In the latest analysis from Canstar, the landscape of home loan rates has shown diverse changes.

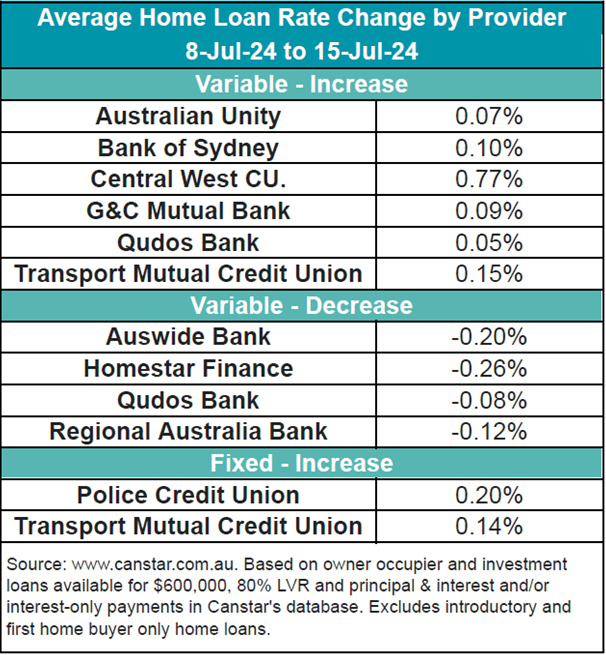

Six lenders increased 28 owner-occupier and investor variable rates by an average of 0.11%, while four lenders cut 14 owner-occupier and investor variable rates by an average of 0.10%.

Additionally, two lenders increased 21 owner-occupier and investor fixed rates by an average of 0.18%.

The average variable interest rate for owner-occupiers paying principal and interest stands at 6.88%. Arab Bank Australia offers the lowest variable rate for any LVR at 5.75%.

Canstar’s database currently features 23 rates below 5.75%. These rates are available at Australian Mutual Bank, Bank Australia, Horizon Bank, LCU, People’s Choice, Queensland Country Bank, RACW Bank, The Mac, and Unity Bank.

Steve Mickenbecker (pictured above), Canstar’s group executive of financial services and chief commentator, shared his thoughts on the current market dynamics.

“Two weeks out from the next Reserve Bank Board meeting, sentiment is mixed about a cash rate hike,” Mickenbecker said. “The ABS June quarter CPI release on July 31 will give us a better read and if it again disappoints, the Reserve Bank may feel that it can’t just sit and wait to get inflation back into its box.”

Mickenbecker also noted the resilience in borrowing despite rate uncertainties.

“The rate outlook has done little to deter buyers, with new borrowing for May a little down on April’s bumper return but still way up on a year ago,” he said.

Bank term deposit rates have been trending upward recently, indicating a possible longer wait for rate cuts.

“Bank term deposit rates have been drifting up in recent weeks, suggesting that they are locking in some funding in the face of a longer wait for rate cuts, but the action is mixed and not categorical evidence of a tide turning,” Mickenbecker said.

“Home loans are a mixed bag, with the balance tipping to increased rates, but the moves look more like fine-tuning of margins than a march up.”

Mickenbecker stressed the potential benefits of refinancing.

“The number of rates below 5.75% has been steady around 23 for a long period, so there are lenders who are likely to give borrowers an enthusiastic hearing when it comes to refinance,” he said. “Refinance is way below 2023 levels and borrowers are missing an opportunity if they just sit and wait for a Reserve Bank rate cut.”

With the next Reserve Bank Board meeting approaching, the market is closely watching upcoming economic indicators, particularly the June quarter CPI release. These developments will likely influence future rate decisions and impact both borrowers and lenders.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.