Australia’s home loan market is seeing further reductions in interest rates, with both variable and fixed rates being adjusted, Canstar reported.

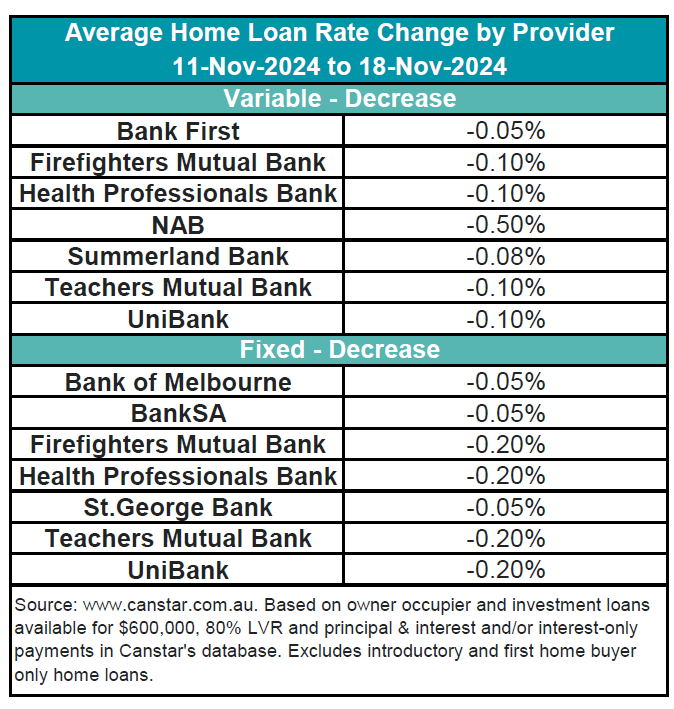

Over the past week, seven lenders cut a total of 27 variable rates for owner-occupiers and investors by an average of 0.15%, while 140 fixed rates were reduced by an average of 0.14%.

See the latest rate adjustments in the table below.

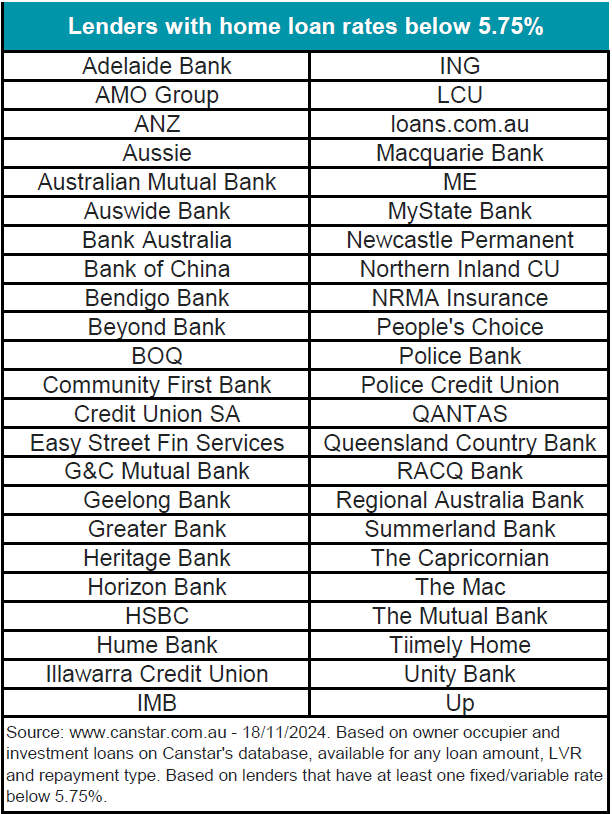

The current average variable interest rate for owner-occupiers paying principal and interest is 6.83%, with the lowest variable rate for any LVR offered by Abal Banking at 5.75%.

Canstar’s database lists 232 rates below 5.75%. These rates are being offered at the following lenders in the list below.

According to Sally Tindall (pictured above), Canstar’s data insights director, major banks are actively cutting rates to attract customers.

“There were several notable cuts over the last week with the Westpac Group brands St George, Bank of Melbourne and BankSA paring back fixed rates by a very minor 0.05 percentage points, while NAB cut its basic variable rate by up to 0.6 percentage points," Tindall said.

Tindall said this is the second instance in three months where a major bank has reduced variable rates for new customers, highlighting intense competition among the big players.

Despite no changes to the cash rate in over a year, the average owner-occupier variable rate has gradually fallen from 6.39% in March to 6.34% in September, indicating ongoing adjustments in the lending market.

However, future cash rate cuts remain uncertain.

“The clouds hanging over the timing of the RBA’s first cash rate cut got a little darker this week,” Tindall said, referencing steady unemployment data and slowed employment growth.

“While borrowers across the country are no doubt hanging out for a February cut, May seems like a more logical choice,” Tindall said.

With more inflation data expected by then, the Reserve Bank of Australia may feel more confident in reducing rates to ease economic restrictions.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.