Despite the economic firestorm of COVID-19, 2020 has been a stellar year for Belinda Gibson, director of TM Finance Group, and Greg Pierlot, principal broker at The 500 Group. These brokers have continued to enjoy success, finding ways to grow their client base and communicate effectively with customers and business partners during Victoria’s lockdown.

Their efforts have paid off: Pierlot was named La Trobe Financial Broker of the Year – Commercial at the 2020 Australian Mortgage Awards, while Gibson’s TM Finance Group won the Brokerage of the Year – Diversification award.

Gibson and Pierlot both began their careers in banking.

Gibson entered the broking industry in 2014, founding TM Finance Group after leaving her job as a commercial relationship manager at Westpac.

“This role and 14 years of experience in lending gave me the skill set to build relationships and write loans for a huge variety of businesses and commercial lending needs, from invoice financing through to commercial property development,” Gibson says.

“At the time I didn’t know a lot about being a broker – aggregators, accreditations, commissions were all new to me. But I knew credit, how to write a business submission, and about consumer credit and equipment finance. I also knew that what one lender may not have the appetite for another would.”

When founding her business, which covers commercial and equipment finance as well as residential, Gibson says she focused on her beliefs and values – service, integrity and community – principles she adheres to today.

“Every approval, every settlement is an achievement and a success, as there is a person or a business that this impacts” Belinda Gibson, director, TM Finance Group

Belinda Gibson, director, TM Finance Group

Belinda Gibson, director, TM Finance Group

“I next focused on growing an independent, stable, successful team and business – and that I am incredibly proud of.”

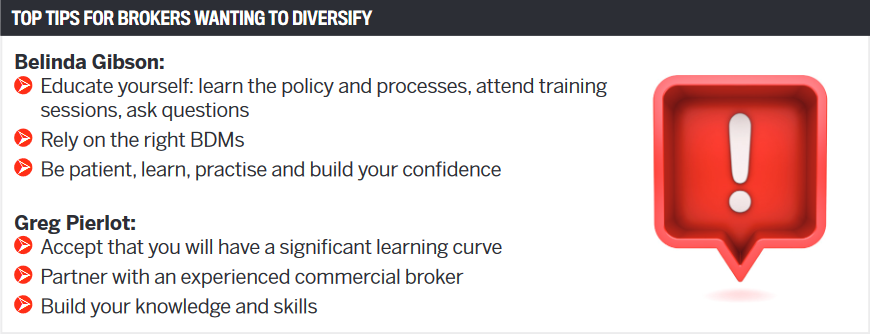

For brokers who are interested in diversifying, Gibson says it’s all about learning policy and processes: “leveraging of the right BDMs, attending training sessions, asking questions”.

“Be memorable to your customer for the right reasons; be patient, learn, practise and build your confidence,” she says.

Pierlot says that even while working in banking he was always passionate about business.

“I admired business owners enormously and wished to leave the comfort of a well-paid career to do what they do. I knew that business owners had many sleepless nights, but what inspired me was the way they would quickly adapt, innovate and change to ensure they survived and then thrived in the face of events that were often outside their control.”

This resilience and ability to adapt when times get tough, particularly during the pandemic, is a common theme for both Pierlot and Gibson.“

COVID-19 is a great example of the way adaptability and innovation can be achieved, even when forced upon the business owner, and it can be exciting,” Pierlot says.

The pandemic forced The 500 Group to review its operating model, finding ways to work remotely while continuing to support its brokers and clients; using technology to stay connected and improve productivity; and setting aside time each week as a team to review performance and address operational issues.

“Each week we also dedicate half a day specifically to strategy and innovation,” says Pierlot. “We engaged an innovation specialist to help guide us through the process and these sessions. Through this and constant communication via Zoom, we have been able to keep the team focused and highly engaged.”

Gibson says running a diversified business is a continuous journey of learning, growing and developing skills not only as a broker but as business director.

“What I did see during the pandemic was leadership, from brokers, their staff and BDMs on the front foot to support their clients, their clients’ businesses, their staff and their colleagues,” says Gibson.

