The Treasury has released the industry’s submissions on ASIC’s Review of Mortgage Broker Remuneration, revealing the ongoing friction between brokers and banks, and the industry forum’s daunting task at hand

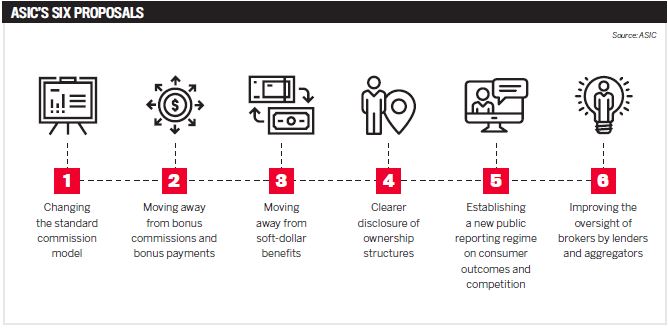

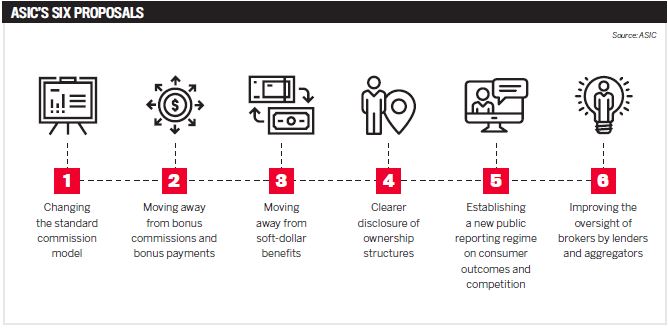

A trove of submissions representing the vast and varied opinions of major banks, aggregators, consumer groups and independent brokers in response to ASIC’s Review of Mortgage Broker Remuneration have been released, shedding some much-needed clarity on where they all stand regarding the regulator’s 13 key findings and six proposals.

The 27 publicly released responses – eight were confidential – provide the industry with a mountain of material to process. Clearly there is still a lot of work to be done before a final outcome is determined, but one thing most groups could agree on was the importance of getting a chance to self-regulate through the industry forum.

Trying to come up with a solution that’s considered fair and sustainable for those involved is a massive undertaking, one that the government supports and is willing to wait for.

“I welcome the proactive steps taken by the mortgage industry forum to engage with the government and consumer stakeholders on the issue of mortgage broker remuneration,” Financial Services Minister Kelly O’Dwyer said, adding that the government would take the forum’s process into account when finalising its response.

The industry has its work cut out for it.

Aggregators express concerns

Aggregators express concerns

As expected, most aggregators discouraged wholesale changes to broker remuneration and pointed out their concerns and misgivings regarding ASIC’s findings.

They argued that, for the most part, the current regulatory framework was sufficient and did not require modification.

“We are concerned there is a risk that any such changes could result in unintended negative consequences for the competitiveness of the industry and ultimately, less favourable consumer outcomes,”

Connective said in its submission.

Connective had concerns about the review abandoning the existing responsible lending framework, “instead seeking to solve a poorly defined problem with an impossible to implement solution”.

The review was based on data from 2012 to 2015, which is not necessarily reflective of the increased regulatory guidance and scrutiny the industry has undergone since then, Connective said.

“Implementing changes based on that data may be attempting to solve concerns that no longer exist.”

AFG said the development of the broking industry had given lenders without a large branch network access to an effective distribution system, limiting the oligopoly of the four major banks.

“It is important to remember that the existing commission model for mortgage brokers is not broken,” AFG said.

The aggregator did not support the introduction of a standard fixed fee, but it did agree with

NAB that upfront commission should be paid on the drawn-down amount rather than the approved amount.

Smartline also said this might be an appropriate way to go.

AFG said some responsibility should be put on lenders to review how they priced loans, to reduce the incentive for consumers to take out larger loans than necessary.

AFG also had a strong rebuke for the ABA-sponsored Sedgwick review, warning the government not to give it more weight than it deserved but to treat it as one submission from a special interest group.

“It is AFG’s contention that the comments in the ABA Report about the mortgage broking industry are misguided and open to allegations of bias or partisanship,” it said.

AFG added that some banks were using this as justification to implement changes designed to reduce and marginalise the financial viability of the broking industry.

Mortgage Choice said the current commission model was sound and appropriately compensated brokers for their time and effort. It said that if ASIC wished to change the shape and nature of lending, then it needed to go about this through lender credit policy and lender pricing.

