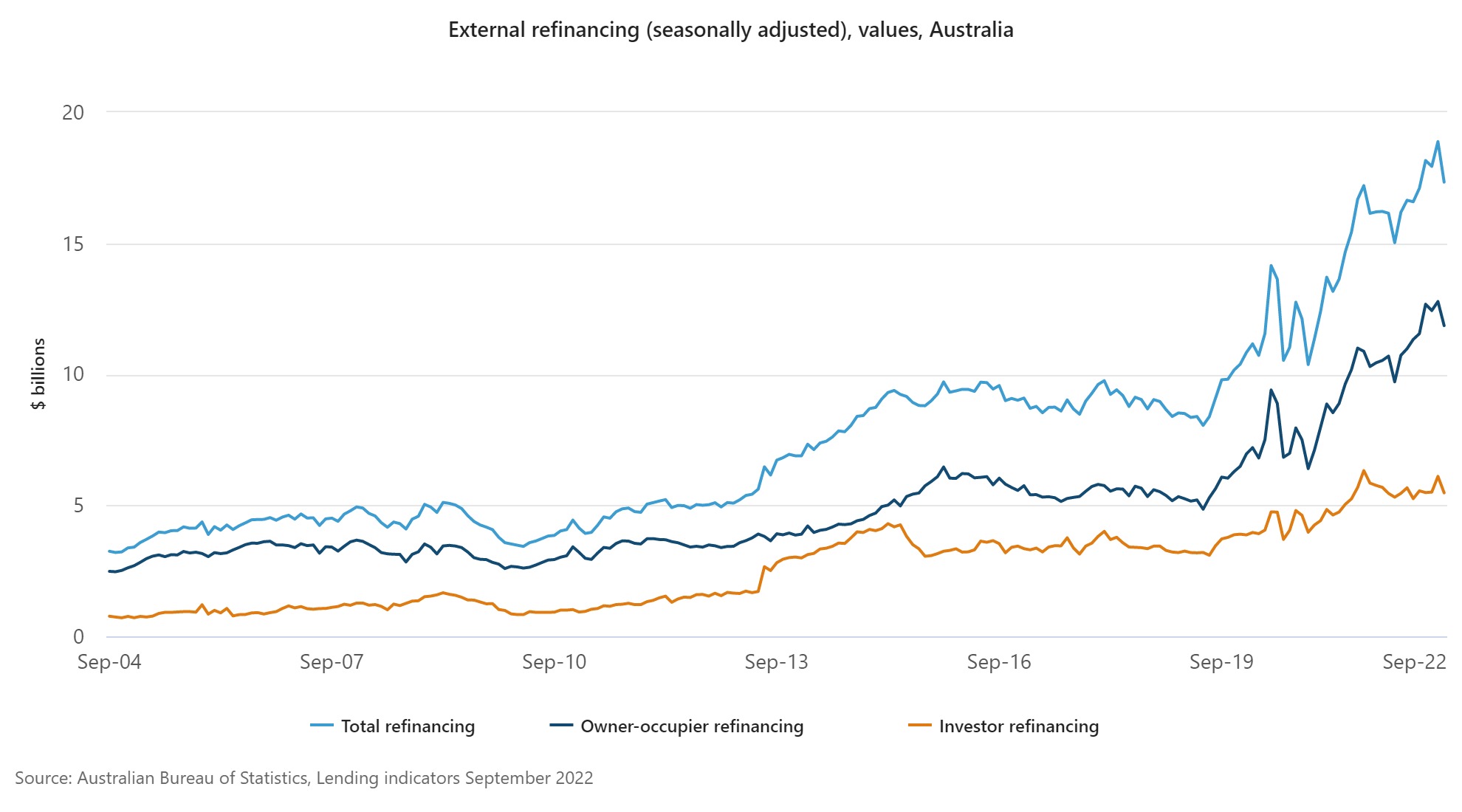

The volume of homeowners refinancing their mortgage has risen rapidly, providing an opportunity for brokers to make up for lower numbers of new customers, says an industry expert.

