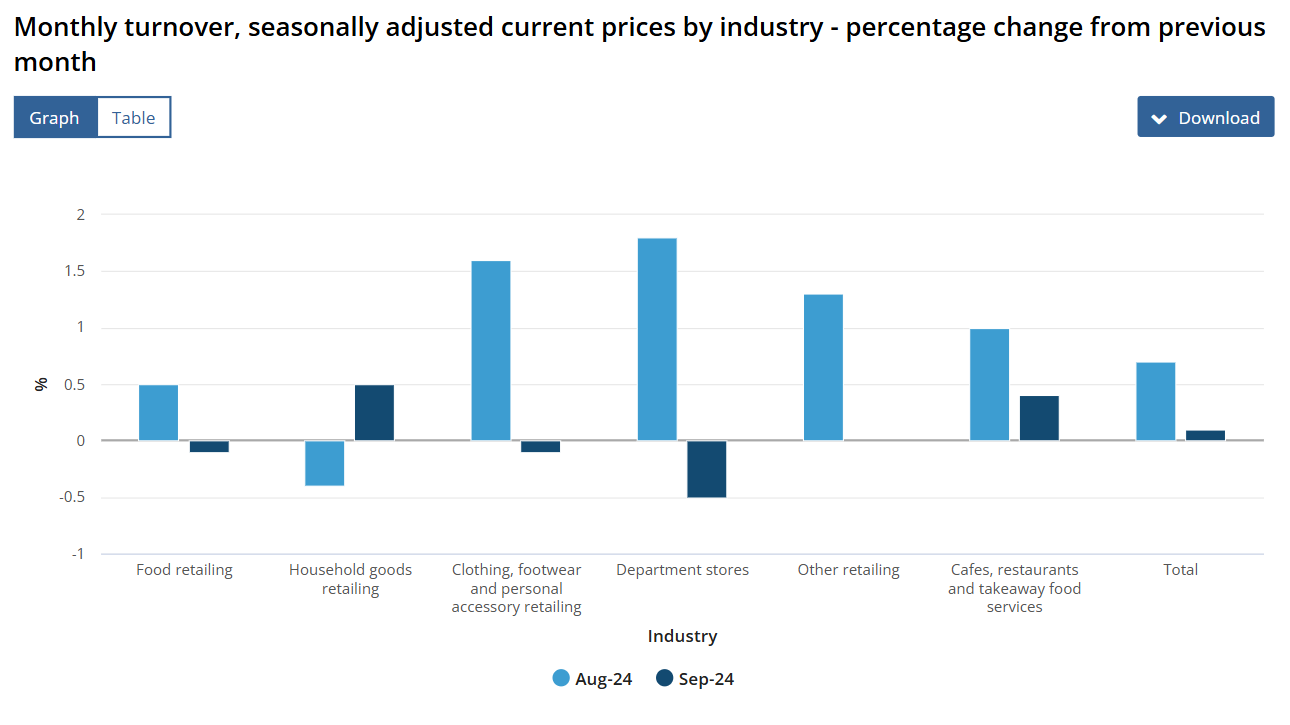

The growth in September was led by household goods, which rose by 0.5% after a dip in August.

Robert Ewing (pictured above), ABS head of business statistics, attributed this increase to a spike in hardware and gardening purchases in Western Australia, where “unseasonal rainfall last month reduced sales,” creating pent-up demand.

Cafes, restaurants, and takeaway services also recorded an uptick of 0.4% as warmer temperatures continued to drive social spending.

In contrast, other sectors saw declines. Department stores experienced a 0.5% drop, while clothing, footwear, and food retailing each saw small decreases after posting gains in August.

Food retailing’s downturn was primarily due to a sharp reversal in liquor sales, which had spiked in August but eased back in September.

“The August boost in spending on alcohol was temporary,” Ewing said, pointing to the transient nature of seasonal spending patterns.

