In her mission to promote financial literacy among women, mortgage broker Cara Julian from Brava Finance has recently released her debut book, which is already creating a buzz.

Focused on breaking down complex financial concepts and challenging outdated mindsets, the book has quickly climbed to number one on Kindle, a feat that Julian didn't expect so soon after its launch.

The book tackles three core issues: encouraging women to take control of their financial future, challenging loyalty to banks, and demystifying mortgages, making home ownership more attainable for everyone.

“My main goal is to help reduce the financial gender gap so that we can all start the race on the same starting line,” Julian said. “That’s my north star.”

Finding time on the weekends when her daughter was her father’s place, writing the book was no easy feat for Julian, who was still working as a mortgage broker while juggling the demands of becoming an author.

“I’ve always been a person who is very succinct with my words. Anything I write is short and to the point, so I thought, ‘How am I going to write a book of 25,000 words?’” said Julian.

However, her determination to make the financial world more accessible helped her stay focused. “Once I started, keeping my eye on the end goal, knowing that it supports my bigger purpose, really helped motivate me.”

Julian's book is part of her "Survival Guide" series, and she’s already planning her next project: co-writing a guide for buying property when single, in collaboration with a buyer’s agent.

She believes that tackling the intimidating aspects of financial independence in a straightforward and digestible way will resonate with many readers.

A key theme of the book is the idea of not being penalised for loyalty to a single bank.

This loyalty tax occurs when banks offer lower interest rates to new customers, while existing customers may be charged higher rates. This difference in rates can result in significant savings for those who shop around.