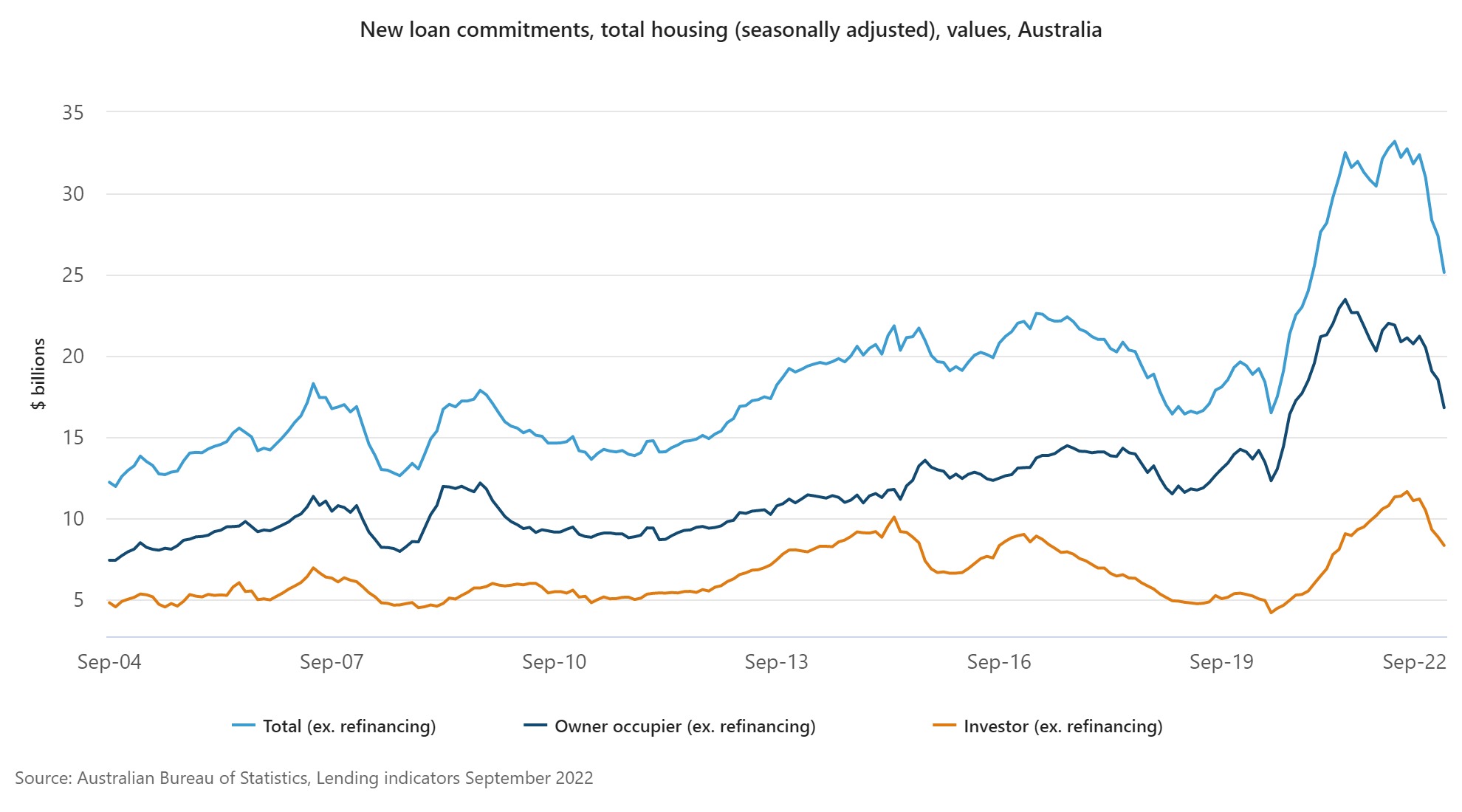

Nick Young (pictured above), founder of Melbourne trail book buying company Trail Homes, said new data released by the Australian Bureau of Statistics showed that refinancing volumes increased from $16.3bn in May 2020 to $33.2bn in January 2022.

“Any mortgage broker would tell you their new business numbers are down, but the volume of their existing clients refinancing is through the roof,” Young said.

“At the end of 2021 and before the rate hikes of 2022, the banks could borrow two to three years’ worth of money for next to nothing from the government and offer super-low interest rates of 2%. People flocked in and took advantage of fixed rates at record lows, which was where the exposure occurred.”

Young said the trend of mortgage holders wanting to regularly refinance their home loan was here to stay.

“This is a permanent change and someone wanting to refinance every three to four years is something brokers need to get used to and something they need to tap into,” he said. “Servicing your existing clients and staying in regular contact with them is so important. Brokers need to pivot their business to ensure they are servicing all clients and not just looking at new business.”

Young said he anticipated a further 10% growth in broker clients refinancing following the boom of 2022.

“This is not a scaremongering tactic. The latest ABS data tells me what goes up must come down and we should consider this as a course correction,” he said. “It will be refreshing to see the market move into a territory hopefully less volatile than what it has been. Brokers should be ready for this and learn what consumer patterns they should be aware of.”

Young said another trend he was watching closely was lenders focusing on acquiring new business by offering cashbacks and incentives rather than taking care of existing clients.

Read more: Mortgage stress hits Australian households

“From a lender point of view, acquiring new clients rather than maintaining existing clients is a dangerous game as it is not a profitable outcome for the lender to have a client on the books for a year or two then they move on,” he said.

“It is ambitious as lenders tighten their lending criteria, coupled with increasing borrower demand from lenders rather than focusing on retention strategies. Lenders are compassionate; however, brokers need to be aware of the term of ‘mortgage prisoners’, a term which is thrown around a lot these days, especially as we all know life events happen.”

Young said client serviceability had been dramatically affected in the last six months, which some people might not be aware of.

“The cost of a loan has increased as the ability to service is much more conservative. My advice to brokers is to conduct a financial health check on your clients,” he said. “Stay close to your clients, stop and look at their circumstances individually. It helps by extending the client broker relationship. All good brokers do it – it’s broker 101.”