Bendigo and Adelaide Bank has reported a solid financial performance for the year, driven by strong growth in residential lending through broker and digital channels.

Despite a challenging economic environment, the bank managed to increase its statutory net profit after tax by 9.7% to $545.0 million.

Bendigo Bank CEO Marnie Baker emphasised the bank's focus on sustainable growth and leveraging its strong pipeline of demand.

“These full year results demonstrate the strength, capability and differentiation of our bank,” Baker said.

“We remain as focused as ever on delivering sustainable growth over the long term, sequencing our investments in key growth areas to leverage the strong pipeline of demand for our products and continue to improve shareholder returns.”

Over the year, Bendigo’s total loan book grew 2.6% over the year and 6.7% annualised in the second half, with residential lending volumes growing 6.4% annualised.

Digital mortgage settlements accounted for 19.3% of all residential lending for the second half.

“Overall, we returned to above system growth in the second half of the financial year in home lending, a positive sign as we launched Bendigo Bank branded home loans to the broker market, underpinned by the Bendigo Lending Platform,” Baker said.

According to Baker, the platform standardises the processing of home loans for Bendigo customers with turnaround times equivalent to the best in the market.

“It is currently available to our mortgage broker partners and will soon be extended across our entire branch network.”

The 15% increase in broker settlements was a result of its new broker channel, Bendigo Bank Broker, which sits within the Bendigo Lending Platform and was launched in November last year.

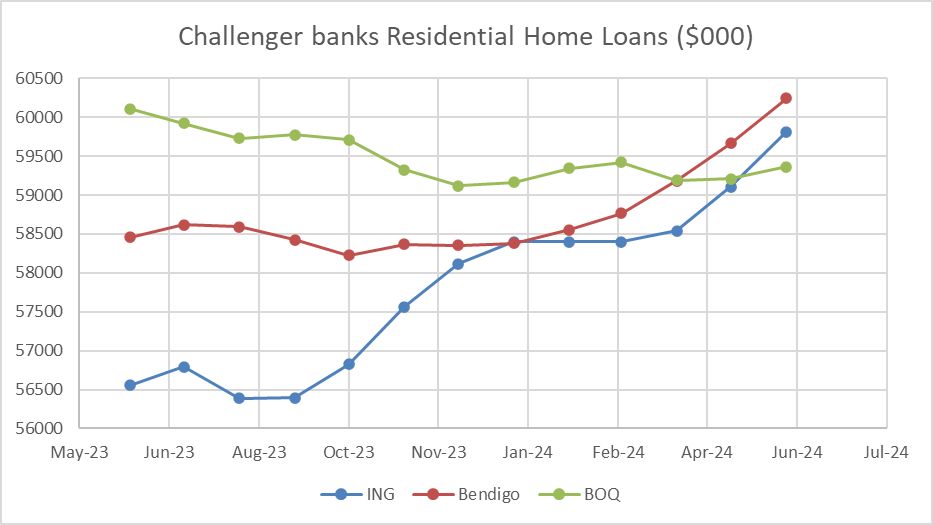

The financial results come after a turbulent year that saw the home loan books of Australia’s challenger banks – Bendigo Bank, ING Bank, and Bank of Queensland – tighten up.

Over the year, Australia’s sixth, seventh, and eighth largest lenders have swapped places month-to-month.

In June 2023, Bank of Queensland was leading the pack with a residential home loan book of $60.1 billion, well above Bendigo ($58.4 billion) and ING Bank ($56.5 billion), according to APRA’s Monthly ADI statistics.

However, since February, both Bendigo and ING have significantly increased their books, particularly through owner-occupier loans, while BOQ has floundered.

This has made Bendigo’s sixth largest lender, behind the major banks and maverick lender Macquarie Bank.

Baker said that put simply, Bendigo Bank is the “only genuine and credible challenger” to the major banks.

“There is no other bank with the strength, capability, and unique characteristics of Bendigo Bank.”

Pleasingly for Bendigo, Agribusiness lending grew 7.4% for the full year as the bank leveraged opportunities in economically prosperous states such as Queensland and Western Australia.

Business lending was also up 1.2% for the year as the bank continues to build capability, uplift processes and focus on its strategic advantages in Micro and SME business.

Cash earnings for our Consumer division decreased by 7.6% impacted by heightened competition in the first half as the Bank prioritised margin over volume. Productivity initiatives implemented through the year saw a 4% reduction in FTE.

Cash earnings for our Business and Agribusiness division increased 13.4% to $409.1 million reflecting strong growth in Agribusiness.

“The transformation of our Business and Agribusiness division has delivered improvements in operational efficiencies and will deepen our connection to our customers,” Baker said.

“Over the half we made investments in the business including the new origination and CRM systems which will better leverage our brand advocacy and uplift our ability to respond to customers.”

Gross impaired loans increased 8.7% to $135.7m, representing just 0.17% of gross loans. This also reflects a change made during the year to adopt a revised definition for restructured loans for the Business and Agribusiness portfolio.

In Business and Agribusiness credit expenses benefited from a $9.3 million net release, mainly driven by a reduction in the collective provision resulting from an improvement in the ratings profile of some larger Business exposures.

In Residential lending, 90-day plus arrears increased by 8 basis points over the year but remain at levels well below industry averages.

The bank continues to expect official interest rates to remain at current levels into the next calendar year as inflation remains persistent.

“Labour markets continue to show resilience however we expect the unemployment rate to gradually rise as the economy responds to restrictive monetary policy settings,” Baker said.

Cost of living pressures also continue to present a challenge to Australian households.

“The bank is ready to support borrowers who experience financial difficulties and has team members from our Mortgage Help Centre standing by,” Baker said.

Conditions are expected to improve for many of our customers next year due to a combination of tax cuts, moderating inflation and forecast cuts to the official cash rate.

Asset quality remains stable, with decreases in 90-day arrears in Business and Agri over the half, partially offset by marginal increases across consumer lending.

“We continue to monitor our portfolio closely and expect arrears to move back toward long-term averages for the Bank, which remain low by industry standards,” Baker said.

"Our home loan customers remain well ahead of their repayments with 40% one year ahead of repayments. Importantly, more than 85% maintain a financial buffer.”

After the announcement, global credit rating service S&P Global Ratings stated that Bendigo would continue to “maintain a strong capital position” with a risk-adjusted capital ratio of 14.0%-14.5% over the next two years.

The bank reported a largely stable common equity Tier-1 capital ratio of 11.3% as of June 30, 2024, the global credit rating service said.

“Credit losses are likely to remain low at about 15 basis points for BEN over the next two years, in line with the Australian banking system. Nevertheless, banks in Australia, including BEN, remain exposed to a jump in credit losses due to high household debt, elevated interest rates and consumer prices, and global economic uncertainties.”