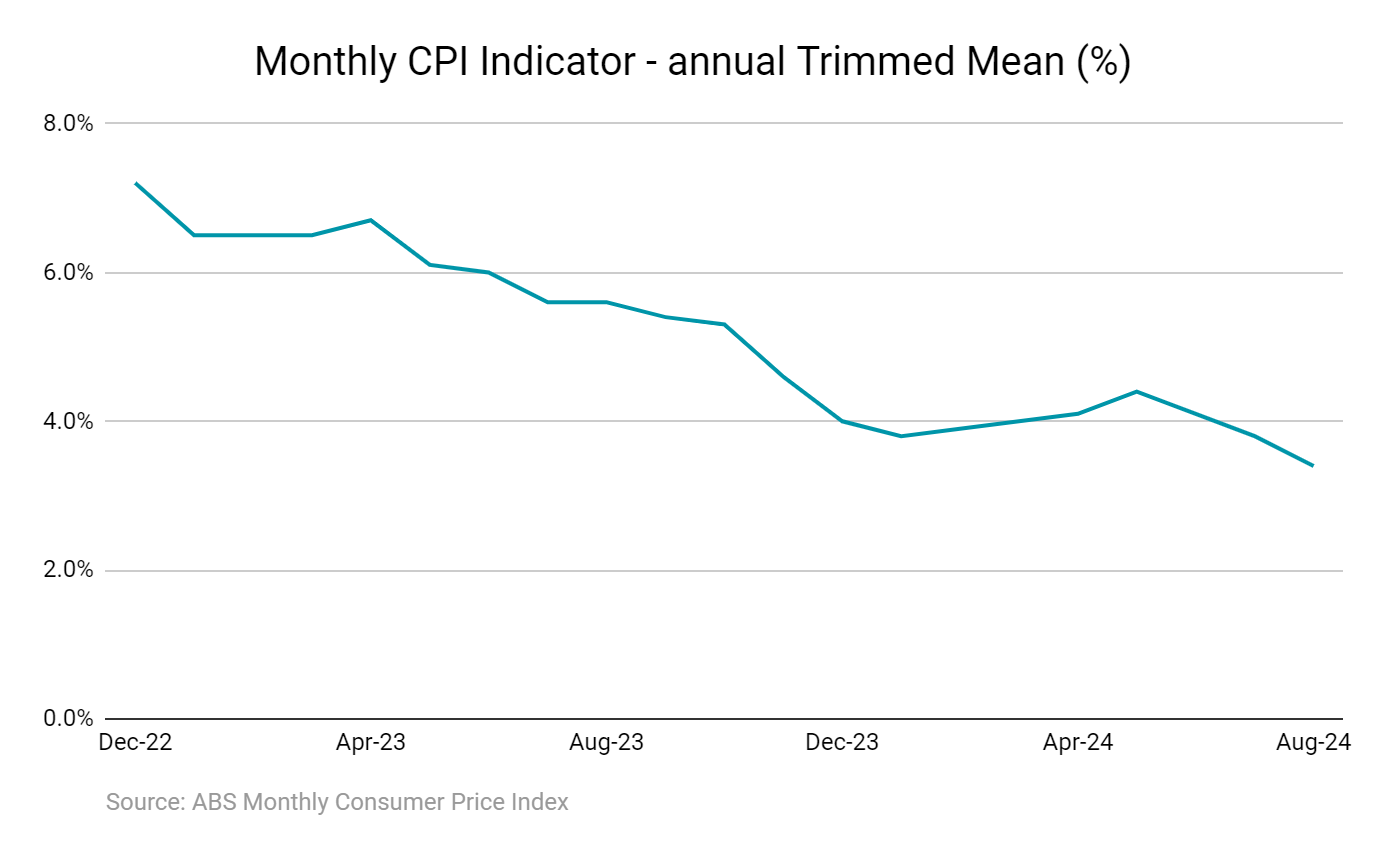

In the wake of the Reserve Bank’s latest cash rate pause yesterday, Australia’s monthly Consumer Price Index (CPI) indicator rose 2.7% in the 12 months to August 2024, according to the latest data from the Australian Bureau of Statistics (ABS).

Down from 3.5% in July and marking the lowest reading since August 2021, the monthly data means inflation finally sits within the RBA’s 2-3% inflation target band.

However, the fight against inflation hasn’t been won yet, with the central bank putting less onus on the more volatile monthly figures compared to the quarterly data.