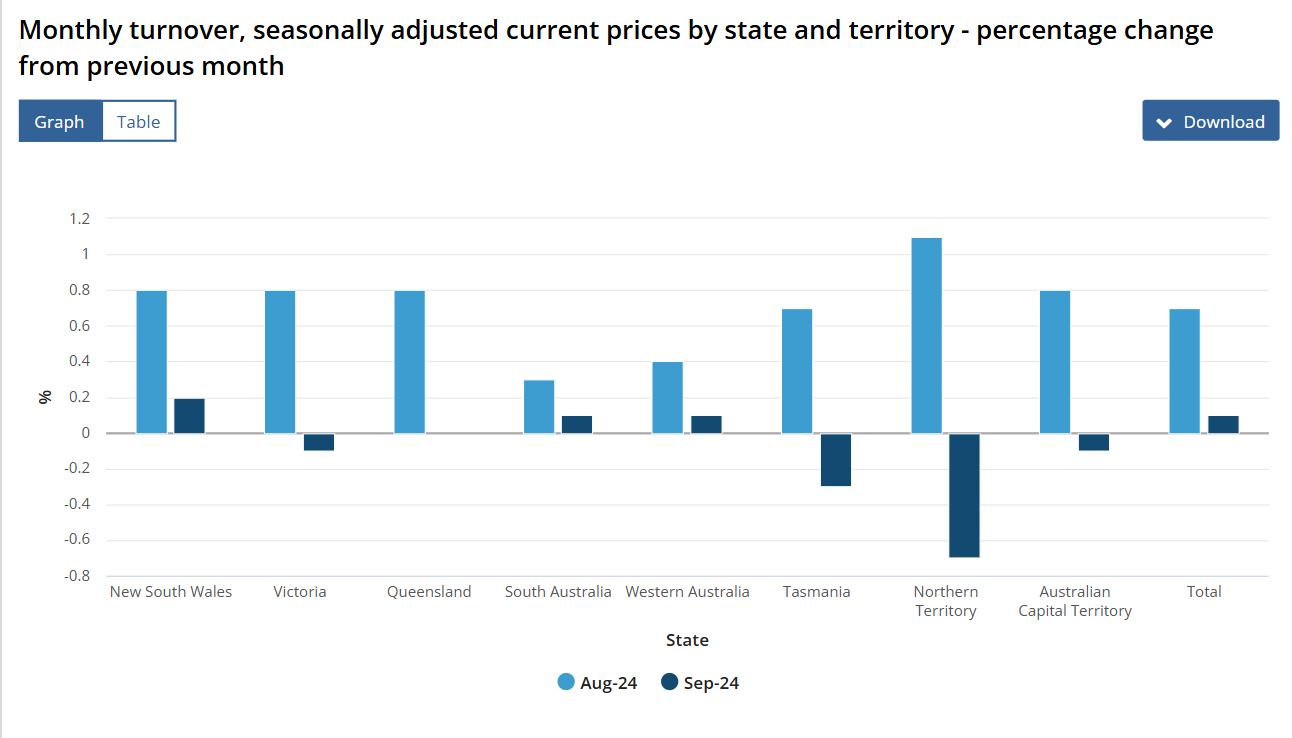

Retail spending patterns varied across regions.

The Northern Territory posted the largest decline, impacted by heavy rainfall that dampened consumer spending, marking its first monthly fall after four consecutive months of growth.

Most other states held steady, mirroring national trends of modest, mixed growth.

In quarterly terms, retail sales volumes increased by 0.5% in the September quarter, marking a return to growth after two quarters of declines.

“Retail sales volumes rose for only the second time in the past two years, regaining some of the lost ground in discretionary spending this year,” Ewing said.

This boost reflects consumers cautiously returning to stores amid slower retail price growth, which eased to 0.6% this quarter compared to 1.0% in June.

Despite the positive quarterly data, per capita retail volumes fell by 0.1%, continuing a nine-quarter decline and signaling that spending remains constrained.

Ewing noted that “recent spending patterns continue to show that consumers remain price conscious and responsive to discounting,” indicating that while spending has stabilised, price sensitivity persists.

Overall, the data points to a steady but cautious consumer market, with spending shaped by weather effects, seasonal patterns, and ongoing consumer responsiveness to pricing shifts.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.