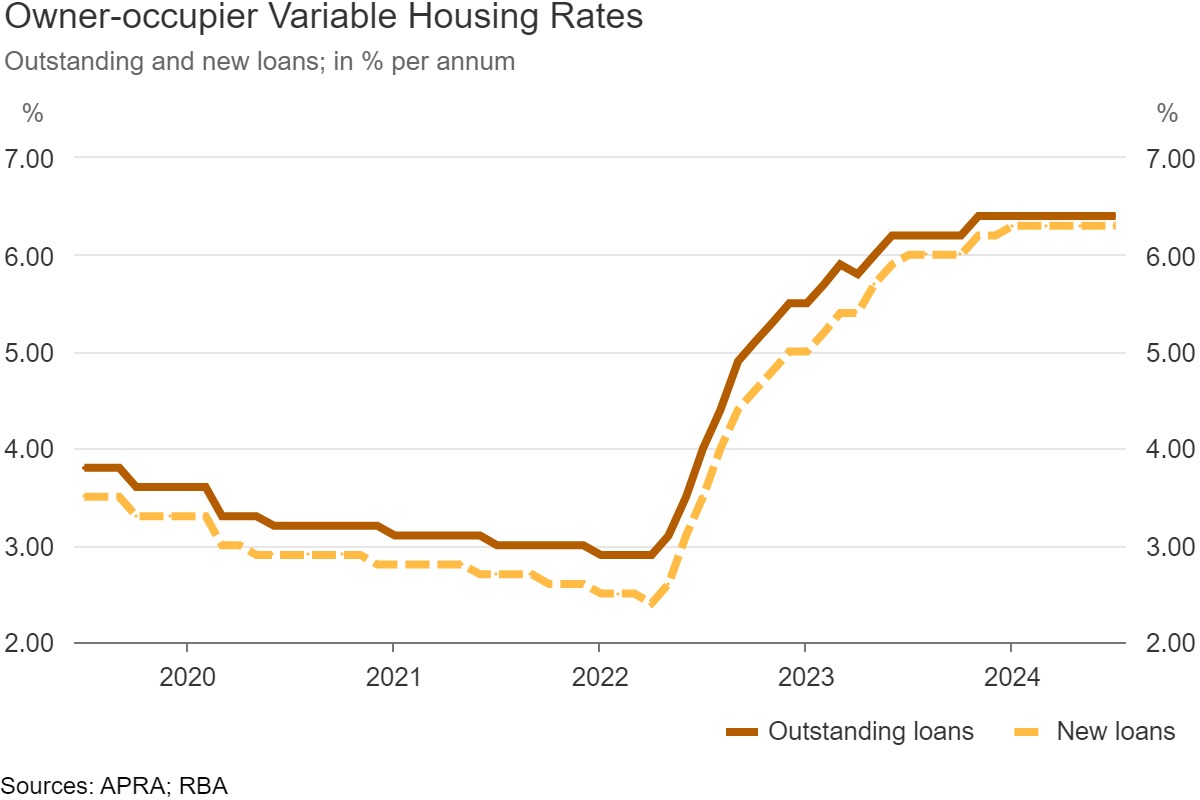

For example, in July 2023, existing borrowers were paying an average variable rate of 6.23% while new customers were paying 5.95% – a gap of 0.28%, according to the RBA.

However, brokers were seeing a gap of 0.44% on the ground. Therefore, borrowers could’ve saved $1,704 per year on a $500k loan simply by seeing what’s on the market.

As demand for new customers among banks dwindles in the aftermath of the aggressive tactics used throughout the 2021-23 mortgage wars, the gap has narrowed in recent months.

However, as the market fluctuates, the gap will likely widen.

As lenders begin to shave their margins as anticipation for a rate cut mounts, borrowers who stay with their existing lenders without shopping around could find that their loyalty is costing them thousands.

“Loyalty isn’t always there,” said Julian. “As a consumer, it’s important to compare rates and products in the market because it’s your largest financial commitment.”

Her book encourages readers to "date your bank, not marry them"—a perspective that challenges traditional approaches to banking.

The book also tackles financial literacy for women, a subject close to Julian’s heart.

She draws on personal experience, having faced financial vulnerability after separating from her husband.

“I grew up in an era where that was the norm, and I carried that mindset until only about three years ago,” Julian said.

“I handed the financial responsibility to my husband, we separated, and I found myself in a financially vulnerable position.”

Julian challenges this mindset of “men look after the finances”.

“It’s important to understand your financial position, whether you're in a relationship or not,” she said.

“If you don’t have financial knowledge and confidence, go out and gain it.”

Lastly, the book aims to detangle the complicated world of mortgages and buying property.

From guiding readers through purchasing and refinancing to understanding the many jargonistic terms that act as a barrier between everyday people and those in the know, Julian hopes the book can demystify home ownership.

To make the book more relatable, Julian included case studies of actual women who have navigated the journey of home ownership.

"Hearing from someone who’s gone through a similar experience is always powerful," she said.

“These real-life examples give readers a practical sense of what is achievable, no matter their circumstances.”

Julian is determined to make her book as accessible as possible. It is available for free as a downloadable PDF on her website, and she’s setting up a system to distribute free copies to readers who prefer physical books.

“I don’t want to charge for it. I don’t want to make money from it. It’s simply a resource I want to get into as many hands as possible,” she said.

Feedback so far has been overwhelmingly positive, with readers appreciating the book’s simplicity and design.

“The most common feedback I’ve been getting is people loving that the front cover is not like a boring finance book,” said Julian.

She added that the font size and layout make it easy to digest, with no intention of overwhelming readers with complex financial jargon.

With female brokers only making up 26.6% of the industry, Julian also highlighted the need for more female representation.

“There are a lot more male brokers, and some of them are amazing. But for many women, having a female mortgage broker on their team feels more supportive and nurturing,” she said.

Julian hopes her work will inspire more women to enter the finance world and take control of their financial futures.

As her book gains traction, Julian is optimistic that it will start a conversation within the finance industry about the inequality in financial literacy, especially for women.

“What can we do as an industry to address that?” she said, urging for broader action on this critical issue.

To download the book, Why You Should Date Your Bank, Not Marry Them, click here.