Australian mortgage holders and prospective homebuyers met a mixed bag of changes this week as lenders adjusted their home loan rates, according to the latest report from Canstar. While some banks introduced rate hikes, others offered cuts.

Two lenders raised rates on four owner-occupier and investor variable loans, with an average increase of 0.07%. Meanwhile, the Bank of Sydney increased six owner-occupier and investor fixed rates by an average of 0.23%.

In contrast, three lenders cut 24 variable rates for owner-occupiers and investors by an average of 0.08%. Additionally, six lenders slashed 116 variable rates by an average of 0.47%.

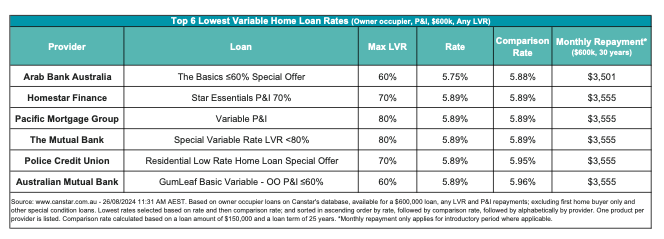

Amid the adjustments, Abal Banking has constantly offered the lowest variable rate for any loan-to-value ratio (LVR) at 5.75%. Canstar’s database revealed that 22 rates remain below this benchmark.

“Westpac now offers the lowest fixed rates among the big four banks across one- to five-year fixed terms, while CBA has the equal lowest three-year fixed rate at 5.89%,” Tindall said. She attributed these cuts to the easing cost of wholesale funding as central banks globally start to reduce official rates.

However, Tindall cautioned against rushing into fixed rates despite the lower offers. “Fixed rates are, by and large, still coming back down to Earth and likely to keep falling,” she said.

A surprising move came from CBA, which decided to cut key variable mortgage rates, but only for new customers. Tindall highlighted this as a strategy to bring in more business while maintaining competitiveness. “Existing CBA customers should use this drop in rates to ask for a rate cut themselves,” she said.

Tindall also remarked on the broader implications of CBA’s rate cuts. “The decision by Australia’s biggest bank to sharpen its advertised mortgage rate offering is evidence of the continued pressure within the market among lenders to remain competitive,” she said. She predicted that this move would likely push other lenders to reconsider their new customer rates as well.

Do you have something to say about the latest figures? Let us know in the comments below.