By

The mortgage and finance industry has welcomed Revenue NSW’s decision to not start any new action to pursue aggregators for payroll tax, after warnings the move could threaten broker businesses and impact borrower access to credit.

The MFAA announced today it had received confirmation from Revenue NSW that no further audits would be conducted of aggregators connected with payroll tax in relation to their broker members.

Previously, Revenue NSW had been pursuing aggregators for backdated payroll tax, based on the premise that brokers receiving commissions were in an employee relationship with aggregators.

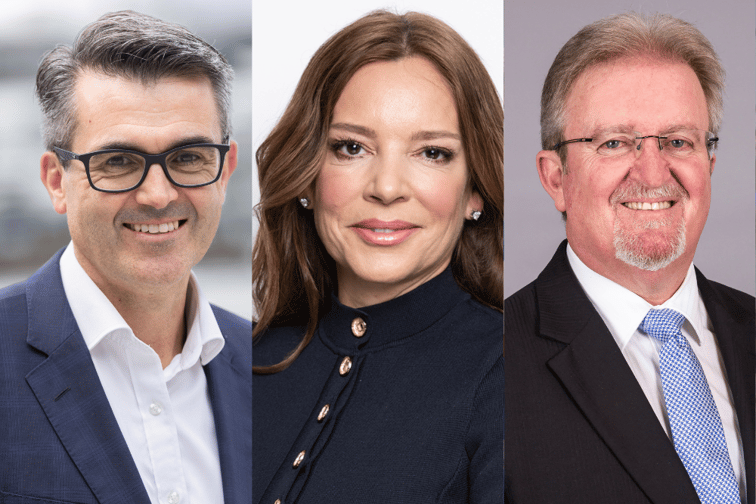

Mortgage Choice CEO Anthony Waldron (pictured above left) said that Revenue NSW’s announcement was “very positive news” and showed that the industry’s efforts in the lead up to the state election have been heard.

“We are looking forward to working with the MFAA and the new NSW Labor government to find a sensible outcome for the broking industry,” Waldron said.

The MFAA said it had met regularly with all sides of government and Revenue NSW heading into last weekend’s state election, arguing the tax had been incorrectly applied to the industry.

The association had also encouraged brokers to contact their local representatives, in the hope a campaign would achieve a moratorium on the payroll tax issue until there was more certainty.

The election resulted in a change of government to Labor, who will form a majority government led by incoming premier Chris Minns.

The MFAA said that with the election result now clear, it was looking forward to working alongside the new government on matters that affected “a significant industry” for the state of NSW.

“We are pleased to have received written confirmation from Revenue NSW that no new action will be taken against aggregators,” MFAA CEO Anja Pannek (pictured above centre) said.

“We held constructive meetings prior to the election where we firmly and respectfully communicated our concern to Revenue NSW and all sides of government that the application of payroll tax threatens broker businesses, the financial stability of our industry, and choice and competition for NSW borrowers.

“In those meetings, we sought commitment from Labor, that should it form a new government, that it would suspend all activities against the broking sector in NSW by Revenue NSW, by way of a moratorium, until there is certainty for industry.”

FBAA managing director Peter White (pictured above right) welcomed the news, saying that he looked forward to Revenue NSW formally engaging industry on this as it was “the outcome we all wanted and have been and are lobbying for”.

“Once Revenue NSW puts out something formally to engage on this we, with industry, look forward to speaking with them.

“This morning I have sent a congratulatory text to the new Premier-elect Chris Minns wishing his team all the best. I also emailed his primary minister for this payroll tax matter with a similar message, thanking him and his team for their engagement on this and re-acknowledging the need to ensure we formally move this matter forward as a priority for our industry.”

The industry had argued that aggregators were not acting as employers of member brokers, but were offering a service to their brokers and passing on commissions that were paid by lenders.

Businesses that do have an employer relationship with their employees and who have a total wage bill of over $1.2 million during the 2022/23 financial year are liable to pay 5.45% in payroll tax.

A previous letter from the MFAA to the now former NSW treasurer Matt Kean as well as the then Labor Opposition badged the plan to pursue payroll tax from aggregators “unwarranted, unfair and unreasonable”.

Brokers had suggested the move could put smaller brokers out of business, as aggregators were likely to pass on much of the backdated bill to their members who may not be able to afford it.

Pannek thanked what the MFAA has said was “thousands of brokers in New South Wales and nationally” who made their voices heard over the past month during the MFAA’s campaign.

“With payroll tax laws harmonised across most Australian states and territories, this is not just a NSW issue, it is a national issue.

“Our campaign has been incredibly successful in making so many voices heard in a pivotal time. Thousands of brokers put their hands up and made it known that this tax was harmful to the industry, their business and to their customers’ access to credit,” Pannek said.

“Our industry looks after one another and we’re committed to protecting the interests of the broker industry alongside the new government.