Mortgage arrears rise as investors exit the market, driven by increased costs and taxes, tightening the rental supply and raising concerns over government policies, PIPA reported.

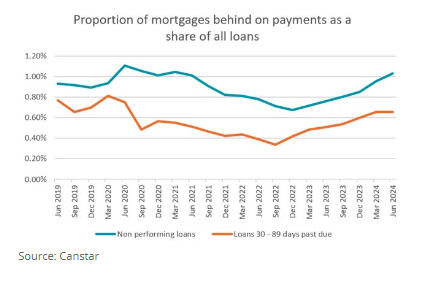

For the sixth straight quarter, the value of mortgages in arrears for 90 days or more has increased, now reaching $23.4 billion.

This rise is linked to the strain of 13 interest rate hikes, impacting borrowers’ ability to make repayments.

The rate of arrears, though still at 1.03%, is above pre-COVID levels.

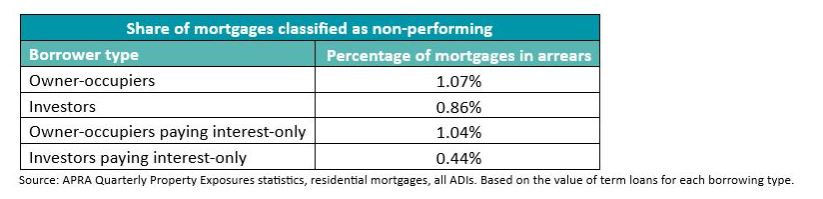

Owner-occupiers, more so than investors, are disproportionately represented in the non-performing loans category, now accounting for 1.07% of all such loans.

The 2024 PIPA Annual Investor Sentiment Survey revealed that an increasing number of investors are selling off properties, with 14.1% having sold at least one investment property this year, up from 12.1% last year.

Around 65% of these homes were bought by owner-occupiers, further tightening the rental market.

According to PIPA chair Nicola McDougall (pictured above), new property taxes and compliance costs are pushing investors out, fueling fears of a worsening rental supply shortage.

The survey showed changing preferences among investors regarding where they see potential for growth.

Melbourne, despite its sluggish market, was chosen by 26.2% of respondents as the best city for investment, followed closely by Perth and Brisbane.

Regional Queensland remains the top choice for regional investments.

“Perth was last year’s favorite, and it proved accurate as property prices surged,” McDougall said.

New property taxes and rental reforms have driven up holding costs for investors, leaving them with little choice but to increase rents.

Nearly 40% of surveyed investors indicated they would raise rents to offset rising costs, with many citing government intervention in the rental market, including rental caps and freezes, as their biggest challenge.

Investors are increasingly wary of government policies perceived as tenant-friendly.

“The continual changing of the goal posts by various levels of government... is negatively impacting property investment sentiment as well as rental housing supply,” McDougall said.

Some 86.8% of survey respondents cited government interference as their top concern, followed by rising costs and inflation, PIPA reported.

To read the article in full, visit the PIPA website. The article was originally published in the Australia Property Investor.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.