A national fund manager has welcomed a well-known industry figure into its team.

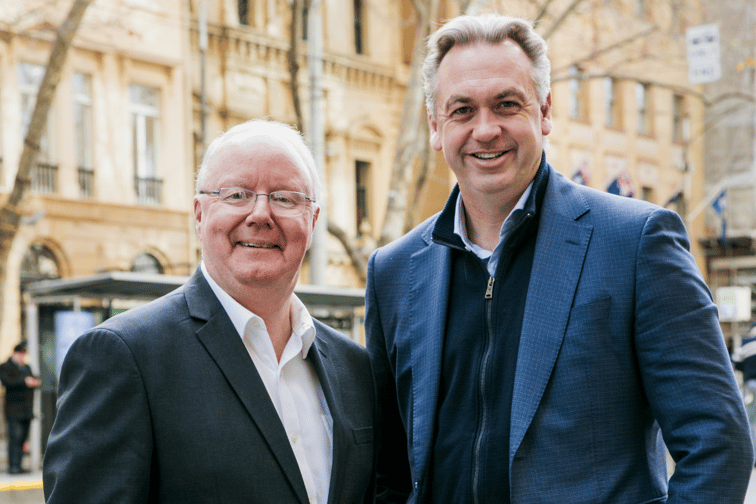

Steve Lawrence (pictured above left) has been appointed chief credit officer at Keystone Capital, to help the company to grow and scale its business operations, expand its loan book, and drive its push to bring greater certainty and reliability to the current lending market.

Lawrence brings to his new role four decades of experience in the banking, finance, and property industries, including executive positions at La Trobe Financial and Pallas Capital.

The appointment follows the recent acquisition of a 50% stake in the business by specialist financial services firm, KeyInvest – a development that will enable the company to expand its business strategy across Australia.

Tom Waltham (pictured above right) and Lachlan Perks, Keystone Capital co-founders and executive directors, welcomed Lawrence’s appointment.

Lawrence “is a highly respected icon of the industry, and his vast executive experience will be vital in helping us extend our reach and establish Keystone Capital as one of the nation’s leading non-bank lenders and providers of alternative property-backed credit to Australians,” Waltham said.

Lawrence said he clearly resonated with the corporate vision shared by Waltham and the Keystone team.

“I’m thrilled to be joining an organisation that, in its 10-year history, has built a team of highly regarded and relationship-driven professionals who have successfully concluded loans in excess of $850 million,” he said.

“Now, with KeyInvest’s investment giving Keystone Capital access to more funds, as well as a suite of borrower and investor products to distribute to its national investor, broker, and borrower networks, I look forward to working with the entire Keystone Capital team to help them achieve the ambitions and goals that have been set for the business.”

Lawrence said nurturing the relationships at Keystone Capital will guide him in building on the company’s competitive advantages of “delivering a consistently high-quality service characterised by a ‘speed-to-market’ commitment and greater flexibility when assessing and delivering loans to a growing client base of predominantly mortgage brokers.”

Lawrence added that it was his aim to always meet – if not exceed – the expectations of these brokers, and to do that, he was looking forward to further developing his strong relationships with those in the broader Australian lending sector.

Got a new appointment in your own organisation? Share it with us in the comments section below.