APRA yesterday released the most recent data illuminating where Australia stands with temporary loan repayment deferrals due to COVID-19.

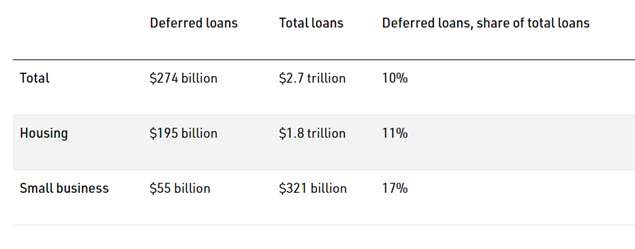

At the close of June, $274bn worth of loans had been granted temporary repayment deferrals – close to 10% of total loans outstanding.

The majority of loans granted repayment deferrals were housing loans; nearly 500,000 were deferred, which is 9% of all home loans within the country and amounts to $195bn in value.

On a more positive note, the APRA data also showed that $18bn of home loans came off loan repayment deferral over the month, up from $2bn in May.

“It’s good news and bad news from APRA’s release of loan repayment pause data," said Canstar group executive of financial services Steve Mickenbecker.

“The bad news is that 9% of home loans are temporarily deferred, which is a large group in financial stress.

“The good news is that the overwhelming majority, 91% of home loans, have not needed their banks’ forbearance at this stage.

“The even better news is that $18bn of home loans came out of pause during June. A surprisingly early return to normality. Let’s hope that Victoria’s July slide back into COVID hasn’t reversed this.”

According to the APRA data, 17% of small business loans had been deferred as of 30 June.

“With 17% of loans temporarily deferred, small business is doing it tougher than households, and the necessity of the further JobKeeper breathing space is confirmed,” said Mickenbecker.

“Canstar’s recent survey reveals that 46% of home loan borrowers have had their income cut or employment status changed due to the COVID-19 pandemic, but the majority have not at this stage requested a formal loan deferral. Those borrowers covering the shortfall with redraw or offset balances will be hoping for early economic recovery.”

APRA’s housing risk profile revealed that loans granted repayment deferrals are more likely to be extended to owner-occupier borrowers paying P&I, and those with higher loan to value ratios.

Source: APRA