“The only truly effective mechanism available to the regulator is through being more prescriptive in lender underwriting policy or shaping the economics at the lender end to drive an increase in consumer pricing at the higher risk end of the market,” Mortgage Choice said.

“It is important to remember that the existing commission model for mortgage brokers is not broken” AFG

Major banks suggest commission changes

Major banks suggest commission changes

The ABA, which represents 25 banks, including the four majors, said it believed the ASIC proposals “align strongly with the intent of the recommendations of the Sedgwick Review, in particular, the focus on reforms and improvements that reduce the risk of poor customer outcomes”.

The association said it supported the opportunity to develop a self-regulatory response “to change payments and governance arrangements in mortgage broking”, and was actively participating in the industry forum.

Its submission did not directly address the main point in ASIC’s review, which centred on changing the standard commission model. It said the banking industry was still considering responses to ASIC’s Proposals 1, 2, 3 and 6 and how they would work in conjunction with the third party recommendations made by Sedgwick.

The Sedgwick review was released in April, about a month after ASIC’s report. Three of its 21 recommendations directly related to mortgage brokers, including one suggestion that banks adopt a remuneration structure for aggregators and brokers that did not link payments to loan size, instead proposing a “holistic approach” to performance management.

NAB,

Westpac and

CBA all submitted separate reports from the one handed in by the ABA on behalf of its members. There was no public submission from

ANZ.

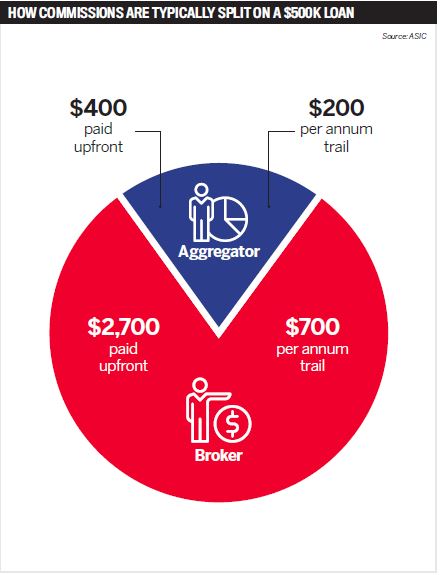

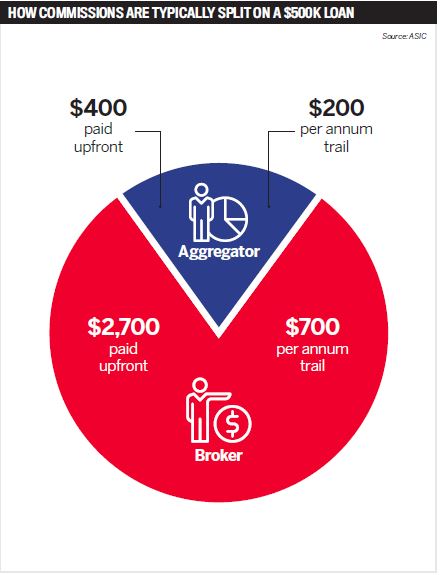

NAB suggested several changes to brokers’ commission. One of its key points was to adjust payments so upfront commission was based on the amount drawn down, not the total facility amount. It also suggested paying upfront commission net of offset account balances.

“NAB supports these changes and will work through the requirements to implement them. These are important improvements that NAB believes should be applied broadly across the industry,” the submission said.

NAB also said it would work with the industry to come up with a model that did not directly link payments to loan size, and it suggested the industry consider attaching key performance indicators, such as KPIs, to the payment of trail commissions.

“NAB will increase oversight on all aggregators it deals with as a lender to assist with ensuring brokers perform preliminary assessments thoroughly. To ensure lenders are comfortable with the quality of the initial discussions, lenders should be able to access preliminary assessments as, and when, they need to,” the bank said.

Another key area NAB addressed was in regard to increasing governance and oversight of brokers. The bank said aggregators needed greater oversight of brokers to ensure they continued to be accessible to customers who settled loans with credit assistance provided by those brokers, and lenders needed visibility of this oversight.

Westpac’s contribution was more muted, referring to the ABA’s submission and its work with the joint industry forum. The bank did say, however, that “steps to change the standard commission model would need to be taken with care to prevent market distortion and unintended consequences”.

