Commonwealth Bank has selected cloud banking platform Mambu as the technology provider behind Unloan, its next-gen digital mortgage brand.

Unloan has been designed as a new kind of loan built for the digital world with the aim of providing more accessible home loans.

Launched in Australia in May, Mambu said Unloan would be a revolutionary force in the Australian mortgage industry, capable of providing refinancing applications in as little as 10 minutes and a discount that increases every year for up to 30 years.

“Partnering with Mambu is an investment in future-proofing CBA.”

Harrap said Mambu’s software-as-a-service (SaaS) cloud banking platform would enable the bank to bring in best-in-class solutions from other high-performing fintechs and vendors.

“It will allow us to build financial solutions that meet the demands and expectations of our customers and retain our position as Australia’s leading bank,” he said.

Mambu was designed as a true SaaS cloud banking platform and has a unique approach that enables the assembly of independent components, systems and connectors to meet business needs and end-user demands.

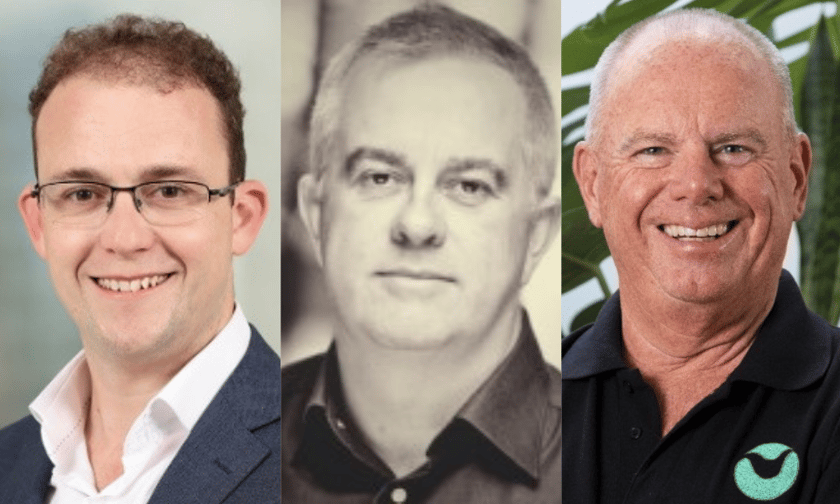

Mambu managing director APAC Myles Bertrand (pictured above centre) said this approach aligned with CBA’s goal to understand and anticipate its customers’ evolving needs, utilising next-gen technology such as data analytics, artificial intelligence and the cloud to deliver personalised, agile and flexible finance solutions to consumers.

“We are thrilled to be working with CBA,” said Bertrand.

“CBA is an organisation that has demonstrated a deep understanding and respect for the power of technology and taken a lead role in Australia’s digital banking revolution. Working with organisations that want to make banking better for everyone is at the heart of what we do at Mambu and this new partnership fits that bill perfectly.”

Mambu general manager Australia and New Zealand Paul Apolony (pictured above right) said there had been a profound shift in the way people think about their finances over the last two years.

“With significant acceleration in the adoption of digital technologies and greater expectations from consumers, people aren’t content to just get what they’re given any more – they want personalised customer service and products that are tailored to their circumstances,” Apolony said.

“Mambu can enable that at a fraction of the cost and much more quickly than traditional banking technology. We are so excited to be working with CBA as it takes this next leap into the digital future.”