By

Many businesses have experienced dramaticdeclines in revenue since the country was largely locked down at the end of March, and are struggling to cover their financial obligations.

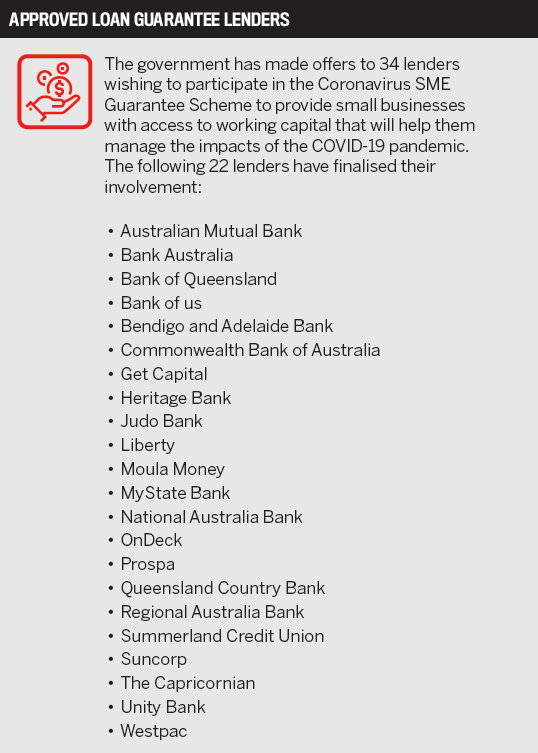

The government has announced a raft of measures to put a financial foundation under the Australian economy, and one of the major initiatives for small businesses is the new Coronavirus SME Guarantee Scheme.

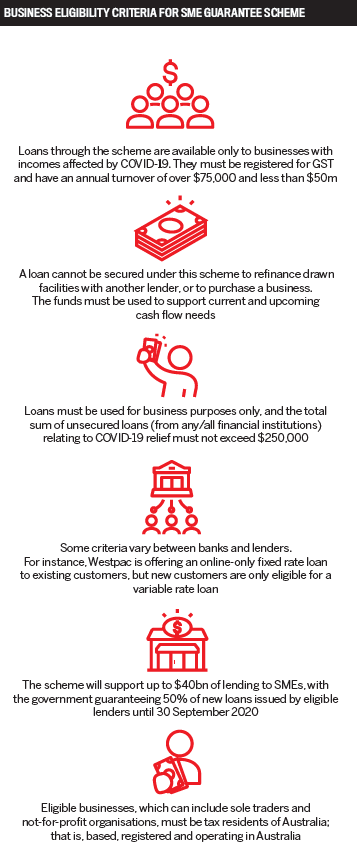

Under the new scheme, lenders can provide eligible SMEs with unsecured loans of up to $250,000 for terms of as long as three years, with no repayments required for the first six months.

An important aspect of the scheme is that, in addition to partnering with many of the major banks, it leverages the ability of smaller, non-bank lenders to distribute funding quickly.

“The inclusion of five non-bank lenders in the scheme means there is a greater chance of credit flowing to viable small businesses that need it,” says Kate Carnell, the Australian Small Business and Family Enterprise Ombudsman.

“Non-bank lenders are accustomed to lending unsecured and getting funding to SMEs quickly, so it’s important the selected fintechs pass on the lower rates for loans under this scheme to small businesses, as they are backed by a 50% government guarantee.

“Essentially this means the government is taking on half of the risk of the loan, and that needs to be reflected in loan pricing. This is something my office will be monitoring closely.”

There are no fees for lenders participating in the scheme, and the government will guarantee 50% of each loan, so the funding can be offered more cheaply and more freely than with regular business loans. This allows the lender to minimise its risk and increase its appetite for SME loans.

There are no fees for lenders participating in the scheme, and the government will guarantee 50% of each loan, so the funding can be offered more cheaply and more freely than with regular business loans. This allows the lender to minimise its risk and increase its appetite for SME loans.

Already, the appetite of the business community to access these funds appears to be strong: Commonwealth Bank confirmed that it has processed and approved 3,700 loans to small businesses, worth approximately $315m, since the scheme was announced.

With a range of both non-bank lenders and banks on the panel, there are plenty of options for borrowers; however, some lenders have indicated that loans provided through the scheme, which will generally be available to both new and existing customers, will not be eligible for broker commission.

Some have commented that they will not be able to confirm the commission structure for brokers until funds become available, while others have confirmed that a partner remuneration program will be launched, but the specifics are not yet known.

