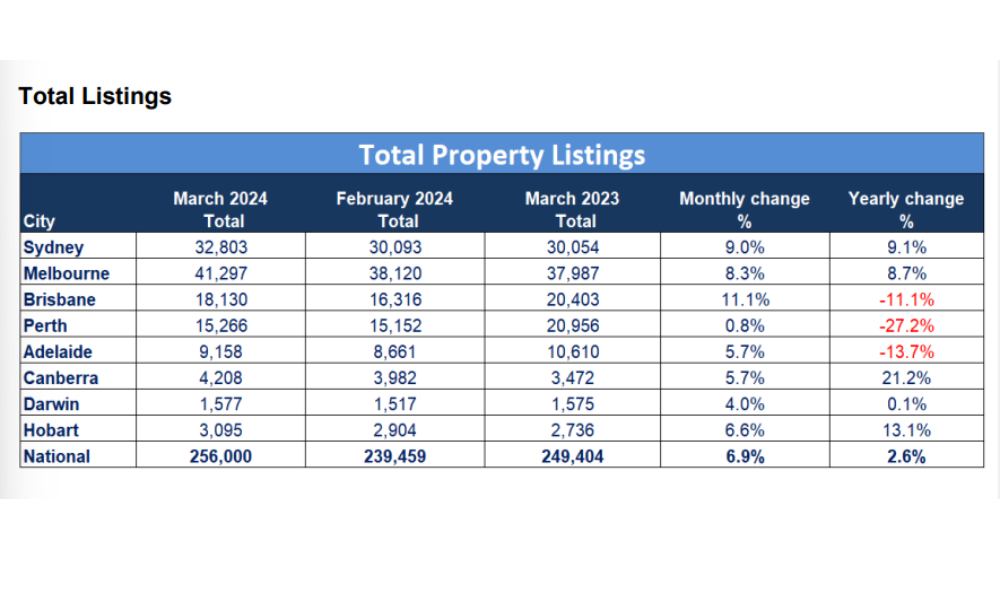

The Australian housing market witnessed a 6.9% increase in total residential property listings in March, reaching a total of 256,000 properties up from February’s 239,459, according to SQM Research’s latest data release.

This marks a significant uptick across all major cities, with an overall 2.6% increase in listings compared to March 2023. Sydney and Melbourne, in particular, showcased notable increases in listings, with rises of 9.1% and 8.7%, respectively, from last year.

However, Brisbane, Perth, and Adelaide bucked the trend with notable declines in their year-over-year listings.

See LinkedIn post here.

