Soaring living costs are forcing a growing number of people to continue living with an ex, according to new research by Finder, Australia’s most visited comparison site.

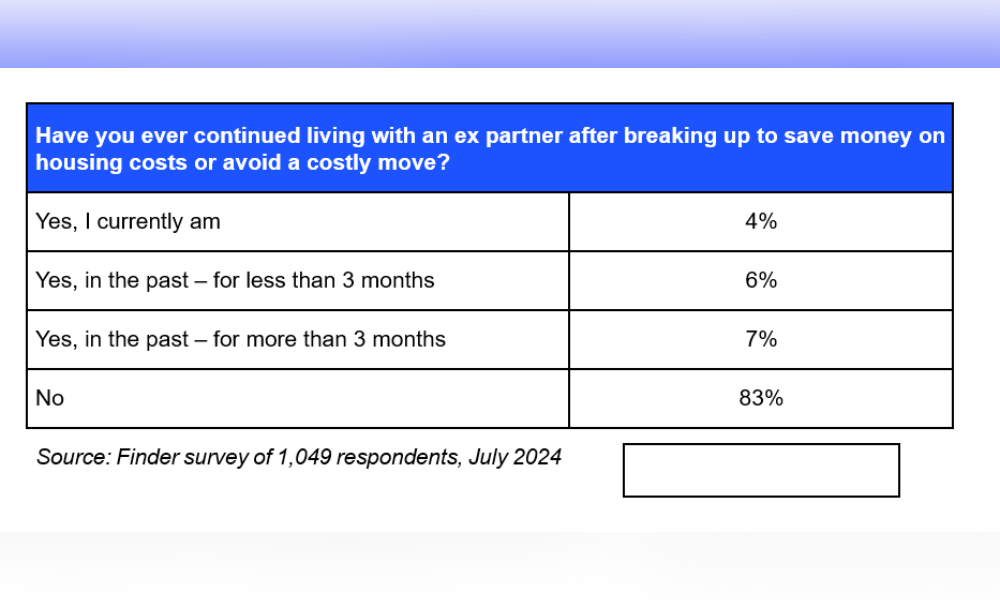

A Finder survey of 1,049 respondents revealed almost 1 in 5 (17%) have remained living with an ex-partner after breaking up due to affordability concerns.

The research found 4% – equivalent to more than 800,000 people – are currently living with an ex to save money on housing costs or to avoid a costly move. A further 13% lived with an ex in the past but have since parted ways.

Gen Z were more likely to share a home with an ex-partner due to cash flow worries – with a shocking 33% admitting they had, compared to 11% of Gen X and 5% of baby boomers.

Graham Cooke (pictured above), head of consumer research at Finder, said facing the housing market as a single person is daunting.

“Thousands of Australians decide to separate but remain living together for a prolonged period because they can’t afford to go their separate ways,” Cooke said. “Living together as a separated couple could be very difficult unless you are on really good terms.”

Almost one in five (19%) women say they continued to live with an ex, compared to 16% of men. Australians in WA (22%) were more likely to have remained living with an ex after a break-up, followed by NSW (18%), and Victoria (17%).

Cooke said that it is often complex to part ways when mortgages and children are involved.

“Some homeowners worry that they will lose out if they leave the family home before any financial settlement but moving out doesn’t diminish your legal rights,” he said.

“It’s also incredibly difficult to find suitable accommodation in some parts of Australia right now so staying together under one roof might be the most realistic option in the short-term.”

Cooke urged Aussies to build an emergency fund to safeguard against unexpected relationship breakdowns.

“During the honeymoon period of a new relationship very few people are imagining a time when they are no longer compatible,” he said. “An emergency fund helps people to be financially prepared for the good and the bad.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.