In a week of mixed movements for home loan rates, the market has generally tilted in favour of borrowers, according to Canstar.

Notably, while two lenders have increased variable rates for owner-occupiers and investors, a more significant number of lenders have made cuts that could benefit those looking to secure a mortgage or refinance existing loans.

“Rate action over the week was overwhelmingly in favour of borrowers, even though the Reserve Bank is not expected to lower the cash rate until late in the year,” said Steve Mickenbecker (pictured above), Canstar’s finance expert.

“The cuts made to rates out of step with the Reserve Bank’s cycle shows that lenders continue to chase new business and should remind borrowers to keep a close eye on their own loan’s interest rate.”

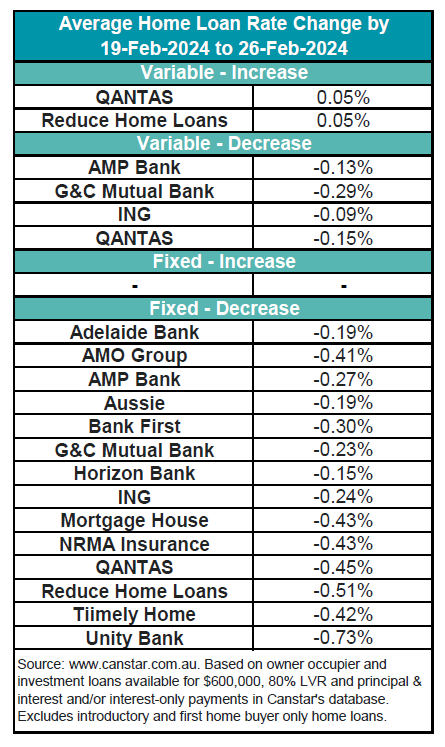

Two lenders have raised three owner-occupier and investor variable rates by an average of 0.05%. In contrast, four lenders have reduced 15 owner-occupier and investor variable rates by an average of 0.15%.

This week saw no increases in fixed rates for either owner-occupiers or investors. However, 14 lenders made substantial cuts to 272 fixed rates, with an average reduction of 0.33%, signalling a significant shift towards more affordable borrowing costs.

See the table below for the lenders that moved during the week of Feb. 19-26.

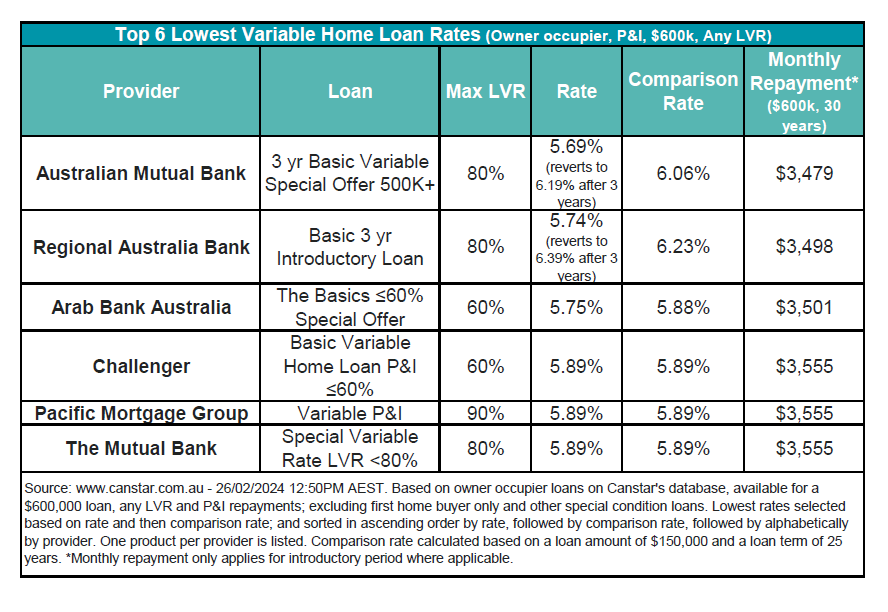

The average variable interest rate for owner-occupiers paying principal and interest stands at 6.9% for an 80% LVR. However, the lowest variable rate available across any LVR is an introductory rate of 5.69% from Australian Mutual Bank.

According to Canstar’s database, there are 19 rates below 5.75%, maintaining the previous week’s numbers, and 225 rates are below 6%, substantially lower than the average loan rate.

See the table below for the lowest variable rates.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.