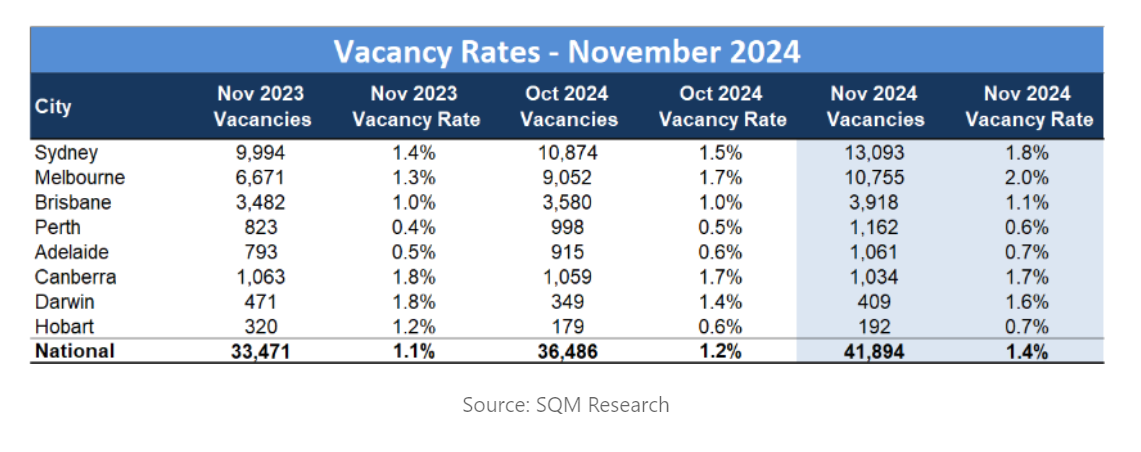

Australia’s residential rental vacancy rate rose to 1.4% in November, marking the highest level in three years, according to SQM Research.

The total number of vacant rental properties climbed to 41,894, up from 36,486 in October.

The increase was primarily driven by higher vacancy rates in Sydney, Melbourne, and Brisbane, while other cities remained steady or saw minor changes:

Other capitals remained stable. Canberra held at 1.7%, while Perth maintained its tight market with a low vacancy rate of 0.6%. Darwin saw an increase to 1.6% due to seasonal factors. Adelaide and Hobart remained steady at 0.7%.

Central business districts (CBDs) experienced notable increases. Sydney’s CBD vacancy rate jumped from 4.7% to 6.4%, while Melbourne’s CBD rose from 5.5% to 5.9%. Brisbane’s CBD recorded a minor uptick from 2.3% to 2.4%.

Rental price trends across capital cities showed varied movement over the month leading to December 12:

Nationally, combined rents fell slightly by 0.5% to $631, while the capital city average held steady at $722.

Louis Christopher (pictured above), managing director of SQM Research, attributed the rise in vacancy rates to seasonal factors and broader economic pressures.

“National rental vacancy rates have hit a three-year high with the vacancy rate reaching 1.4%,” Christopher said. “Now at this time of year, we normally record a seasonal increase in vacancies driven in part by university graduates completing their courses and returning home.”

However, the SQM Research leader also noted structural shifts in living arrangements.

“Sky-high rents have forced many to make compromises in their living arrangements, with the number of occupiers increasing per property,” Christopher said.

While the increase in vacancies indicated slight relief for renters, Christopher cautioned that Australia is not out of the rental crisis yet.

“Are we out of the rental crisis? No, not yet, but there is a little bit of light at the end of the tunnel,” he said.

Despite recent improvements, rapidly growing population levels and low housing construction rates will continue to strain tenants throughout 2025.

For now, renters may see slight improvements in availability, particularly in major cities like Sydney and Melbourne, but challenges remain as demand continues to outpace supply, SQM Research reported.

Read the full SQM Research report on LinkedIn.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.