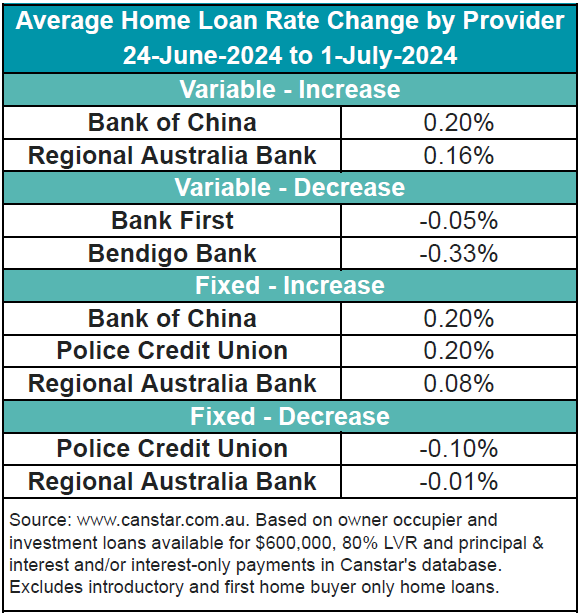

Canstar’s data revealed shifts in both variable and fixed rates across the market over the past week.

Recent changes in home loan rates saw two lenders increasing 12 owner-occupier and investor variable rates by an average of 0.17%, while three lenders raised 66 fixed rates by an average of 0.12%.

Conversely, two lenders cut 11 variable rates by an average of 0.10%, and two lenders reduced eight fixed rates by an average of 0.08%.

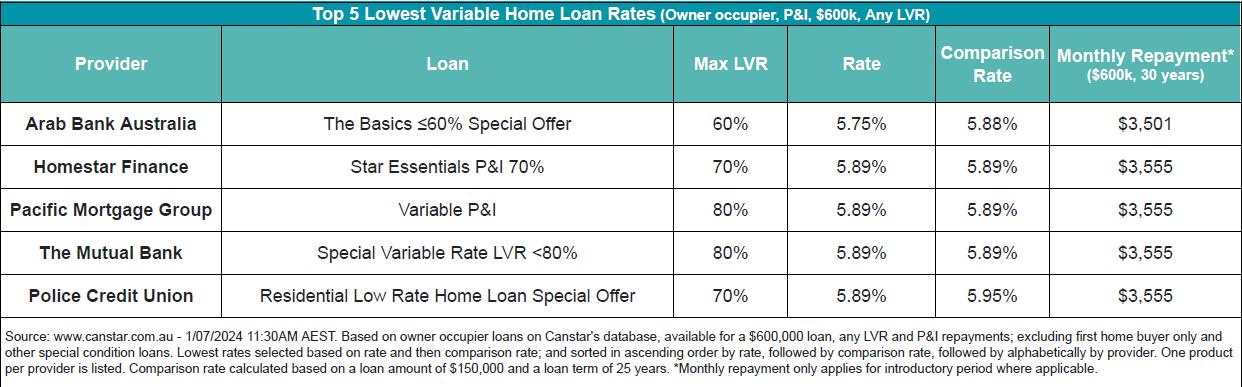

The lowest variable rate for any LVR is 5.75%, offered by Arab Bank Australia. Currently, there are 23 rates below 5.75% in Canstar’s database, a slight decrease from previous weeks. These rates are available at Australian Mutual Bank, Bank Australia, Horizon Bank, LCU, People’s Choice, Queensland Country Bank, RACQ Bank, The Mac, and Unity Bank.

Steve Mickenbecker (pictured above), Canstar’s group executive for financial services and chief commentator, commented on the recent economic indicators and rate movements.

“The increase of the May CPI Indicator to 4.1% will have disappointed the Reserve Bank and borrowers alike,” Mickenbecker said. “National Australia Bank has immediately confirmed borrowers’ fears and pushed out its expectation for the first interest rate cut from November 2024 to May next year.”

Mickenbecker acknowledged the concerns of borrowers facing prolonged high rates.

“At least the bank is not talking up an interest rate increase in 2024, but the long period before any interest rate relief will worry already stressed borrowers, who are wondering when and where they find some joy,” he said.

Mickenbecker advised borrowers to actively seek better rates.

“Eleven months is too long to wait for a rate cut and any borrower in sound financial shape should be looking for their own cut,” Mickenbecker said.

Highlighting potential savings, Mickenbecker said, “Canstar lists 23 loans below 5.75%, which is a saving of around 0.6% for the average borrower. Many borrowers have already negotiated a lower rate with their bank, but a second bite of that cherry is probably still possible even if it means shifting banks.”

There is some positive news for savers, with term deposit rates being lifted by six banks for a healthy average increase of 0.78 %, Canstar reported.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.