Australian property prices reached a new record high in November, defying the impact of higher interest rates, although the pace of growth eased as more properties entered the market, according to a recent PropTrack report.

PropTrack’s Home Price Index for December showed that national home prices rose by 0.22%, bringing the year-to-date increase to 5.53%, which was 1.29% above their previous peak in March 2022.

“National home price growth slowed in November, with the spring selling surge increasing choice for buyers,” said Eleanor Creagh (pictured above), PropTrack senior economist.

“Strong housing demand, buoyed by record net overseas migration, tight rental markets, low unemployment, and home equity gains, has worked alongside limited housing stock to offset the impacts of higher interest rates this year.

“Despite interest rates climbing again in November and the flow of listings hitting the market increasing, housing demand has remained strong and national prices have now risen for 11 straight months.”

But hampering the supply of new housing supply, Creagh said, was the sharp increase in construction costs along with materials shortages, which has slowed down the delivery of new builds.

Sydney, although experiencing slowed growth, achieved a record high with a 0.32% increase in November, totalling an 8.27% rise this year – 1% above the previous peak recorded in February 2022.

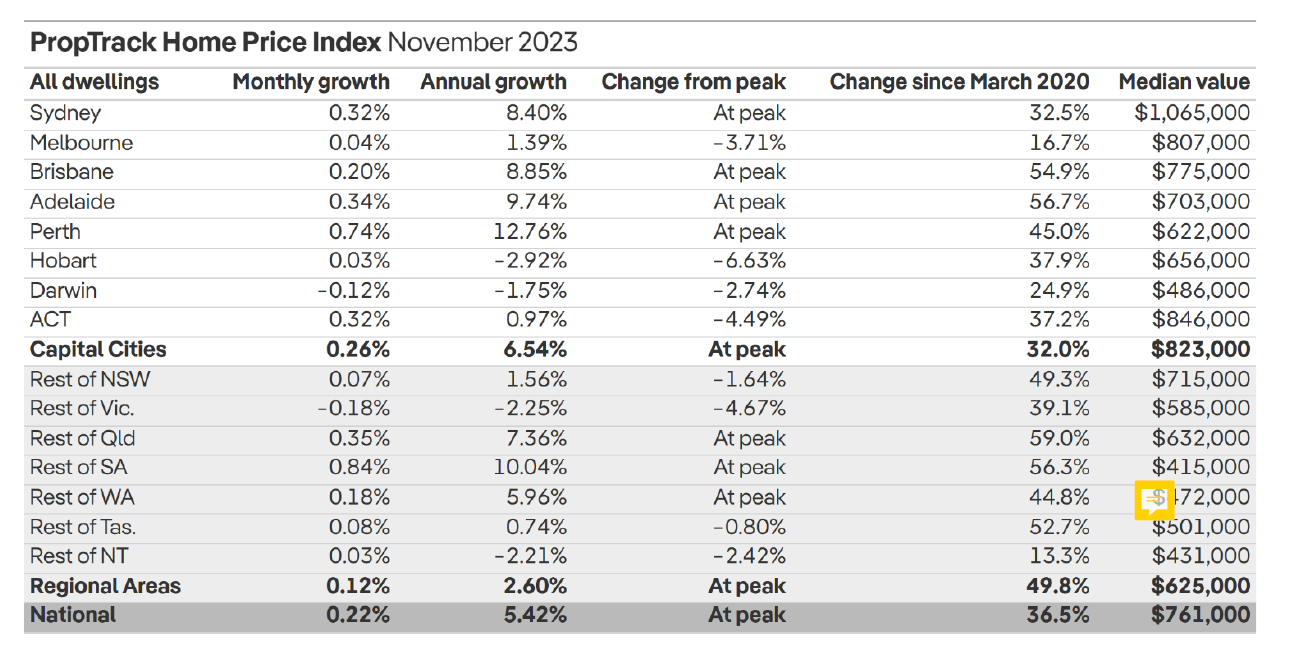

In November, all capitals, except Darwin, witnessed price rises, with Perth leading at 0.74%. This made Perth the strongest capital throughout the month, with Adelaide (+0.34%), Sydney (+0.32%), and Canberra (+0.32%) also experiencing robust growth.

The combined capital cities outperformed regional markets in 2023, experiencing stronger growth (0.26%) compared to regional markets (0.12%), despite both reaching fresh peaks last month, PropTrack reported.

“Looking ahead, price growth is expected to continue as the positive tailwinds for housing demand and a slowdown in the completion of new homes counter the sharp deterioration in affordability and slowing economy,” Creagh said. “However, prices are likely to lift at a slower pace than they have across 2023.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.