Prospa is one non-bank lender in the latter category.

“The government has recognised the important role non-bank lenders play in promoting competition among the banks, providing fast access to capital and securing financial inclusion for small businesses,” says Prospa chief revenue officer Beau Bertoli, before reiterating the essential role that brokers are playing right now.

“The inclusion of five non-bank lenders in the scheme means there is a greater chance of credit flowing to viable small businesses that need it” Kate Carnell, Australian Small Business and Family Enterprise Ombudsman

“Brokers are trusted advisers to small business, and in these uncertain times this role is crucial, as small businesses need a lot of help and a lot of empathy. Brokers have always been a vital part of what we do, and we will be working closely with our partners to quickly distribute funding to eligible customers,” he says.

“We know many brokers are small business owners too, and that these are really tough times, so we’ll continue to work hard to support our partners and their small business customers in any way we can.”

Meanwhile, Liberty is one of the lenders on the panel that has confirmed it will be paying brokers a commission on any loans written through the scheme. An upfront commission of 0.45% of the approved amount will apply to all successful loan applications; however, no trailing commission will be paid.

“The Australian broker industry has our commitment to continue providing funding to support our valued customers during this challenging period,” says John Mohnacheff, Liberty’s group sales manager.

“The Australian broker industry has our commitment to continue providing funding to support our valued customers during this challenging period” John Mohnacheff, group sales manager, Liberty

“The Australian broker industry has our commitment to continue providing funding to support our valued customers during this challenging period” John Mohnacheff, group sales manager, Liberty

“We want small businesses to know that they are not alone, that help is available, and their broker is a great starting point for exploring their options. Brokers are encouraged to contact our underwriting teams directly to discuss any unique or complex scenarios they may have. We know that timely responses are important and believe that opening the lines of communication between us and our business partners helps us to deliver on tight turnarounds.”

Mohnacheff adds that the new SME loan guarantee provides confidence to lenders, which is essential in the current environment in which many small businesses have been impacted by the repercussions of COVID-19.

“Being a participating lender in the SME Guarantee Scheme with our new offering, Liberty Business Care, allows us to extend our experience to further support individuals, households, businesses and our economy at this critical time. We would also encourage any brokers with customers or scenarios where they are unsure how to help, to reach out to their Liberty BDM ... as we assess applications on a case-by-case basis, so we can offer solutions for each customer.”

The response from banks in terms of paying broker commissions varies.

“Brokers are trusted advisers to small business, and in these uncertain times this role is crucial, as small businesses need a lot of help and a lot of empathy” Beau Bertoli, chief revenue officer, Prospa

NAB has confirmed that “the nature of this specialised loan and the urgency in which it is being provided has deemed [broker] commission not applicable in this instance”.

“Our new Business Support Loan is available to existing broker-introduced customers experiencing the impacts of COVID-19; however, no broker commissions will be paid. We ask that our brokers direct their commercial customers to contact their NAB business banking manager or submit a request online,” said an NAB spokesperson.

Commonwealth Bank has taken a different approach.

“Our customers were able to apply for loans under the Australian government’s SME Guarantee Scheme from March 23, a day after the government announced the scheme,” says Angus Sullivan, group executive, retail banking services at Commonwealth Bank.

“As part of our support for brokers, we have made the decision to pay trail commissions on eligible loans.”

And at Suncorp, the bank “stands with our brokers”, a spokesperson said. “If a broker is accredited with Suncorp to write small business products, then we will be paying standard commissions in accordance with existing agreements.”

Commissions aside, there remain concerns that these new government-backed loans won’t be delivered in a time frame that will guarantee small businesses’ survival through the economic hardship brought on by the COVID-19 pandemic.

Four in five business owners (79%) believe banks will not be able to approve and settle loans under the scheme as quickly as is necessary, according to a survey of 207 business owners commissioned by lending platform lend.com.au.

The research found that 70% of businesses feel they need the loans to survive. Of these, 12% said it was already too late for their business, and 32% said they would need a loan by the first week of May.

Lenders, however, remain confident that all the right steps are being taken to support the business community at large.

“The government’s response has been swift and considered, and their support will enable lenders to help thousands of small businesses cope with the significant impact of COVID-19,” says Prospa’s Bertoli.

“Recent measures like the scheme and stimulus packages reinforce that government understands how crucial small businesses are to the economy, and the importance of getting capital quickly to those who need it.”