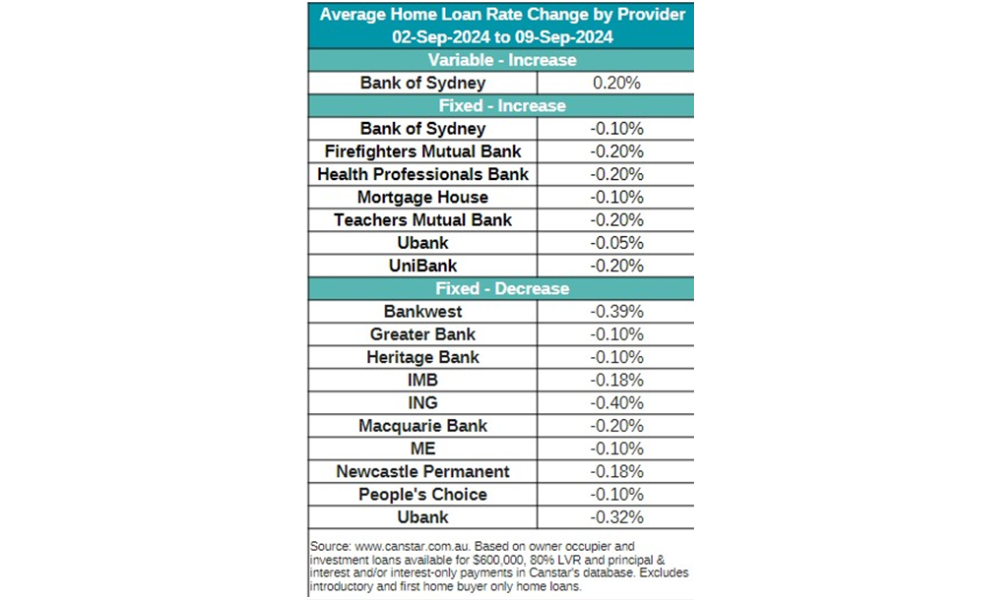

This week saw significant fixed rate cuts, with 10 lenders reducing a total of 238 fixed mortgage rates by an average of 0.23%, according to Canstar.

“It was another bumper week for fixed rate cuts,” said Sally Tindall (pictured above), Canstar data insights director, noting that major lenders like Macquarie Bank, ING, and Bankwest now offer fixed rates under 6% for owner-occupiers paying principal and interest.

Macquarie Bank made the most competitive changes, lowering its two- and year-year fixed rates to 5.59%, the lowest for a two-year term on Canstar.com.au.

Despite these cuts, fixed rate borrowing remains subdued.

ABS data for July showed that only 1.9% of new and refinanced loans opted for fixed rates, down from 2.6% the previous month.

“We expect this will pick up in the months ahead, but it is unlikely to reach the peak of July 2021 when almost half of new loans were fixed,” Tindall said.

The variable rate market was quieter, with only minor changes.

Bank of Sydney increased one investor variable rate by 0.2%, while seven lenders cut 24 variable rates by an average of 0.16%.

The average variable rate for owner-occupiers paying principal and interest is now 6.87%, with Arab Bank Australia offering the lowest rate at 5.75%.

See the summary of home loan rate adjustments over the past week in the table below.

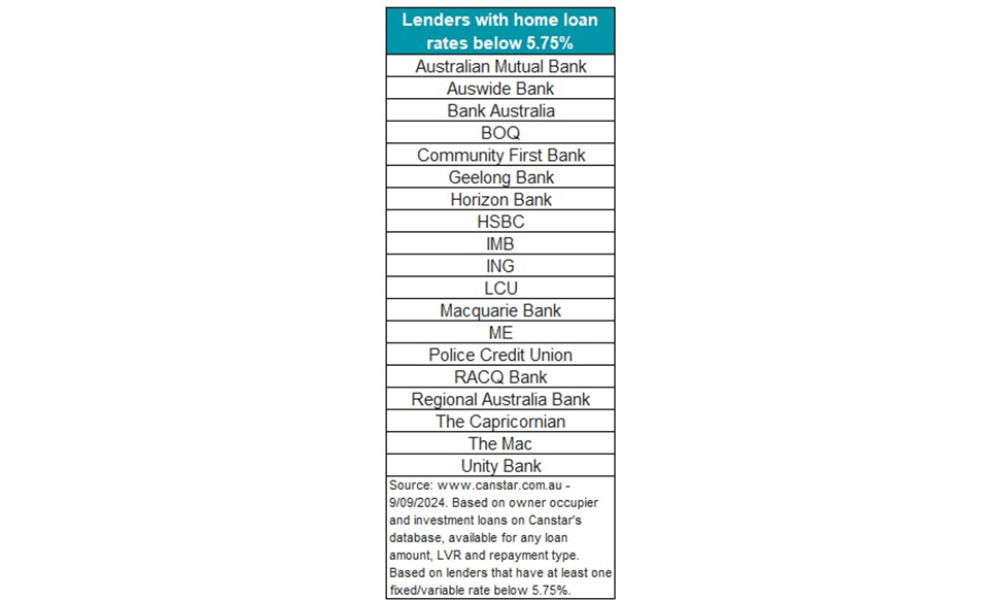

With 47 rates below 5.75% available on Canstar’s database, competition among lenders is intensifying.

“It will be interesting to see if this wave of fixed rate cuts drives borrowers to lock in their rate,” Tindall said.

For the list of lenders offering rates below, 5.75%, see table below.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.