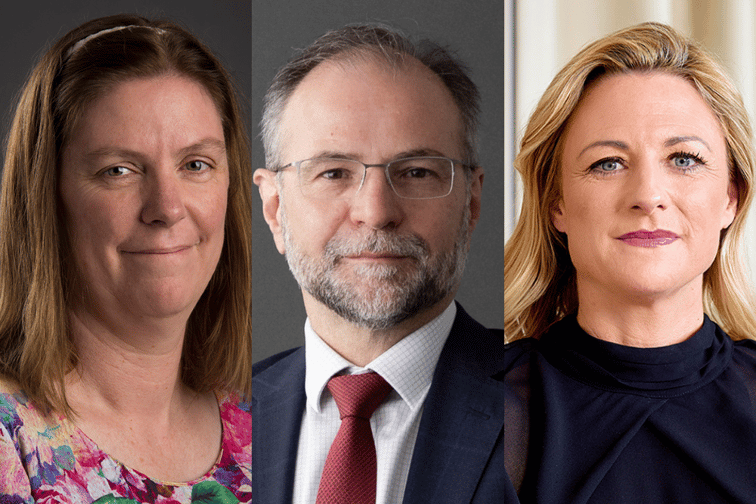

Bendigo Bank chief economist David Robertson (pictured centre) said while today’s data was only a subset of the full Q3 CPI report out on October 30, the numbers are “very encouraging for rate cuts in 2025, and certainly brings a February rate cut back into play”.

“Bendigo Bank’s forecast for the easing cycle to commence in 2025 and not earlier has been unchanged since January 2023, although the precise timing (February or May 2025) remains a close call,” Robertson said.

“Today’s data certainly helps the case for a February cut, however upcoming data and events will keep markets guessing between now and then, including the US Presidential election in November.”

“We continue to expect at least three rate cuts next year.”

|

Monthly CPI Indicator - annual movement |

||

|---|---|---|

|

Month |

CPI indicator |

Annual Trimmed mean |

|

January 2024 |

3.4% |

3.8% |

|

February 2024 |

3.4% |

3.9% |

|

March 2024 |

3.5% |

4.0% |

|

April 2024 |

3.6% |

4.1% |

|

May 2024 |

4.0% |

4.4% |

|

June 2024 |

3.8% |

4.1% |

|

July 2024 |

3.5% |

3.8% |

|

August 2024 |

2.7% |

3.4% |

|

Source: ABS Monthly Consumer Price Index Indicator. Prepared by Canstar on 25/09/2024. ‘CPI excluding volatile items’ excludes fruit and vegetables, automotive fuel and holiday travel. |

||

At the Group level, the top contributors to the annual movement were Housing (+2.6%), Food and non-alcoholic beverages (+3.4%), and Alcohol and tobacco (+6.6%). Partly offsetting the annual increase was Transport (-1.1%).

Falls in Automotive fuel and Electricity were significant moderators of annual inflation in August. Automotive fuel was 7.6% lower than August 2023 after price falls in recent months.

For Electricity, the combined impact of Commonwealth Energy Bill Relief Fund rebates and State Government rebates in Queensland, Western Australia and Tasmania, drove the largest annual fall in electricity prices on record of 17.9%.

Michelle Marquardt (pictured left), ABS head of prices statistics, said the falls in electricity and fuel had a significant impact on the annual CPI measure this month.

“When prices for some items move by large amounts, measures of underlying inflation like the CPI excluding Automotive fuel, Fruit and vegetables and Holiday travel, and the Trimmed mean can provide additional insights into how inflation is trending,” Marquardt said.

Given that the read for underlying inflation was lower than forecast, Robertson said the result “bodes well for steady progress in the months ahead”.

However, Canstar’s Data Insights Director Sally Tindall (pictured right) said while this result proves Australia is on the right track, it won’t be nearly enough for the RBA to pop the champagne, nor is it likely to bring forward the timing of rate cuts into 2024.

“At 3.4% in the monthly indicator, annual trimmed mean inflation is still too high,” Tindall said.

With the latest inflation data coming one day after the RBA’s cash rate decision, the market turns to questioning what will be the next move.

Robertson said this data matched the hint of dovishness from Michele Bullock yesterday when she stated that a hike was not considered in policy deliberations.

“Although equally she effectively ruled out a cut this calendar year in the absence of a significant shock.”

Tindall agreed saying relief in the form of cash rate cuts is still likely to be “some months away” but that doesn’t mean households just have to wear it.

“People may feel like they have one hand tied behind their back as the price of so many everyday essentials continue to rise. However, those feeling the pinch should use the other hand to try and cut costs where they can,” Tindall said.

“What’s important to remember is that CPI is an average. Those focused on saving money are likely to find they can beat this average just by utilising competition in the market.”

Tindall suggested starting with the biggest recurring expense and work backwards.

“For many households that’s the mortgage, but don’t stop there. Unless you’re already a bill ninja, you should be able to find relief across a range of budget pressure points.”

Canstar’s repayment calculations show the potential impact on repayments for customers of the big four banks if each of their cash rate forecast eventuates.

|

Potential impact of cash rate forecasts |

||

|---|---|---|

|

|

Cash rate forecast |

Drop in monthly repayments by June 2026 |

|

3 x 0.25% cuts starting Feb-25 |

$269 |

|

|

5 x 0.25% cuts starting Dec-24 |

$444 |

|

|

5 x 0.25% cuts starting May-25 |

$438 |

|

|

4 x 0.25% cuts starting Feb-25 |

$356 |

|

Source: www.canstar.com.au - 28/08/2024. Based on RBA Lenders' rates (June 2024) for existing owner occupier variable loans of 6.36%. Calculations assume a balance of $600k over 25 years, principal and interest repayments and that the cash rate forecasts for the major bank's take effect in the month following the forecasted movement.