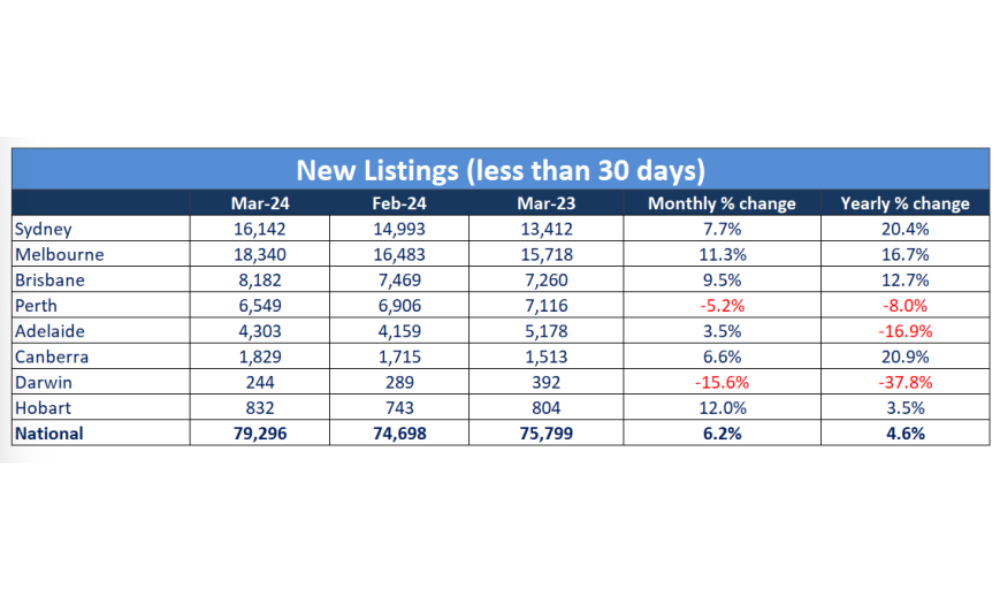

The national count for new listings, properties listed for less than 30 days, rose by 6.2% in March, totaling 79,296. This rise was predominantly seen in all listed cities except Perth and Darwin, highlighting a seasonal trend of increased listings during the early months of the year.

Sydney and Melbourne reported significant year-over-year increases in new listings, with Sydney up by 20.4% compared to March 2023, SQM Research data showed.

“The Australian housing market has recorded a further increase in activity,” said Louis Christopher (pictured above), managing director of SQM Research. “While listings are up across the nation, they are not at levels which would be regarded as an oversupply situation.”

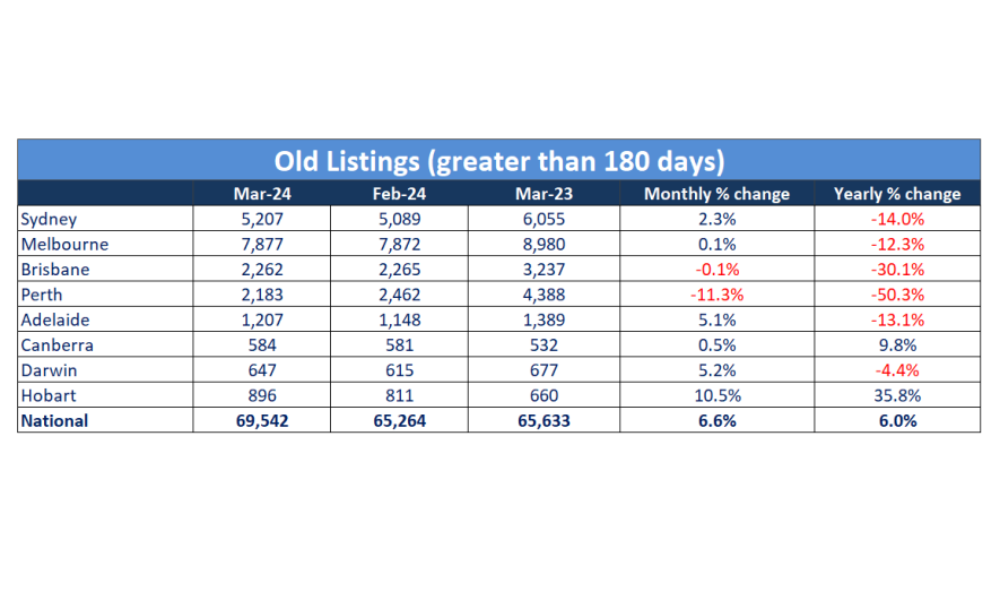

Older listings, those on the market for more than 180 days, increased by 6% over the past year. Despite this uptick, the total number of older listings remains lower than the figures recorded in March 2023, suggesting a healthy turnover in the housing market.

