This may have been a tough year so far for the industry, but for the quick and nimble non-bank lender Pepper Money it has meant opportunities. Mortgages boss Mario Rehayem explains some of the exciting developments the lender has in the works

Mario Rehayem expected 2017 to be a “turbulent” year for the mortgage industry, but what his crystal ball didn’t make clear was just how uncertain some things would be.

“It’s hard enough for someone who’s in the know to understand what’s going on, let alone your average consumer,” says Rehayem, Pepper Money’s managing director of Australian mortgages and personal loans. And the one thing businesses can’t afford to do is complicate matters even more, he says.

“If there’s ever a point in time for us to become simpler than ever, it is now.”

So what does Rehayem predict the year ahead will hold?

“The crystal ball tells me it’s going to be a very good year for Pepper, because whenever the opportunities arise in the market where there’s a clampdown, we have, I would say, a knack to understand where to enter,” he says.

Since Pepper opened its doors in 2000, it’s been providing mortgage products to underserved communities. Every time the market has moved or requirements have changed, Pepper has adapted to ensure it continues to offer credit to Australians who deserve a second chance. It just so happens that non-conforming clients now encompass an even broader swathe of the population.

Rehayem is confident that while other lenders are busy second-guessing themselves, Pepper will be able to capitalise on its strength and its track record, and the market will play out to its benefit.

Even though Pepper is a flexible and agile non-conforming lender, the environment it’s currently playing in is different than it was before, and those changes can’t be ignored, he says.

“It’s still a changing environment … and we have to be quick and nimble to be able to act, otherwise we will definitely fall behind. But Pepper’s always been known as the one that does not lag in that area; we’re confident this year that we’ll close off extremely strong,” he says.

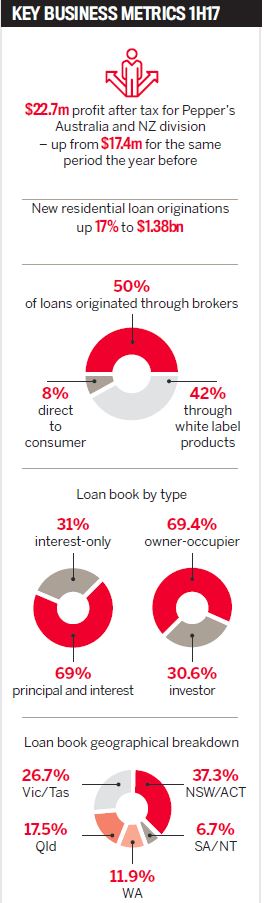

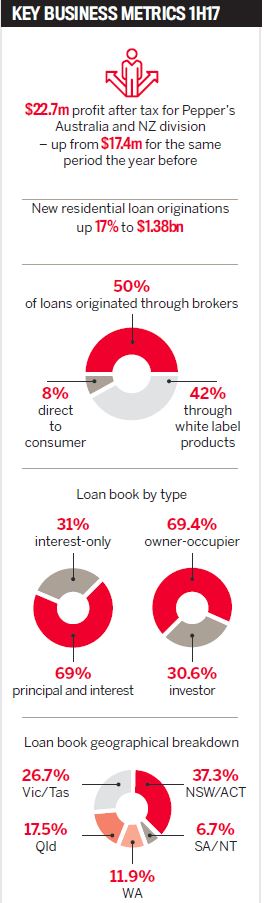

The non-bank’s results for the first half of 2017 certainly suggest he’s right, with new residential loan originations up 17% to $1.38bn.

It will be a busy year for Pepper as the lender launches its commercial loans, trains brokers to get the most out of the two new tools in its “customer conversion toolkit”, unveils a direct-to-consumer marketing campaign, and continues to foster strong growth of its white label and personal loan products.

Providing commercial loans is a natural progression for Pepper, Rehayem says, and will help the lender appeal to its existing customer base, 40% of whom are self-employed.

Pepper is currently conducting broker focus groups with some of the leading commercial writers in the country in order to find out what nuisances and gaps exist in the commercial market so it can develop products that best suit the needs of brokers and their clients.

