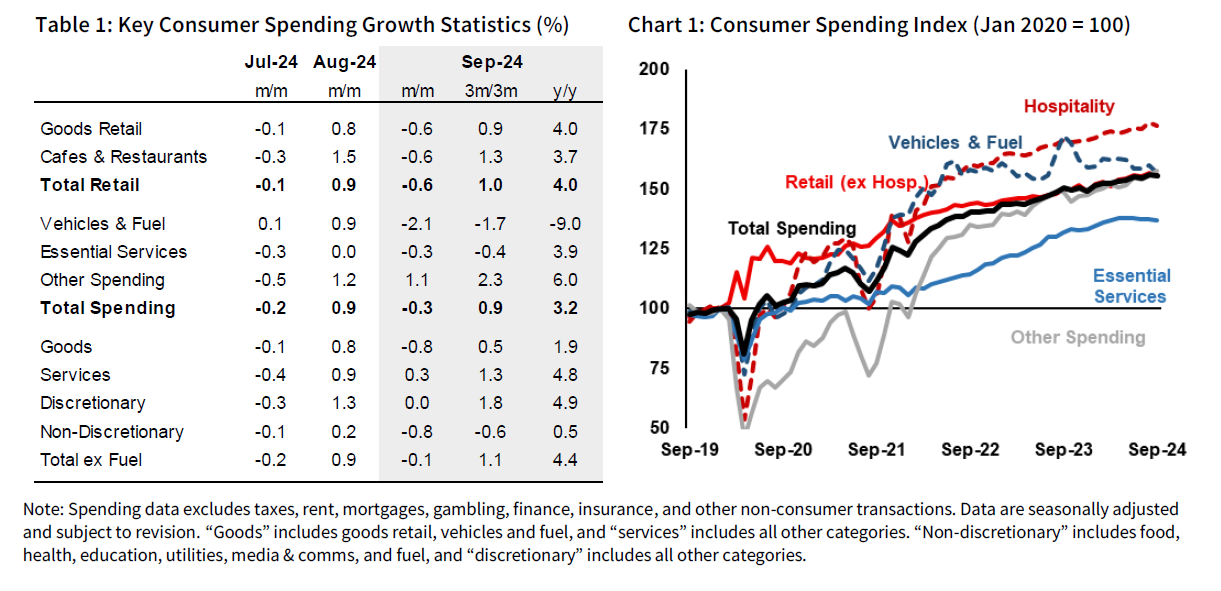

NAB’s transaction data revealed that consumer spending fell by 0.3% in September, a shift from the 0.9% increase recorded the previous month.

“While consumer spending has declined this month, it remains strong in the broader context, with a 0.9% increase over the past three months and a 3.2% rise year-on-year,” said Alan Oster (pictured above), NAB Group chief economist.

Discretionary spending remained stable, while non-discretionary spending dropped 0.8%.

However, over the past three months, total spending saw a 0.9% rise, and it grew 3.2% over the last year.

Retail spending dropped by 0.6%, reflecting declines in both goods retail and dining at cafes and restaurants. Goods spending specifically fell by 0.8%, while services saw a modest 0.3% increase. Essential purchases like vehicles and fuel also took a hit, with vehicle-related spending down by 2.1%.

Retail spending saw notable declines in department stores (-3.5%) and other retail categories (-1.3%).

Spending on food and clothing dropped slightly by 0.3% and 0.4%, respectively, while household goods spending remained steady.

Despite these drops, total retail spending increased 1% over the past three months and 4% year-over-year. In hospitality, spending was up by 1.3% over the last three months and 3.7% annually, NAB reported.

Non-retail spending saw a significant drop in vehicle and fuel expenditures, with fuel spending falling by 3.5%. Essential services spending also declined by 0.3%, primarily driven by a 4.4% reduction in utility bills, attributed to energy relief measures.

However, education and health services experienced growth, with education spending rising 1.9% and health and care up 1%.

Business credit growth continued in September with a modest 0.4% increase. The mining sector led with a 6.9% rise, followed by a 5.8% increase in other services.

However, sectors like utilities and wholesale trade experienced declines of 2.6% and 2.1%, respectively. Over the last 12 months, business credits grew 6.8%, or 8.5% when excluding mining and agriculture, NAB reported.

For more details, visit the NAB website.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.