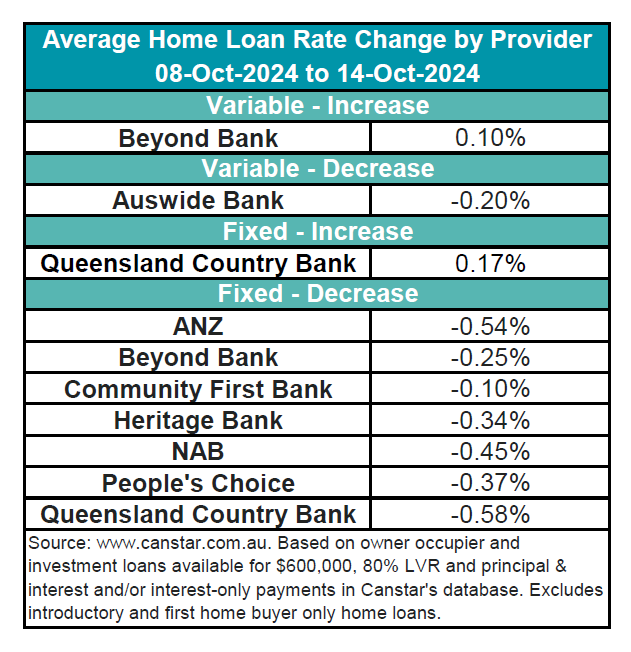

Several banks made notable changes to their home loan rates this week, according to Canstar’s latest weekly rate wrapup.

Beyond Bank increased one investor variable rate by 0.1%, while Auswide Bank made a 0.20% cut to an owner-occupier variable rate.

Queensland Country Bank raised 21 fixed rates for both owner-occupier and investor loans by an average of 0.17%, while seven other lenders slashed 116 fixed rates by an average of 0.41%.

According to Canstar, the average variable interest rate for owner-occupiers paying principal and interest currently sits at 6.86%, with the lowest variable rate of 5.75% offered by Abal Banking.

ANZ finally joined the rate-cutting cycle, reducing fixed rates for both owner-occupier and investor loans by up to 0.7 percentage points, after months of lagging behind its competitors.

“ANZ did not make any market-leading moves in its fixed-rate cuts last Friday, but rather was playing a game of ‘catch up’ with its big bank competitors,” said Sally Tindall (pictured above), Canstar’s data insights director.

Fixed rate cuts have dominated recent movements, with seven lenders dropping rates in the past week and only one bank increasing them.

Tindall noted that the cost of fixed rate funding, which had been declining, is beginning to rise again.

“Market pressure in this space could still drive a few lenders to sharpen their rates in a bid to remain competitive,” she said.

Lenders are adjusting variable rates in response to market shifts.

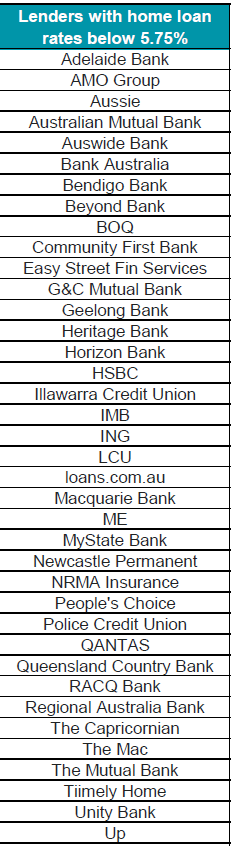

There are now 227 rates below 5.75% on Canstar’s database, up from 204 the previous week.

This increase highlights the growing competitiveness in variable rate offers, as lenders seek to attract more borrowers.

As fixed rate funding costs rise, the pace of rate cuts may slow down, but competitive pressures are expected to keep some lenders reducing rates to maintain their market position, Canstar reported.

Mortgage brokers are encouraged to monitor rate changes closely and assist clients in exploring the best available options for their needs.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.