“I consider myself lucky that I can call some incredible brokers in this industry my friends, colleagues and business partners. Having their support and being able to share information, experiences or even see a friendly face on Zoom, particularly during March and April, was something I will always value.”

TM Finance Group called all its customers to check on their wellbeing and determine if they had been affected by the pandemic and needed help.

“This was tough on everyone. Some of the stories we heard will stay with us for a long time. It was important to let customers know we are here to help if they need it,” says Gibson.

Celebrating achievement is also important to Pierlot and Gibson. They are thrilled by their honours at the AMAs but also by their day-to-day successes.

Pierlot highlights The 500 Group’s refining of its value proposition for customers, referral partners and bankers.

“Whilst at one level the broker value proposition is self-evident, what we offer as an industry extends way beyond providing choice and a great deal for borrowers. Being able to clearly articulate this is important and very powerful,” he says.

Pierlot also points to the brokerage’s well-received Loan and Bankability Assessment program, which enables it to advise business owners on where they stand with the banks and improve their access to finance.

“This has significantly reduced the time needed to assess a borrower’s position, highlight potential issues to be addressed and then submit the application to bankers in a format that reduces their assessment time.”

The next step is to take it online as part of a fully integrated commercial broking solution.

Gibson is proud of the way TM Finance Group has supported its clients through the pandemic.

“Every approval, every settlement is an achievement and a success, as there is a person or a business that this impacts,” she says.

“A first home buyer is always special, businesses buying commercial property, and saving people thousands of dollars when they refinance – it makes a real difference to those clients.”

The 500 Group focuses on commercial and equipment finance. Pierlot says the key difference from residential loans is the complexity and variables that need to be considered for each finance request.

“COVID-19 is a great example of the way adaptability and innovation can be achieved, even when forced upon the business owner, and it can be exciting” Greg Pierlot, principal broker, The 500 Group

Greg Pierlot, principal broker, The 500 Group

Greg Pierlot, principal broker, The 500 Group

“This complexity requires a broker to understand the financials of a business and trace the flow of funds, particularly where multiple entities are involved,” he says.

“The analysis also needs to focus on material movements in the company balance sheet, as well as the servicing of the borrower’s total debt position.”

Pierlot says brokers who are seeking to diversify need to accept that there will be a significant learning curve, and they should partner with an experienced commercial broker to deliver a quality client experience while they build their knowledge and skills.

Change is a constant in the finance world, and Gibson and Pierlot have their own views on ways to improve the industry.

Gibson says it now takes a lot longer to write a loan than ever before, and TM Finance Group uses technology as much as possible for loan assessment, such as bankstatements.com.au, DocuSign and Trello for pipeline/workflow management.

“I’d love to see banks embrace technology more,” she says. “Every bank has a different VOI process to achieve the same outcome.

“The eDoc process is incredible and so fast. It’s simply not efficient to be posting loan contracts when we have the technology to improve the end-to-end customer experience.”

Pierlot says there is an urgent need for a single fully integrated, user-friendly system for commercial, mortgage and equipment finance broking, one with a central database and CRM, sales and marketing, data collection, document and communications management, job tracking and employee management.

“Whilst some moves have been made in this direction, the solutions appear to be principally focused on residential broking. Currently there is too much double handling and a lack of automation that impacts industry productivity, profitability and growth,” he says.

Pierlot and Gibson are excited about the future.

“If September, October and November’s activity is anything to go off, I think we’ll be needing another team member very soon,” Gibson says.

“Early this year there were glum forecasts for property. Customers and agents are telling me the opposite. There are towns in Gippsland where you can no longer buy any titled land; it’s all been snapped up by people wanting access to the builders grant.”

Pierlot says, “Whilst COVID-19 has had a devastating impact ... we are already seeing increased demand from clients for finance as we move out of lockdown.

“We are excited by the new initiatives being implemented to help automate and further improve the client experience.

“We are also seeing new lenders in the market that are leveraging technology to offer borrowers more choice, flexible loan products, and all in very fast time.”