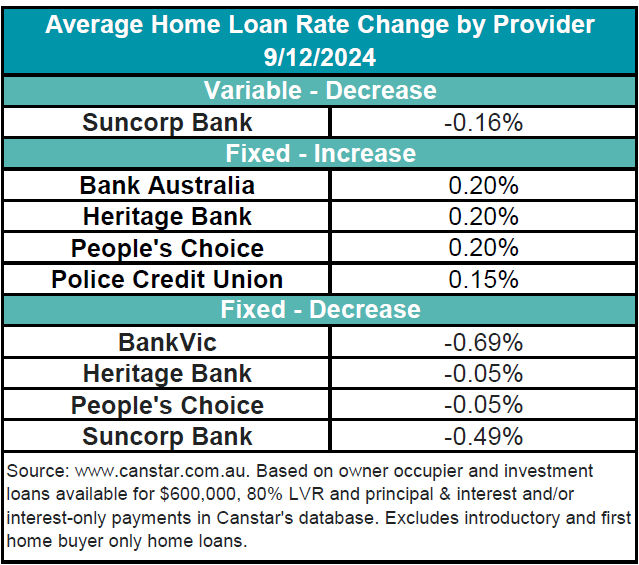

This week’s Canstar Weekly Interest Rate Wrap revealed a split in home loan rates, as fixed rate cuts that once dominated have now balanced with notable increases.

Four lenders increased 58 owner occupier and investor fixed rates by an average of 0.20%. Meanwhile, four other lenders cut 49 fixed rates by an average of 0.42%.

While fixed rates shifted both ways, Suncorp Bank cut four investor variable rates by an average of 0.16%

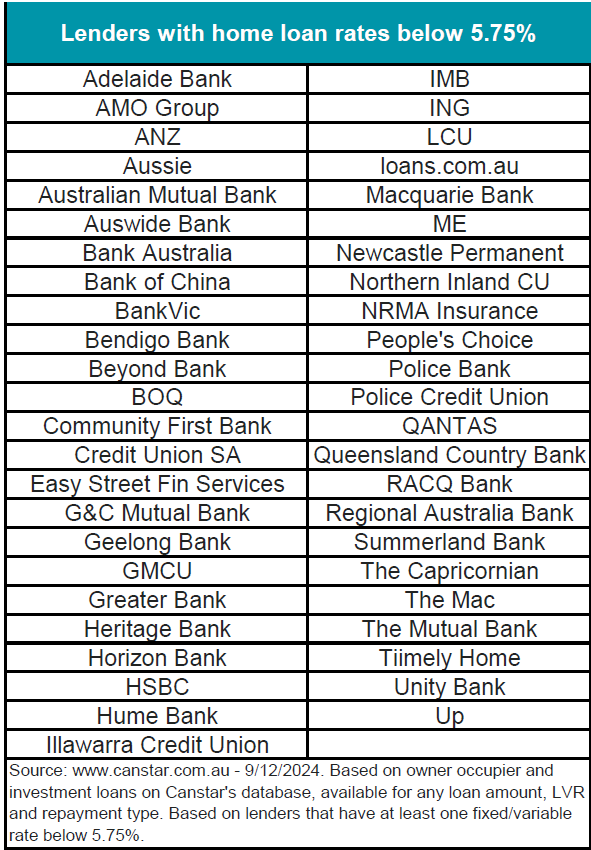

Amid these shifts, competitive rates under 5.75% are becoming harder to find.

Canstar’s database now lists 192 such rates, down from 233 the previous week. This decline signals a growing challenge for borrowers looking to secure the lowest fixed and variable offers.

Sally Tindall (pictured above), Canstar’s data insights director, commented on the shifting rate environment:

“The dominance of fixed rate cuts recorded in earlier months has started to die down,” Tindall said. “This week there was an even split between the number of lenders cutting fixed rates and the number hiking these rates – something we haven’t seen for months.”

Tindall explained that fixed rate movements often align with the cost of wholesale funding but also reflect the broader economic outlook.

“While fixed rate changes are often linked to the cost of wholesale funding, it broadly matches the growing consensus the RBA won’t be firing off a rate cut at its first meeting back from the summer break in February 2025,” she said.

Australia’s economy remains under pressure, with GDP growth at just 0.8% for the year through September – below market expectations. However, the Reserve Bank (RBA) is unlikely to cut rates yet, given unemployment remains steady at 4.1% and annual trimmed mean inflation sits at 3.5%.

Despite the cash rate holding steady throughout 2024, new variable rates for customers are gradually falling. According to RBA data released for October, the average variable rate for owner occupiers fell to 6.23%, down from a peak of 6.28% in June.

Tindall emphasised that even small rate drops are significant across the market.

“A drop of 0.05 percentage points might not sound like much, but as an average across the market, it is significant,” she said. “It serves as yet another piece of evidence that banks can and do put competitive rates on the table if it means winning new business.”

With fixed rate hikes gaining momentum and competitive variable offers still available, borrowers are encouraged to explore their options in a shifting market.

To compare with the previous week’s rate changes, click here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.