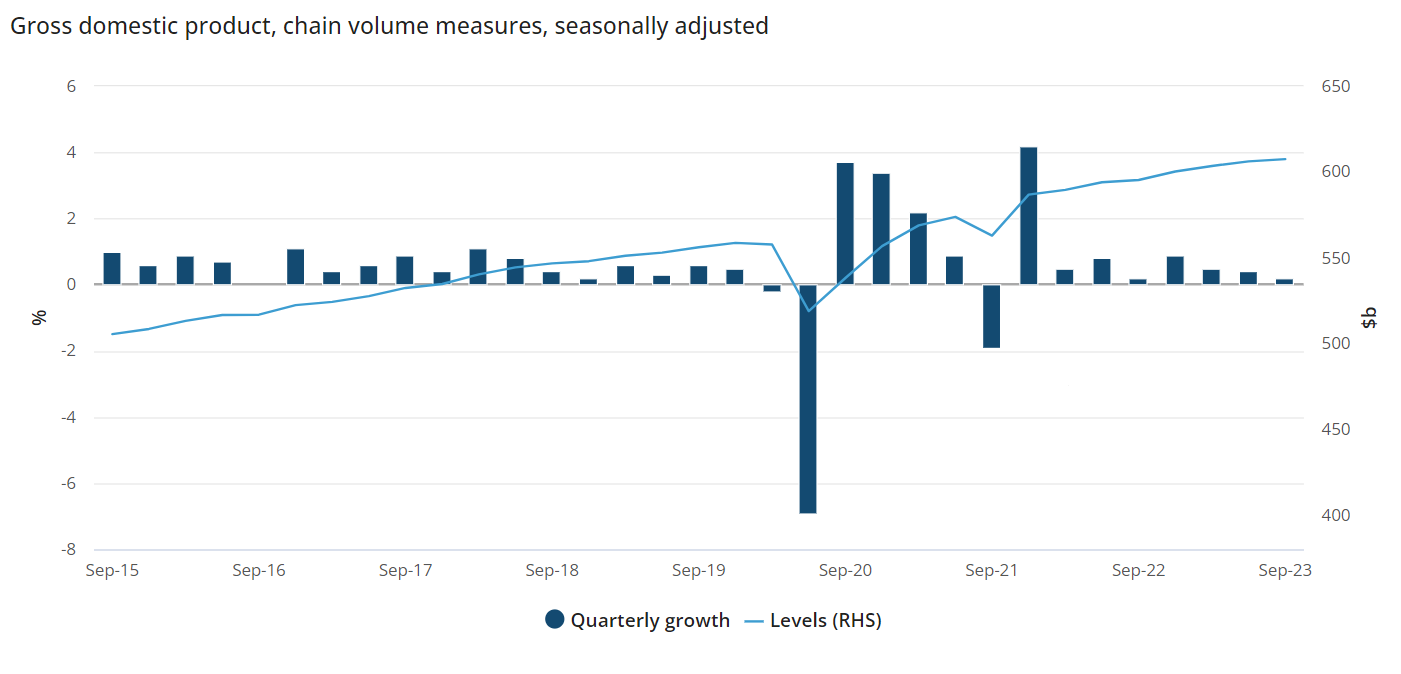

Australia’s GDP increased by a modest 0.2% in the September quarter, according to the latest ABS figures. This growth, measured in seasonally adjusted, chain volume terms, reflects a 2.1% expansion since September last year.

Katherine Keenan, head of national accounts at ABS, said that while this marks the eighth consecutive quarterly GDP increase, growth has decelerated throughout 2023.

“Government spending and capital investment were the main drivers of GDP growth this quarter,” Keenan said.

Government final consumption expenditure increased by 1.1% this quarter, building on a 0.6% rise in the June quarter.

“The growth in government expenditure was driven by social benefits to households, including the Energy Bill Relief Fund rebates, and extra payments for childcare, aged care and pharmaceutical products,” Keenan said.

Defense spending also contributed, particularly due to increased expenditure related to international training exercises held in Australia.

Gross fixed capital formation rose by 1.1%, with public corporations leading the increase at 8.9%. Investments by Commonwealth, state, and territory corporations primarily focused on transport, communication, and utilities projects. Private engineering construction also saw a rise, driven by increased investment in the mining industry.

Change in inventories contributed 0.4 percentage points to overall growth in September, in contrast to a 1.2 percentage point detraction in the June quarter. A notable shift in export dynamics, particularly falling prices for coal and LNG, impacted mining inventories and led to a decline in the terms of trade.

Imports of services rose by 8.4%, surpassing the 1.9% growth in services exports.

Increased travel services imports, up by 19.5%, reflected Australians traveling overseas during the Northern Hemisphere summer. However, exports of travel services continued to recover post-COVID-19 international border restrictions, up by 4.4%.

ABS noted the surge in tourism activity in September, with Australia hosting the FIFA Women’s World Cup, and education exports experiencing a notable increase due to a record-breaking number of international students.

Keenan said household spending remained flat in the September quarter, affected by government benefits and rebates that reduced spending on essential services.

The household saving-to-income ratio fell to 1.1%, its lowest level since December quarter 2007. Factors contributing to this decline include the removal of the Low and Middle Income Tax Offset, increased interest paid on home loans, and inflationary pressure on households.

The compensation of employees saw its largest quarterly rise since September 2022, with the superannuation guarantee rate, the minimum wage, and ongoing tightness in the labour market all contributing to the increase, Keenan said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.