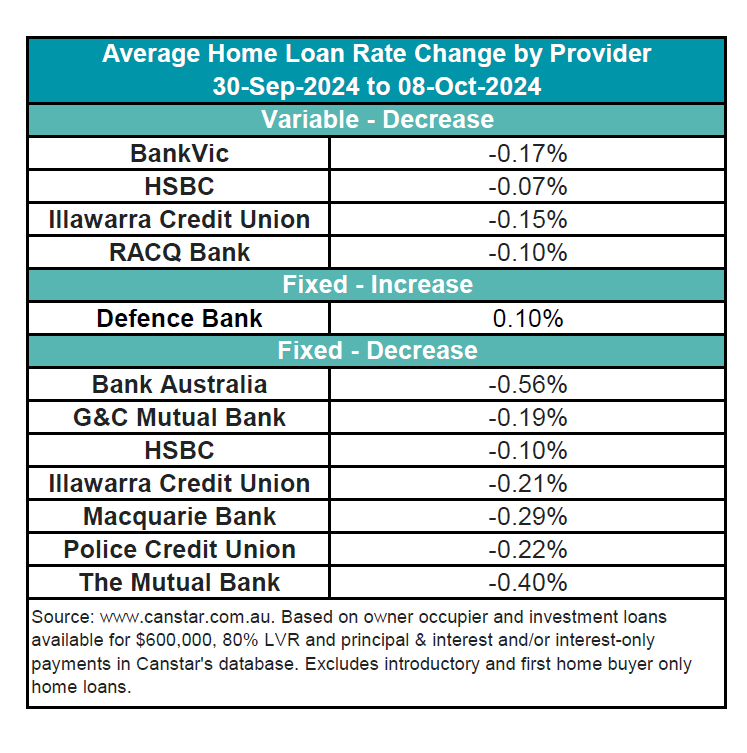

The latest Canstar data revealed several movements in home loan rates over the past week, with some notable trends in both fixed and variable rate offerings.

One lender, Defence Bank, increased the rate on its one-year fixed interest-only investor loan by 0.1%.

Meanwhile, a total of 12 lenders made rate cuts, with 31 variable rates reduced by an average of 0.12% and 144 fixed rates dropping by an average of 0.30%.

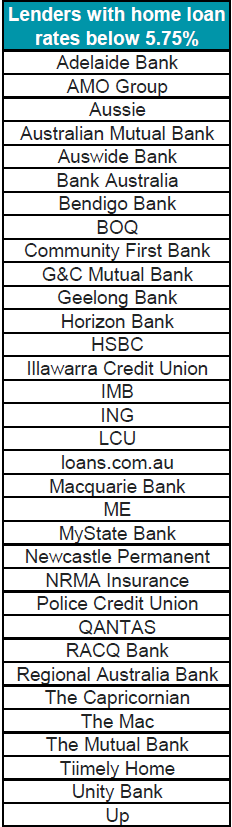

The lowest variable rate remains at 5.75%, offered by Abal Banking. There are now 204 rates below this mark on Canstar’s database, an increase of 92 from last week.

Sally Tindall (pictured above), Canstar’s data insights director, pointed out the significant number of fixed rate reductions.

“There was the now-usual flood of fixed rate cuts this week with seven lenders cutting a total of 138 fixed rates,” Tindall said.

Macquarie Bank was a standout, slashing its fixed term rates, bringing its offerings down to as low as 5.39%. As a result, the bank now has the most competitive two-, four-, and five-year fixed rates in the market, excluding green loans.

In the variable rate market, four lenders made cuts, including HSBC, which reduced its lowest variable rate to 5.99%.

“This cut will help keep some heat in the refinancing market, which has been more or less losing steam since mid last year,” Tindall said.

While the refinancing market has slowed compared to its July 2023 peak, when $21 billion in loans were refinanced, Canstar’s analysis of ABS data showed around $16bn worth of loans continue to be refinanced monthly in 2024.

Tindall anticipates that fixed rate cuts will continue as the year progresses.

Regarding the Reserve Bank (RBA), she mentioned the board’s recent minutes: “The RBA board minutes released this week from the September meeting reconfirmed that the board ‘did not expect to lower rates in the near term.’”

However, the board also indicated openness to potential rate cuts in early 2025 if economic conditions allow.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.