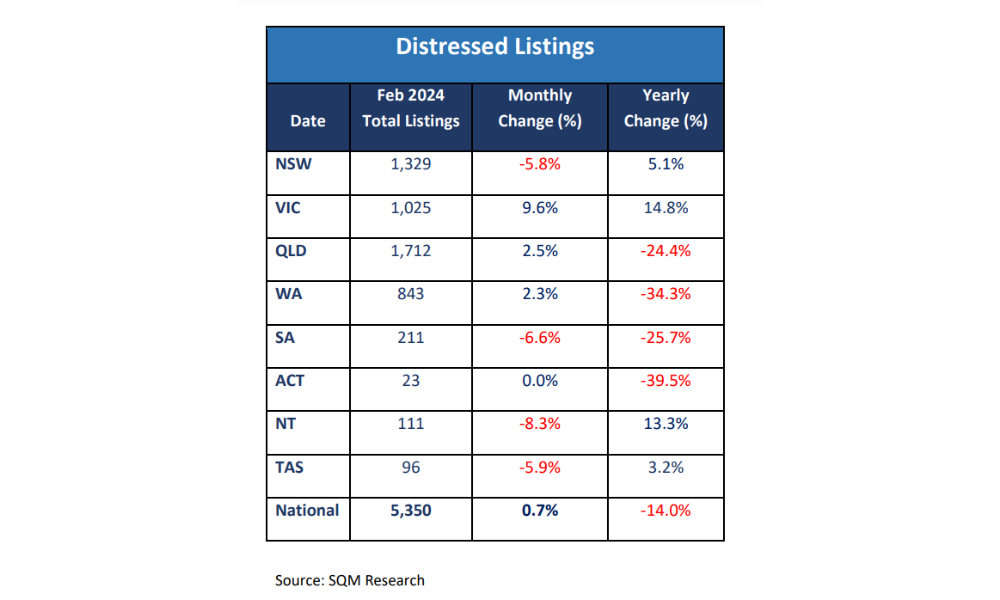

March witnessed a slight increase in distressed property sales across Australia, with a 0.7% rise to 5,350 listings. This change reflects a mix of trends across states, with NSW, SA, NT, and TAS seeing reductions in distressed listings, while VIC and QLD recorded increases.

“Distressed activity was somewhat muted over March with a large decline in NSW distressed listings,” Christopher said. “However, Victoria recorded another surge and so we are watching that state closely.”

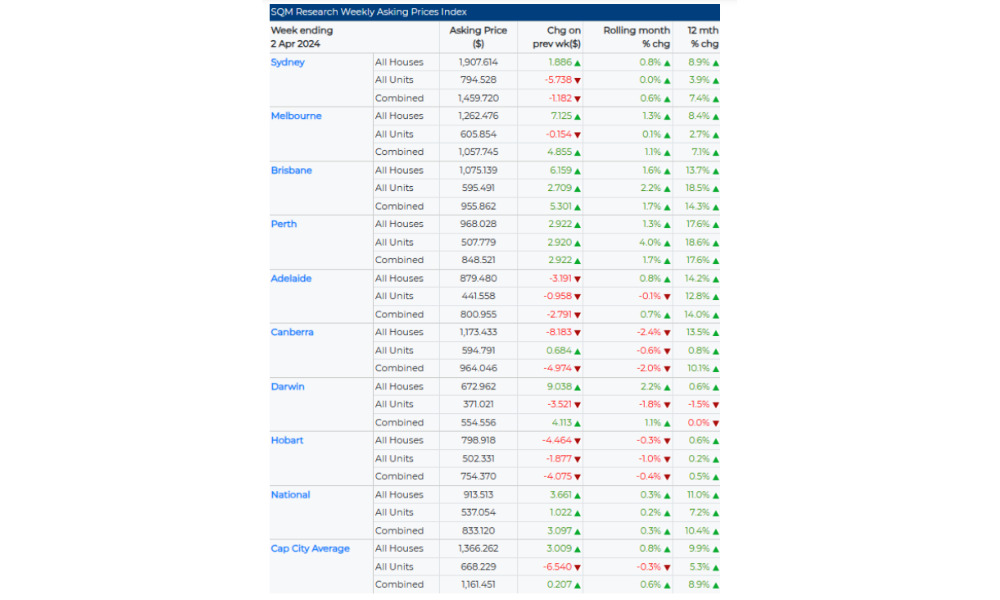

The national median dwelling asking price edged up by 0.3% to $833,120, with capital cities experiencing a 0.6% increase and a notable 8.9% rise compared to March 2023. However, Canberra’s combined asking price saw a decrease.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.