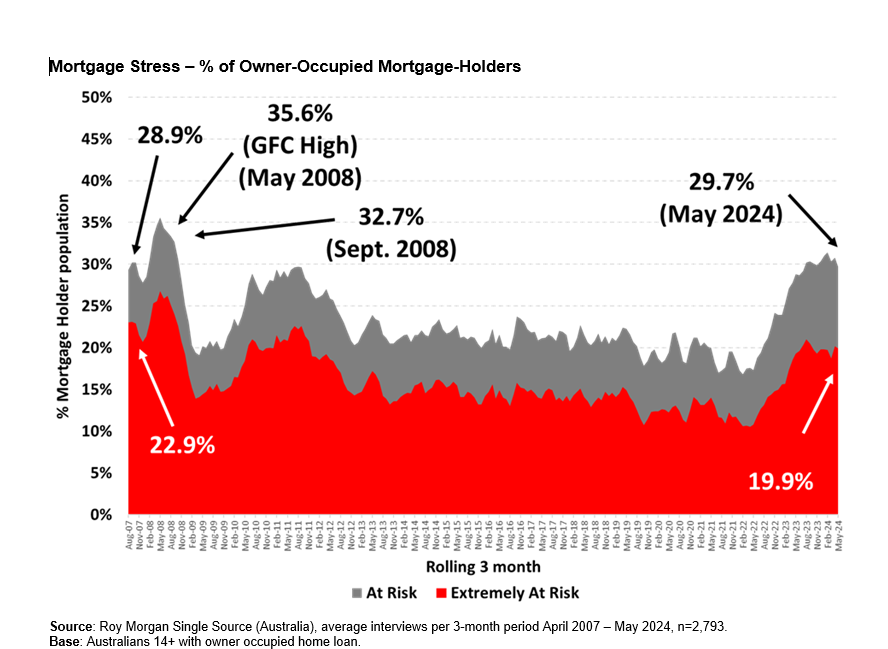

New data from Roy Morgan revealed a significant drop in mortgage stress among Australians.

As of May, 1,514,000 mortgage holders, or 29.7%, are considered “at risk” – a reduction of 46,000 from the previous month. This marks the lowest level of mortgage stress recorded this year, according to Roy Morgan’s latest findings.

Michele Levine (pictured above), CEO of Roy Morgan, said that the pause in rate increases since November 2023 has helped ease pressure on mortgage holders, allowing economic growth in various sectors.

The number of Australians “at risk” of mortgage stress has significantly risen by 707,000 since May 2022, when the Reserve Bank (RBA) initiated a series of interest rate hikes.

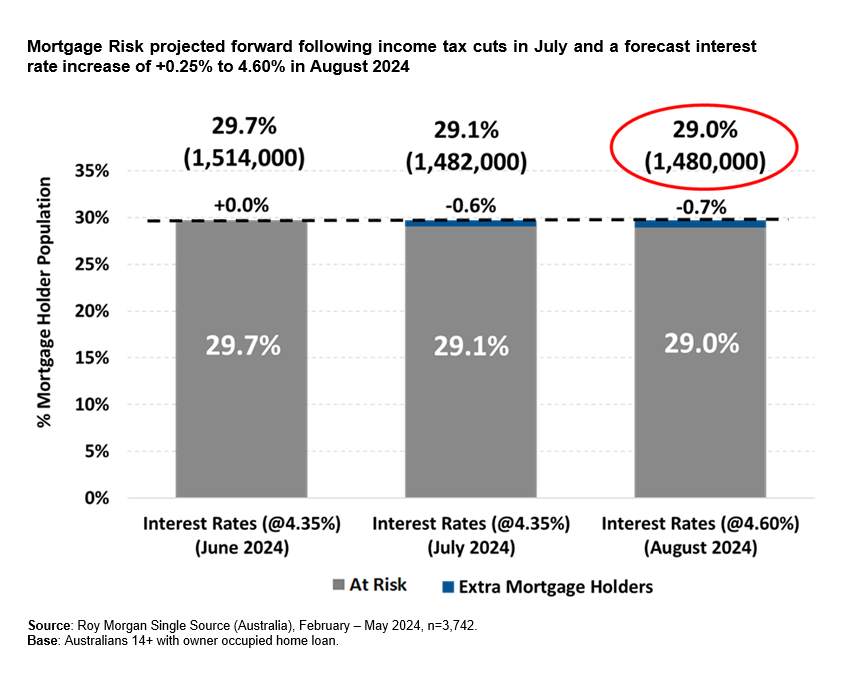

Despite this historical increase, Roy Morgan’s analysis anticipates a further reduction in mortgage stress following the implementation of Stage 3 tax cuts in early July, which are expected to substantially boost household incomes.

Unemployment remains a significant factor affecting income and, consequently, mortgage stress.

Roy Morgan’s unemployment estimates from May indicated that 17.2% of the workforce is either unemployed or under-employed.

Despite these challenges, the employment market has been strong over the past year, with 603,000 new jobs created compared to the previous year. This has been crucial in supporting rising household incomes and moderating increases in mortgage stress.

Looking ahead, even with a potential RBA interest rate increase of +0.25% in August to 4.6%, mortgage stress is expected to continue its downward trend.

“Even if the RBA increases interest rates by +0.25% to 4.6% in August, the level of mortgage stress would still drop by 34,000 to 1,480,000 mortgage holders (29.0%) considered ‘at risk’ in the three months to August 2024. This would be the lowest level of mortgage stress for a year since June 2023,” Levine said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.