The company prides itself on its regular consultation with brokers and consumers, which pays off when a product is introduced to the market and it takes off, Rehayem says. The commercial business will hopefully do the same when it’s launched early next year.

“We know what people want, we know what the consumers are asking for and we know what the brokers are starving for,” Rehayem says.

The company also unveiled two technology solutions for brokers, Pepper Product Selector and Pepper Resolve, at its National Insights Roadshow series in June. The tools have different uses. Pepper Product Selector is a digital tool that allows brokers to provide their clients with indicative offers within two minutes, and Pepper Resolve is an integrated solution that does this in real time.

“We cannot change the big levers that are getting pulled at the moment, so ... brokers just need to focus on the consumer, their customer base, and focus on their business”

Nearly 630 brokers have already used the Pepper Product Selector tool since it was introduced at the roadshows, and 190 brokers have now used it to submit their first ever non-conforming loans to the lender.

According to Pepper, six out of 10 borrowers miss out on a finance solution despite being eligible for the types of loans the non-bank offers. These unique broker solutions have been created to help a broker match their customer with the most appropriate Pepper home loan product, and help the customer understand what they are likely to receive when they make one of the most important decisions of their life. Pepper is currently in discussion with aggregator groups to roll out the Pepper Resolve tool.

After several years in the concept and development phases, Rehayem says it’s rewarding to see how these tools have been embraced by the third party channel.

Pepper will continue to provide brokers with training around all the features of the tools at state-based training sessions in October and November. These workshops will pick up where the roadshows left off and provide brokers with further detail to help them understand non-conforming loans, and how to use the five-step sales process to talk to clients so they better understand their credit journeys.

“If you’re not familiar with non-conforming policies, you’re going to shy away from it; so this is what the tool does, it brings that familiarity straight up from day one,” he says.

Conversing with consumers

Rehayem says the company has come to realise that it needs to do more to lift brand awareness among consumers so they’re “knocking on the door of the broker, saying, ‘I actually need a Pepper loan’,” he says.

In September, Pepper will launch a full-scale marketing campaign, featuring advertisements on the radio, bus shelters and billboards to tell confused customers that there are alternatives and they should seek out a mortgage broker to discuss their options.

While Pepper has had a direct channel since 2012, it plays a minor part in the business. The latest half-year financial results for the Australian market show that around 50% of its loans were originated through the broker channel, 42% were through the lender’s white label products, and 8% were direct to consumer.

“[The broker channel] is definitely the channel that is the backbone of this business from the Australian mortgages distribution perspective,” he says.

Rehayem expects the advertising campaign to grow both the broker and direct channels, with an uplift in calls, enquiries and customers.

“No matter what brokers say or do, we cannot change the big levers that are getting pulled at the moment, so I think that brokers just need to focus on the consumer, their customer base, and focus on their business,” Rehayem says.

He believes that when there are factors that cannot be controlled, brokers, aggregators and lenders need to find a way to embrace them quickly or get left behind.

Thanks to Pepper’s global footprint, Rehayem has the advantage of foresight. Those overseas businesses have endured through various governments’ regulatory crackdowns, giving some hint of what the future might hold for Australia as so much in the industry has yet to be determined following ASIC’s remuneration review and the Sedgwick report.

In the meantime, Rehayem says: “We need to focus on our business, and we will continue to drive our business plan and keep a close eye on what is happening out there, and we will adapt when we need to adapt.”

.JPG)

Since Pepper opened its doors in 2000, it’s been providing mortgage products to underserved communities. Every time the market has moved or requirements have changed, Pepper has adapted to ensure it continues to offer credit to Australians who deserve a second chance. It just so happens that non-conforming clients now encompass an even broader swathe of the population.

Since Pepper opened its doors in 2000, it’s been providing mortgage products to underserved communities. Every time the market has moved or requirements have changed, Pepper has adapted to ensure it continues to offer credit to Australians who deserve a second chance. It just so happens that non-conforming clients now encompass an even broader swathe of the population.