The Commonwealth Bank (CBA) and MRI Software have announced a partnership to streamline payment processes in the residential real estate sector.

This collaboration aims to enhance the payment processes for Australian real estate agents, property managers, and tenants by integrating CBA’s Smart Real Estate Payments solution with MRI’s Property Tree software.

The initiative will provide tenants with a more efficient way to manage their rental payments.

Features include flexible payment workflows, the ability to change payment methods easily, and visibility into payment history and upcoming bills.

This system aims to reduce the time and effort spent on managing rental payments for all parties involved.

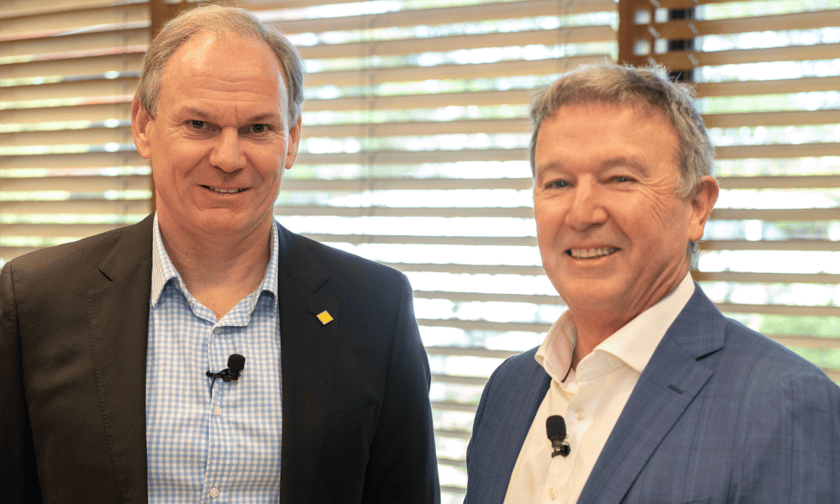

“This digitised solution will make it simple and easy for everyone in the rental ecosystem to make and receive rental payments,” said Mike Vacy-Lyle (pictured above left), CBA group executive of business banking, in a media release.

See LinkedIn post here.

With the integration of major digital payment options like BPAY, direct debit, PayTo, and cards, the Smart Real Estate Payments solution not only simplifies the transaction process but also enhances security, according to CBA.

“The safety of payments remains one of our core priorities and the new solution will provide a safer and more secure digital experience for tenants, real estate agents, and property managers,” Vacy-Lyle said.

The “announcement is a significant leap forward towards addressing friction points and payment security for our Property Tree clients,” said David Bowie (pictured above right), Asia Pacific senior vice president and executive managing director for MRI Software.

Beyond the payment solution, CBA is also committed to supporting real estate agents in expanding their businesses. This includes financing options for rent roll acquisitions and, for a limited time, waiving valuation fees to lower operational costs. These initiatives are designed to facilitate growth and reduce financial strains on real estate businesses.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.