“There’s a mismatch between what consumers think they are getting when they see a broker and what they receive” Consumer Groups

Consumer groups say overhaul needed

Consumer groups CHOICE, Consumer Action, Financial Counselling Australia and the Financial Rights Legal Centre also made their voices clear in a joint submission suggesting that the current broker remuneration structure should be completely overhauled.

The groups recommended that upfront commissions should be replaced with a ‘fixed fee for advice’ model (either through a lump sum or hourly rates), while trail should be scrapped entirely.

“Based on cases that financial counsellors and community legal centres see, it appears that some mortgage brokers are so motivated by commissions that they put customers at significant risk and take extreme steps, including likely document fraud and breaches of the responsible lending obligations under the [NCCP Act],” they said.

The consumer groups also requested that they be included in future industry discussions to address the issues raised by ASIC.

The industry forum to date hasn’t included these groups, but that is slated to change. Strengthening partnerships with them has been identified as an important step.

The groups went above just addressing ASIC’s six proposals, saying the regulator needed to widen its scope and deal with other problems in the broking sector.

As brokers’ market share grows, they must be held to higher standards, they said. “ASIC’s research into consumer perceptions of brokers revealed that there’s a mismatch between what consumers think they are getting when they see a broker and what they receive.”

OPINIONS VOICED

Twenty-six submissions were made public from the following:

1. Australian Bankers’ Association

2.

Australian Finance Group

3. Australian Finance Industry Association

4.

Aussie Home Loans

5. Central Lending Solutions

6. Customer Owned Banking Association

7. Connective

8. Commonwealth Bank of Australia

9. Everfirst Financial Services

10.

FBAA

11. Shawn French

12. Futurity

13. Tim Howard

14. Joint Consumer Groups

15. KeyInvest Lending Services

16.

Loan Market

17. Loans Actually

18.

MFAA

19. Mortgage Choice

20. NAB

21. RFS Finance

22. Rice Warner

23. Smartline Home Loans

24.

Specialist Finance Group

25. Barry Thatcher

26. Universal Wealth Management

27. Westpac

FBAA disappointed in findings

Conclusions drawn by ASIC’s review “directly contradict” findings within the broking industry, the FBAA said in its submission.

“We were surprised by some of the findings in that they are not supported by our own observations and those of our members, some even going so far as to directly contradict our understanding of the segment,” FBAA executive director Peter White said in the submission.

The FBAA also maintains that there is no correlation between broker commission and consumer borrowing patterns.

“Any change to remuneration models which adversely impact brokers provide no gain to consumers. Any proposal for change must evidence a clear business case in favour of consumers,” White wrote.

“The FBAA will not support changes to remuneration models that injure the profession and deliver no consumer benefit.”

Noting that ASIC’s data indicated a possible correlation between broker-arranged loans, loan size and LVR, White said commissions could not be singled out as the causative factor.

“Incentives are an inherent part of any sales or fee for service model, but we should not rush to call an incentive a conflict of interest.”

LVR-weighted commission payments would be difficult to implement and administer, he said, which NAB and Westpac also pointed out.

“It may be possible to base commission payments on the utilised/drawn down balance and not on large amounts left in redraw,” White added, although this would need to be subject to a reasonable time frame or a “utilisation trigger” so the broker’s income is not left to matters outside their control.

“Such changes could result in unintended negative consequences for the competitiveness of the industry and ultimately, less favourable consumer outcomes” Connective

MFAA focuses on industry forum

In a 46-page paper submitted to the Treasury, the MFAA gave the green light to certain proposals while expressing its concern about others.

Linking upfront commission to loan size was flagged by the MFAA, with ideas such as implementing a cap on the maximum LVR, or paying upfront based on both loan size and complexity, being shot down by the organisation.

Paying different-sized upfront commissions around a pre-agreed pivot point also comes with risks, including potential impacts on tax-based investor lending and first home buyers, MFAA CEO

Mike Felton told Australian Broker in an exclusive interview before the submissions were released publicly.

Felton said the MFAA was fully behind moving away from bonus commissions and payments as they could cause heightened conflicts of interest.

Both ASIC and Treasury have been clear about giving the industry the chance to self-regulate, and Felton is taking that task seriously.

“Self-regulation is not a right,” he said. “It’s an opportunity. It’s also not an invitation to do business as usual. We have to use it as a window of opportunity to make meaningful change so that we can drive an increase in trust, confidence and sustainability of our industry.”

Aggregators express concerns

Aggregators express concerns Major banks suggest commission changes

Major banks suggest commission changes