By

Property buyers and sellers have begun the calendar year with higher than expected clearance rates and property prices in some locations across Australia, although a Sydney real estate agent and broker have warned underlying market fundamentals may see prices decline in coming months.

Figures from Domain show clearance rates in Sydney reached 69% during the month of February – the highest recorded since October 2021 – while the Melbourne market achieved a 63.8% clearance rate. Australia’s combined capital city clearance rate for February was 64.8%.

CoreLogic also reported slowing declines in home values during February, with its Home Value Index falling -0.14% over the month – the smallest monthly drop since May when rate hikes started.

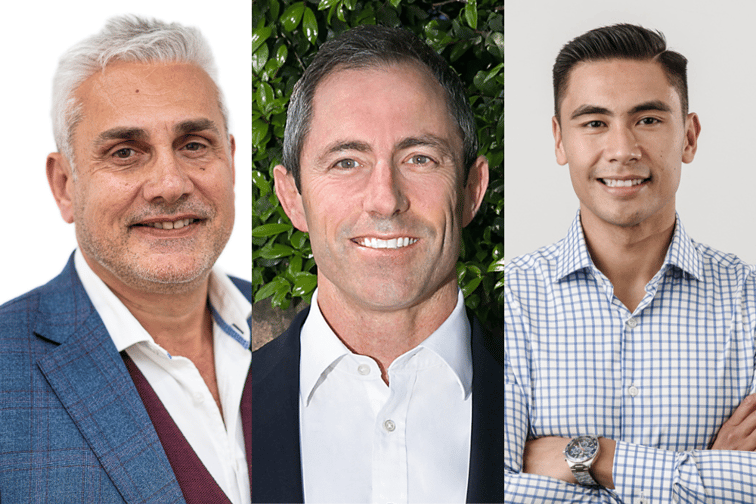

The unexpected market heat caused influential real estate expert and coach Tom Panos (pictured above left) to declare last weekend that the real estate market had actually started going up, and buyers who had been waiting for the bottom of the market “may have just missed it”, as evidenced by some high-priced sales.

“The results today were quite astonishing,” Panos said in a video he posted on Instagram.

“In January there was a big spike of buyers and I thought it was the fake January spike, but now I’m beginning to think this market has not only stopped going down, it has started to go up. There is no way in the world some of those houses sold today would have got that three or four months ago.”

Sydney-based McGrath real estate agent Simon Nolan (pictured above centre), whose specialty suburbs include Coogee, Kingsford, Maroubra, Matraville and Randwick, said that he believed that current high clearance rates and prices came down to the “same old challenge – which is stock levels”.

“We went into Christmas with triple the listings we normally have, and thought that would continue into the new year, but it didn’t,” Nolan said. “We had some early stuff coming on to the market, but now stock levels in the area I work in are low and don’t seem like they will be changing through into Easter.”

Nolan, who deals mainly in houses rather than apartments, said the activity made him believe that things would likely stay that way for the foreseeable future. “Stock is the main driver for prices holding up and even going up in some sectors, particularly fully done houses.”

However he said current market prices may not hold up forever, and that with interest rates continuing to rise, house prices were likely to settle back somewhere between 5% and 10%.

“My general feeling is that if I was selling is that I would want to sell as early in this year as I could, although it’s all relative when you are buying and selling. But I get the feeling things will get worse before they gets better. But so far it has been better than we thought it would be,” he said.

Nolan said there wasn’t the same pressure on people buying and selling to make a move quickly, and that most were willing to take the time to see every possible option, which in some cases meant people were passing on opportunities because they wanted to see more properties before making a decision.

He said there was also a hidden stock of buyers who were fully ready to list their properties for sale – and who might be a good match for each other – but who were actually waiting to buy their next property first before pressing go on putting their current one on the market.

Lendary principal broker and lending specialist Onar Serrano (pictured above right), who is based in Sydney’s Alexandria and deals with both investor and owner occupier clients, said rising serviceability hurdles due to rate rises had affected many people’s borrowing capacity. He estimated the impact at between 30% and 40%.

“The general trend is that borrowing capacity is significantly affected, especially guys who are maxing out their serviceability,” Serrano said. “Whereas last year you might have had 100 people who can borrow $1 million, now you only have 70 who can. So that means less people coming to an auction.”

Serrano said there was a general trend of decreasing property prices. Valuations were coming in lower than last year, he said, with one house recently valued at 11% less, and some valuations for refinancing deals on apartments coming in at $100,000 to $150,000 less than last year.

Serrano agreed that low stock levels were supporting clearance rates. “The clearance rate is still fairly OK, given that we have had 10 rate rises, and the reason is purely low stock. If we had the same amount of stock as last year, the clearance rate would be terrible,” he said.

He added that demand from motivated buyers was helping. Lower prices were drawing some clients who may have been pre-approved but priced out of the market last year to re-enter the market. They were more easily buying properties at the price they were looking for.

“We had one client who wanted to buy a property last year for $1.55 million or $1.6 million, but every time there would be 30 or 40 people at an auction and it would go $200 to $300K above the reserve and they would be priced out. Well, we did a pre-approval for them this year and they were able to go out and buy a similar property last week for the same price,” Serrano said.